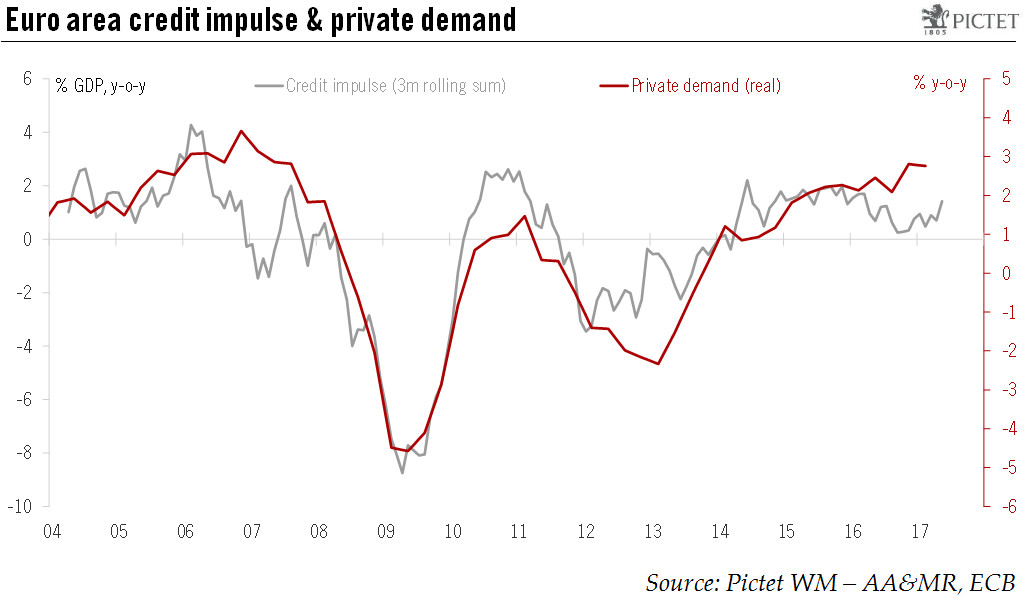

Euro area M3 and credit flows for May were pretty strong overall. Our GDP growth forecast remains unchanged for the euro area.Euro area credit flows to non-financial corporations increased again in May, by EUR10 bn in adjusted terms, following a gain of EUR11 bn in April.Broad money growth (M3) rose marginally from 4.9% to 5.0% y-o-y. Bank lending growth to the private sector was broadly unchanged at 2.6% y-o-y, in line with leading indicators.Overall, we are keeping unchanged our GDP growth forecast for the euro area at 1.9% for 2017 as a whole. We continue to see a number of headwinds that could lead to a modest slowdown in the pace of economic expansion, which should nonetheless remain comfortably above potential this year, at around 1.75% in annualised terms.Read full report here

Topics:

Nadia Gharbi considers the following as important: euro area credit, Euro area GDP growth, Euro area growth momentum, euro area M3, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area M3 and credit flows for May were pretty strong overall. Our GDP growth forecast remains unchanged for the euro area.

Euro area credit flows to non-financial corporations increased again in May, by EUR10 bn in adjusted terms, following a gain of EUR11 bn in April.

Broad money growth (M3) rose marginally from 4.9% to 5.0% y-o-y. Bank lending growth to the private sector was broadly unchanged at 2.6% y-o-y, in line with leading indicators.

Overall, we are keeping unchanged our GDP growth forecast for the euro area at 1.9% for 2017 as a whole. We continue to see a number of headwinds that could lead to a modest slowdown in the pace of economic expansion, which should nonetheless remain comfortably above potential this year, at around 1.75% in annualised terms.