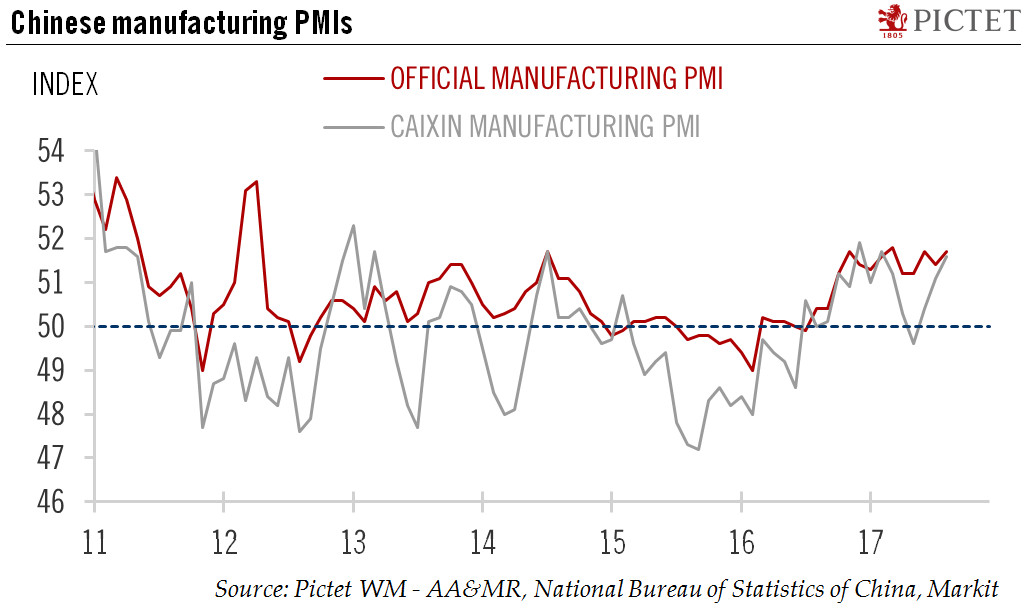

August manufacturing PMI showed solid industrial activity, while domestic demand is holding up well. We are keeping our Chinese GDP forecast unchanged.China’s official manufacturing PMI in August came in at 51.7, rising slightly from July (51.4), and remaining firmly in expansionary territory. The Markit PMI extended its ascendance for the third consecutive month to reach 51.6 in August.Domestic demand seems to be holding up well. The production, new orders and imports sub-indices of the official PMI, which are closely related to Chinese domestic demand, are all showing a healthy upward trend.The new export order sub-index of the official PMI has been declining for the second consecutive month, suggesting export growth may have peaked.In addition, the data suggests industrial inflation

Topics:

Dong Chen considers the following as important: China growth forecast, China PMI, Chinese domestic demand, Chinese manufacturing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

August manufacturing PMI showed solid industrial activity, while domestic demand is holding up well. We are keeping our Chinese GDP forecast unchanged.

China’s official manufacturing PMI in August came in at 51.7, rising slightly from July (51.4), and remaining firmly in expansionary territory. The Markit PMI extended its ascendance for the third consecutive month to reach 51.6 in August.

Domestic demand seems to be holding up well. The production, new orders and imports sub-indices of the official PMI, which are closely related to Chinese domestic demand, are all showing a healthy upward trend.

The new export order sub-index of the official PMI has been declining for the second consecutive month, suggesting export growth may have peaked.

In addition, the data suggests industrial inflation may rebound in the near term. Since peaking at 7.8% in February, China’s industrial inflation, measured by the y-o-y change in the producer price index (PPI), has been declining. The rise in PPI was one of the key drivers of the surge in China’s nominal GDP in the first half of 2017.

The upbeat manufacturing PMI report for August indicates that industrial activity in China remains solid, mainly driven by domestic demand. The potential slowdown in China’s growth momentum in H2 2017 could be fairly modest. Hence, we have decided to keep our Chinese GDP forecast for 2017 unchanged at 6.8%.