Underlying trends in the labour market are unlikely to deter the Fed from a further rate hike in December.Non-farm payrolls (NFPs) rose 156,000 in August, bringing the three-month average to a still-robust 185,000/month. The three-month average stands higher than the 12-month average of 175,000, suggesting that underlying momentum in the US labour market – and the broader economy – remains healthy. The unemployment rate increased marginally (+0.1%) to 4.4%, but this remains within the Federal Reserve’s full-employment territory. (As an aside, the employment survey was conducted before Hurricane Harvey hit Texas. We expect the effects of the hurricane to show up in next month’s job report, but we could see a v-shaped recovery in new jobs after an initial hit.)The fly in the ointment was

Topics:

Thomas Costerg considers the following as important: Macroview, US employment trends, US jobs growth, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Underlying trends in the labour market are unlikely to deter the Fed from a further rate hike in December.

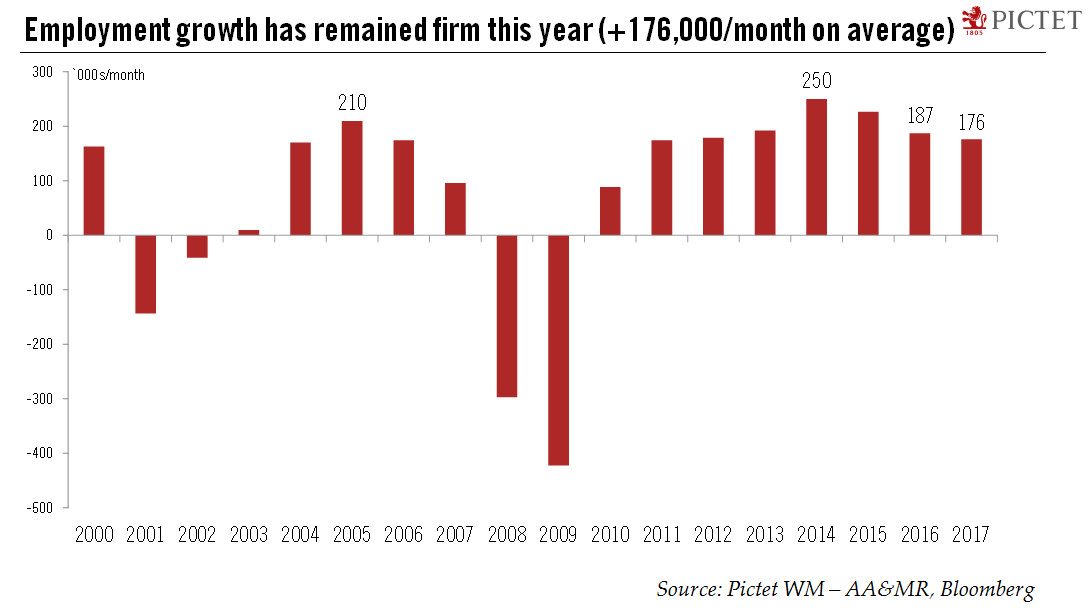

Non-farm payrolls (NFPs) rose 156,000 in August, bringing the three-month average to a still-robust 185,000/month. The three-month average stands higher than the 12-month average of 175,000, suggesting that underlying momentum in the US labour market – and the broader economy – remains healthy. The unemployment rate increased marginally (+0.1%) to 4.4%, but this remains within the Federal Reserve’s full-employment territory. (As an aside, the employment survey was conducted before Hurricane Harvey hit Texas. We expect the effects of the hurricane to show up in next month’s job report, but we could see a v-shaped recovery in new jobs after an initial hit.)

The fly in the ointment was the ongoing softness in wage growth. Average hourly earnings rose only 0.1% m-o-m in August, compared with 0.3% in July, with the y-o-y reading unchanged at 2.5%. There are structural impediments to better wage growth, in our view, including ongoing technological change, low inflation, and the difficulties of the retail sector (retail employment was down 0.2% y-o-y). We see wage growth staying tepid in the coming months, as pressure from these sources is unlikely to abate.

From a Federal Reserve perspective, we think this report will be seen as ‘more of the same’. The Fed is still likely to announce plans for balance sheet shrinkage at its 20 September meeting. While recent inflation prints and, to some degree, wage growth, have been mixed, we think loose financial conditions are front-and-centre of the Fed’s concerns. While the market (Fed futures) is now only pricing in a 34% probability of a Fed hike by the end of this year, we expect one to come at the Fed’s December meeting.