Retail sales posted their third consecutive monthly decline in February, but there is no need to worry, for now.The US consumer has shown surprising stinginess lately. Soft February retail sales data continue the uneven pattern of consumption data since the beginning of the year. On a y-o-y basis (and nominal terms) they were up only 4.0% in February, below the 1-year average of 4.4%.This soft consumption data is even more surprising as all consumption signals are flashing green for the US...

Read More »Messing about in boats

A sharp rise in boat buying suggests that US economic expansion has matured.A key question for investors is how to gauge the point we are at in the US business cycle. Some are worried that we have already surpassed the length of the previous expansion. According to data from the National Bureau of Economic Research, we are 99 months into an upward cycle that started in July 2009, while the 2002-07 expansion lasted for 72 months. That said, we are still below the lengthy expansion of the...

Read More »U.S. consumer spending picks up, but inflation is still soft

Just-released figures lead us to revise our forecasts for US spending and inflation.Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We...

Read More »U.S. consumer spending showing signs of rebound

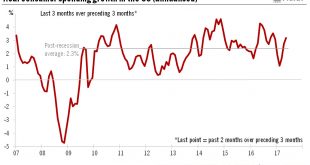

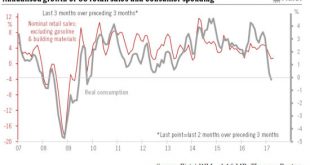

After a weak first quarter, consumer spending in the US is showing healthier signs. We remain upbeat about prospects for the rest of this year too.Core retail sales in the US rose by 0.2% m-o-m in April, below consensus expectations (+0.4%). However, retail sales for March were revised up by 0.2%.The result was that between Q1 and April, nominal core retail sales grew by a healthy 3.6% annualised, following an increase of 3.5% q-o-q in Q1 and 3.1% in Q4 2016. However, although up month on...

Read More »Solid U.S. retail sales follow Fed’s upbeat economic assessment

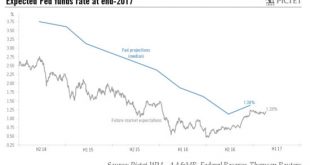

Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.All in all, we remain optimistic about consumer spending...

Read More »Soft U.S. retail data conceals healthy consumer spending

Macroview Our forecasts for US GDP growth remain unchanged, and we continue to expect a 25bp rate hike in December, followed by two others in 2017. Core retail sales in the U.S. rose by ‘only’ 0.1% month on month ( m-o-m) in September, below consensus expectations. Moreover, the July number was revised down. The result was that core retail sales were almost flat (+0.3% quarter on quarter (q-o-q) annualised in Q3), much lower than the 6.9% rise seen in Q2. Nevertheless, we continue to believe...

Read More »U.S. data remain mixed

Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%. According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.Other US data published in recent days has been mixed. Pending home...

Read More »Core retail sales weak in August, but U.S. consumption still healthy

Macroview In spite of poor August retail report, we remain reasonably sanguine on US consumer spending growth over the near term. Today’s US retail sales report for August was surprisingly downbeat, with core retail sales recording their second monthly decline in a row. Core retail sales in the US fell by 0.1% month over month (m-o-m) in August, worse than consensus expectations. Moreover, June and July numbers were revised down by a cumulative 0.2%. The result was that between Q2 and...

Read More »US retail sales solid in June, very strong in Q2 overall

Macroview Upbeat consumer spending figures and other data mean we maintain our forecast of 2.5% GDP growth for the US in the second quarter. Core retail sales in the US increased by 0.5% month-on-month in June, above consensus expectations. Moreover, April and May numbers were revised up by a cumulative 0.1%. The result was that core retail sales grew by a very strong rate of 7.4% quarter-on-quarter (q-o-q) annualised in Q2 2016, much higher than the 2.8% rise seen in Q1.Together with auto...

Read More »US GDP growth expectations tilted to the upside

Healthy consumer spending figures lead us to believe that US GDP growth might actually be better than we have been forecasting. Inflation pressures look likely to remain modest for a while Real consumer spending in the US rose by a healthy 0.3% month over month in May, according to the Bureau of Economic Analysis (BEA) on 29 June, beating consensus expectations. Moreover April’s number was revised up, so that between Q1 and April-May, US personal consumption grew by an astonishing 4.8%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org