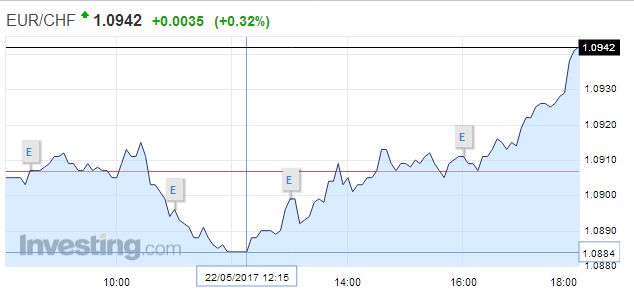

Swiss Franc EUR/CHF - Euro Swiss Franc, May 22(see more posts on EUR/CHF, ) - Click to enlarge FX Rates After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors’ minds from intensifying political uncertainty in the US. Rather it seems to be simply the absence of more negative developments that is allowing the greenback to post corrective gains. The deals with Saudi Arabia announced were very much seen as the strength of the transactional orientation of the Trump Administration. However, impact on US employment or the US trade balance may not be particularly significant. There also seem to be a sense that the markets may have gone too far too fast last week. Asian shares got the ball rolling today. The MSCI Asia-Pacific Index gapped higher today, and the 0.7% gain was the most in two weeks. The Nikkei had gapped lower last Thursday and left a potential island top in its wake. Today’s 0.5% gain saw the index enter but not close the gap. The Hong Kong Enterprise Index (H-shares) snapped a four-day slide to close a little more than 1% higher, while mainland shares (A-shares) in Shanghai and Shenzhen fell. Korea’s Kospi rose almost 0.

Topics:

Marc Chandler considers the following as important: AUD, EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, Japan Exports, Japan Imports, Japan Trade Balance, JPY, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 22(see more posts on EUR/CHF, ) |

FX RatesAfter being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors’ minds from intensifying political uncertainty in the US. Rather it seems to be simply the absence of more negative developments that is allowing the greenback to post corrective gains. The deals with Saudi Arabia announced were very much seen as the strength of the transactional orientation of the Trump Administration. However, impact on US employment or the US trade balance may not be particularly significant. There also seem to be a sense that the markets may have gone too far too fast last week. Asian shares got the ball rolling today. The MSCI Asia-Pacific Index gapped higher today, and the 0.7% gain was the most in two weeks. The Nikkei had gapped lower last Thursday and left a potential island top in its wake. Today’s 0.5% gain saw the index enter but not close the gap. The Hong Kong Enterprise Index (H-shares) snapped a four-day slide to close a little more than 1% higher, while mainland shares (A-shares) in Shanghai and Shenzhen fell. Korea’s Kospi rose almost 0.7% and set a record closing high. |

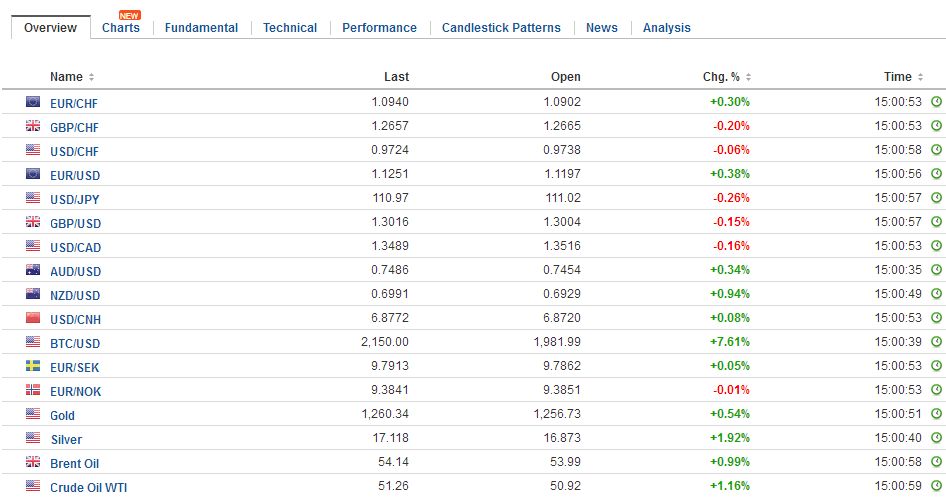

FX Daily Rates, May 22 |

| The dollar rose in early Asia and rose to JPY111.60, just shy of the high from the second half of last week in the JPY111.75 area. On the downside, support is seen around JPY110.80. The US 10-year yield is a single basis point firmer just below 2.25%.

The euro had been trading within its pre-weekend range, as the market seems content to consolidate as it awaits from developments. However, it caught a good bid $1.1160 and surged back to take out last week’s high in response to reports that Merkel said the euro was too weak. This is not a new German argument but the timing of it may be more important, and the contrast with the US is notable. The euro reached almost $1.1230 in response. Third, sterling has lost some luster. It is the weakest of the majors, off about 0.4% against the dollar. There are two drags today, leaving aside the proximity of the $1.3055 retracement objective of the losses since last year’s referendum. A couple of polls suggest the national election may have tightened in recent days. Some bookmakers in London have upgraded the odds of what Britain calls a hung parliament, which means a coalition government in other countries. |

