Swiss Franc The Euro has risen by 0.05% to 1.1015 EUR/CHF and USD/CHF, April 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week’s lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55....

Read More »FX Daily, April 5: Market Pushes First Rate Hike into 2022

Swiss Franc The Euro has fallen by 0.25% to 1.1053 EUR/CHF and USD/CHF, April 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many financial centers in Asia and Europe remain closed for the extended holiday. Although several markets that were open were higher in the Asia Pacific region, India was an exception as a record contagion sent stocks down the most in five weeks. US futures are pointing higher, led by...

Read More »Is the Fed too focused on corporates?

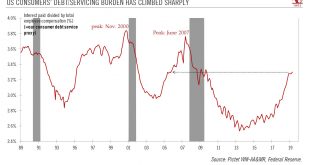

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch. The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy...

Read More »Is the Fed too focused on corporates?

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch.The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s.Low Fed interest rates tend to percolate quickly down to the...

Read More »A dovish Fed could become even more so

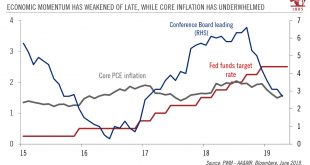

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months. We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance...

Read More »A dovish Fed could become even more so

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2)...

Read More »US macro and Federal reserve forecast update

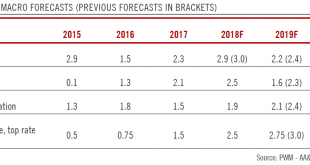

Near-term recession risks remain limited, and a dovish Fed offers supportWe are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be...

Read More »Solid U.S. retail sales follow Fed’s upbeat economic assessment

Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.All in all, we remain optimistic about consumer spending...

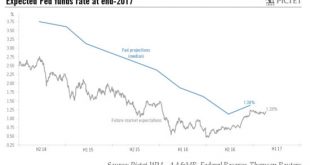

Read More »Surprisingly hawkish FOMC minutes unsettles observers

Macroview Although the probability of a June/July rate hike by the Fed has increased, the minutes also highlighted downside risks still facing the US economy Read full report here The minutes of the April Federal Open Market Committee meeting published on 18 May surprised by their hawkish tone. The key phrase that unsettled observers was that should conditions continue to improve, “it likely would be appropriate for the Committee to increase the target range for the federal funds rate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org