The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »Euro area core inflation to rise again after Easter

Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a...

Read More »ECB meeting preview: guide me if you can!

We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The...

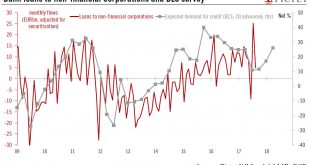

Read More »Broad-based rebound in euro area credit demand

The latest ECB's lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.Net demand for bank loans to enterprises increased further in Q3, in line with banks’...

Read More »Small dip in headline PMI hides robust domestic momentum

The euro area composite PMI index fell slightly in October, consistent with our forecast of a moderate slowdown in activity in Q4.The euro area composite flash PMI declined to 55.9 in October, from 56.7 in September, below consensus expectations, led by a drop in the services sector which offset an increase in manufacturing. However, survey details were fairly strong, especially in terms of job creation.In Germany, the survey points to robust private sector growth. The PMI index decreased,...

Read More »Euro area cyclical inflation is on the rise

Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s...

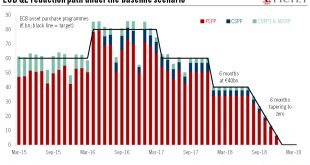

Read More »Scenarios for QExit

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

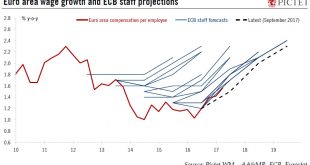

Read More »Euro area wage growth suggests the Phillips curve is not dead

The latest signs that wages are picking up together with drops in unemployment should help push the ECB along the road of policy normalisation.Wage growth is an important input in the ECB’s reaction function, and so far it has failed to respond to the narrowing of the output gap. It could be the normal behaviour of a lagging indicator, especially as labour market slack is likely to be larger than what the drop in headline unemployment would suggest. Or, it could be that “the slope of the...

Read More »ECB, a forced taper

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks...

Read More »ECB: first (hawkish) move since 2011

The ECB took its first step towards a very slow normalisation of its monetary stance – a very small one, but symbolically important nonetheless.As we expected, the ECB moved to a more neutral stance today by describing the risks to economic activity as “broadly balanced” and by removing its bias to even “lower” policy rates. The symbolic significance of the move should not be underestimated. It is the first time that the balance of risks to growth has been upgraded since August 2011, just...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org