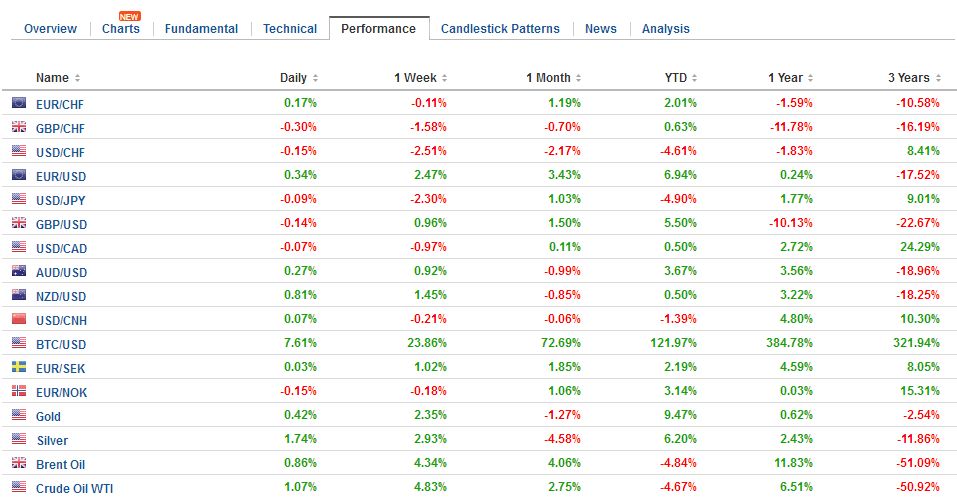

FX Performance, May 22 |

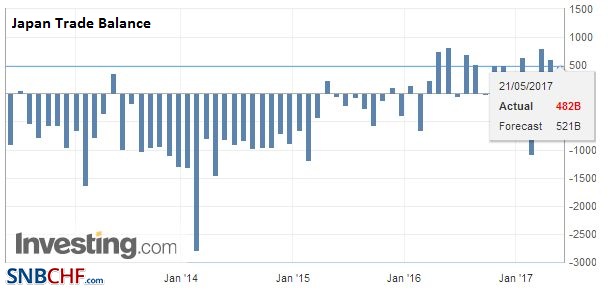

JapanThere are three notable developments. First, Japan’s April trade surplus was a little smaller than expected at JPY481.7 bln. |

Japan Trade Balance, April 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

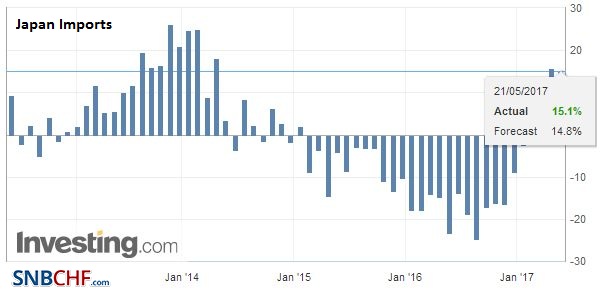

| Imports held in better, rising 15.1% after a 15.8% gain in March. |

Japan Imports YoY, April 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

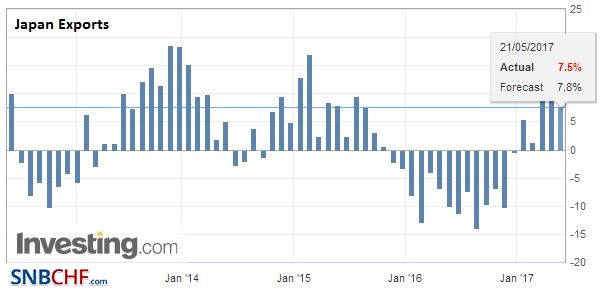

| Exports of auto parts, electronic parts, and motors were strong, while the imports featured crude and partly refined oil and communication equipment.Exports rose 7.5% compared with the median forecast in the Bloomberg survey for an 8% year-over-year gain after a 12% in March. Exports to the US rose 2.6% year-over-year, while exports to the EU were up 2.2%. However, exports to China, its biggest trading partner rose 14.8%. |

Japan Exports YoY, April 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

Eurozone

European equities are mixed, but the Dow Jones Stoxx 600 is up marginally in late morning turnover. Real estate and telecoms are leading the advance. Utilities, information technology, and utilities are providing drags. Recall; that week’s little more than 1% decline was the worst performance since last November and ended a three-week rally. Spain and Italian share are trading lower.

Spain

Some are linking Spain’s losses to the Sanchez re-capturing the Socialist Party’s leadership post from the party establishment. Spanish bonds are also underperforming in the periphery. The 10-year yield is up a little more than two basis points, while Italy’s 10-year yield is off two basis points as is a similar yield in Portugal. Core yields in Germany, the Netherlands, and France are up 1-2 bp.

Australia

Second S&P cut the credit scores of nearly two dozen financial institutions in Australia due to risks emanating from the property market. The rating agency exempted the country’s four largest banks ostensibly on ideas that they would be backstopped by government support. The Australian dollar fell about a quarter of a cent before finding a bid near $0.7435. It is little changed on the day as North American dealers return to their posts. The Aussie was advanced in seven of the last eight sessions coming into today. The five-day moving average is set to cross above the 20-day average for the first time since early April today. It is bumping along a downtrend line that is near $0.7475 today.

United Kingdom

The other drag was the threat issued by the UK’s Brexit Secretary Davis that warned the UK would abandon negotiations if the EU did not drop its demand for a “divorce payment.” EU officials have put this payment between 40-60 bln euros, while the Financial Times claims it could be 100 bln. Sterling is consolidating within the broad ranges established at the end of last week. Demand was seen in the London morning ahead of $1.2960.

United States

It is a light economic calendar this week and today begins off in form. The Chicago Fed’s national economic indicator will be reported. It is hardly a market mover. Three regional Fed presidents speak (Harker, Kashkari, and Evans). Kashkari dissented against the March rate hike, and would likely dissent against a June move as well. Governor Brainard speaks late in the session. She had emphasized international sources of caution previously, but these headwinds seem to have lessened.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$EUR,$JPY,EUR/CHF,Featured,FX Daily,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent