The euro rose sharply against the US dollar after a speech by Mario Draghi today. We still expect the US dollar to strengthen in the coming months.The euro appreciated significantly against the US dollar (by as much as 1.4% at one stage) on 27 June, reaching a 10-month high. The main reaon was a speech by ECB President Mario Draghi at the ECB forum on central banking at Sintra. To a lesser extent, the ongoing struggle to find legislative consensus among the US Republican Party, highlighted by another delay in the vote on the health care bill, also weighed on the dollar.But we do not see Draghi’s speech as signalling a change in the ECB’s monetary stance. Instead, it confirmed our view that the ECB remains prudent about adjusting its monetary policy parameters. Indeed, Draghi again

Topics:

Luc Luyet considers the following as important: Dollar strength, ECB monetary policy, euro currency forecast, Macroview, USD currency forecast, USD/EUR rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro rose sharply against the US dollar after a speech by Mario Draghi today. We still expect the US dollar to strengthen in the coming months.

The euro appreciated significantly against the US dollar (by as much as 1.4% at one stage) on 27 June, reaching a 10-month high. The main reaon was a speech by ECB President Mario Draghi at the ECB forum on central banking at Sintra. To a lesser extent, the ongoing struggle to find legislative consensus among the US Republican Party, highlighted by another delay in the vote on the health care bill, also weighed on the dollar.

But we do not see Draghi’s speech as signalling a change in the ECB’s monetary stance. Instead, it confirmed our view that the ECB remains prudent about adjusting its monetary policy parameters. Indeed, Draghi again stressed that “inflation dynamics are not yet durable and self sustained”, indicating the need for a persistent policy stance.

We have previously mentioned that there was too much pessimism surrounding the US dollar. We see no reason to change our view. US activity is likely to remain robust in 2017, the recent weakness in inflation is unlikely to mark the start of a new downward trend, the market is underestimating the Fed’s desire to tighten financial conditions in the face of a strong labour market, and a fiscal boost to be ratified near the end of this year remains feasible, in our view. Consequently, the US dollar is likely to appreciate in the next six months.

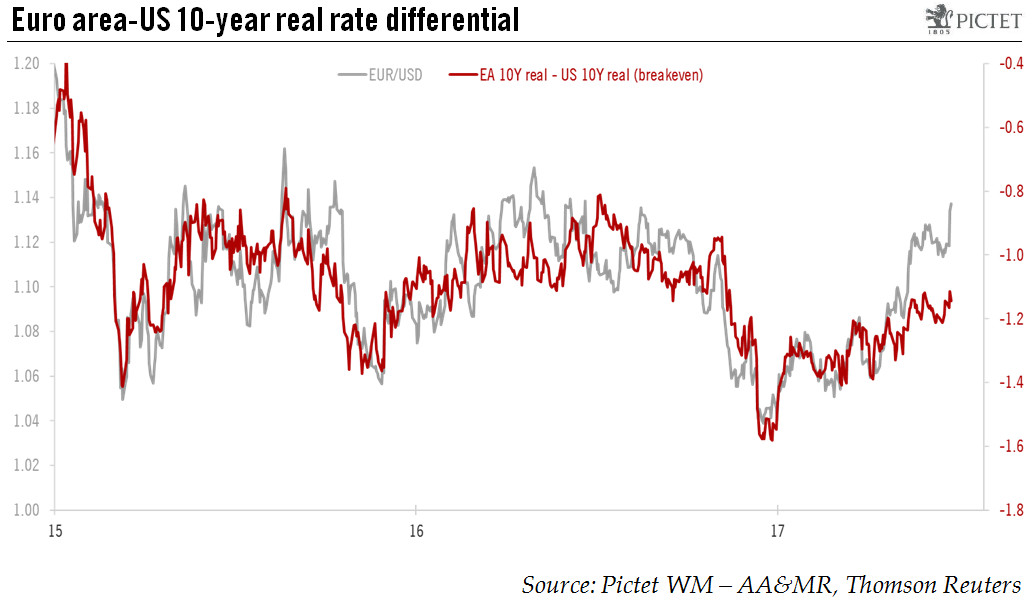

We continue to expect a strengthening of the US dollar in the coming months, while the euro should correct, as the ECB is unlikely to move as fast as the market is expecting. Current EUR levels against the US dollar are not attractive from a tactical risk/reward perspective. This is confirmed by long-term real rate differentials, which do not back the recent rise of the euro against the US dollar. That said, we acknowledge that following the persistent rise in the EUR/USD rate, our current end-of-year forecast of USD1.06 per euro relies on a perfect alignment of a number of factors. This forecast is at risk of needing a modest tweek upward.