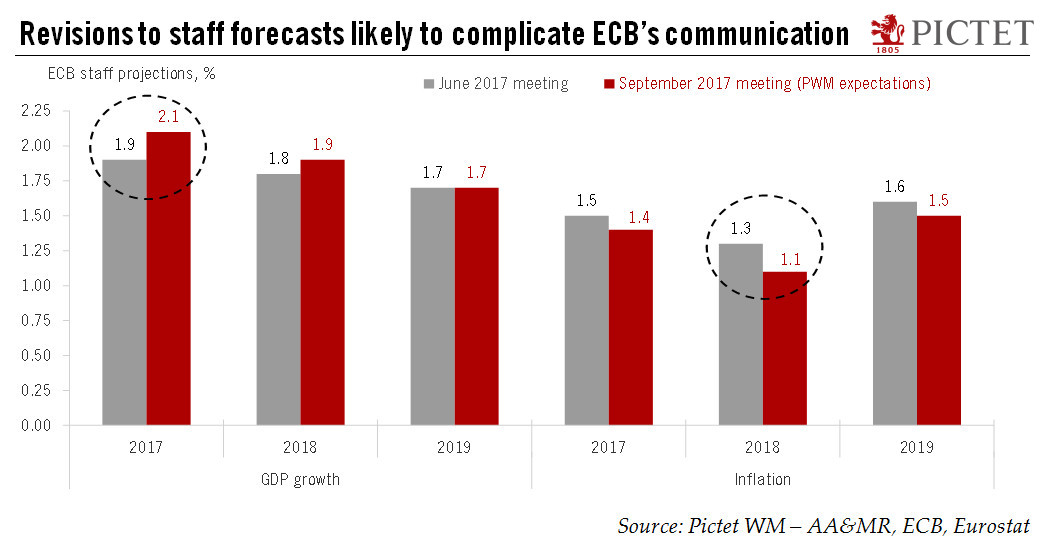

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per month instead of EUR60bn, before further adjustments are decided.The appreciation of the euro will mechancially push down staff projections for inflation and complicate the ECB’s communication, but it should not derail the ECB’s path for exiting QE. Euro strength may force ECB president Mario Draghi to

Topics:

Frederik Ducrozet considers the following as important: ECB exit strategy, ECB monetary policy, ECB quantitative easing, ECB September meeting, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.

The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per month instead of EUR60bn, before further adjustments are decided.

The appreciation of the euro will mechancially push down staff projections for inflation and complicate the ECB’s communication, but it should not derail the ECB’s path for exiting QE. Euro strength may force ECB president Mario Draghi to step up the “unwarranted tightening” rhetoric to some extent. But we think he will refrain from more aggressive intervention at this stage.

If needs be, the ECB could use a number of ‘exit sweeteners’ in the coming months in order to avoid market overreaction, including a further delay of exit announcements to December or mention of a prolonged bias for an increase in the size of QE. Stronger forward guidance on policy rates would be less efficient, in our view, especially if is not backed by an unanimous decision. We still think the best option would be for the ECB to hint at increased flexibility in terms of QE implementation, including larger deviations from capital keys.