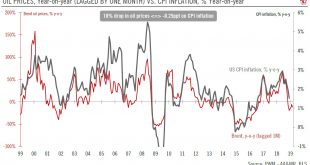

Latest data released confirm our expectations of modest US inflation this year.CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.There are signs...

Read More »US inflation remains modest, but tariffs will soon make themselves felt

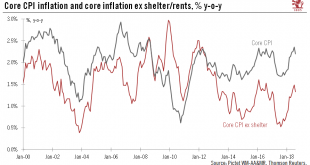

While we await the effect of import tariffs, inflation has still not taken off in the US. The Fed is unlikely to be swayed from its current rate tightening routine.Core consumer-price index (CPI) inflation rose a modest 0.12% month on month (m-o-m) in September, again undershooting market expectations, and the year-on-year (y-o-y) print stayed unchanged at 2.2% –a relatively benign outcome given the flourishing US economy and the tight labour market.Core inflation (excluding energy and food...

Read More »Throw the textbook away: US inflation is still modest

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still...

Read More »Underlying US inflation remains moderate

While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y...

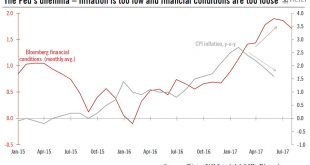

Read More »US economy: Too-loose financial conditions versus too-low inflation

In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor,...

Read More »US inflation still low at end-2016, our forecast unchanged for 2017

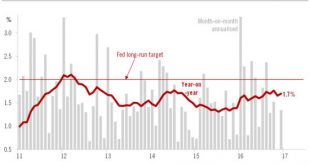

Virtually static in 2016, we continue to believe that core inflation will pick up only modestly in 2017.Core PCE inflation in the US settled at 1.7% y-o-y in December, in line with consensus and exactly the same rate as in February 2016. We continue to believe that PCE core inflation will pick up only modestly in 2017, ending the year at around 2.1%.Following a significant pick-up between October 2015 and February 2016 , y-o-y core PCE inflation stabilised at around 1.6%-1.7% for the...

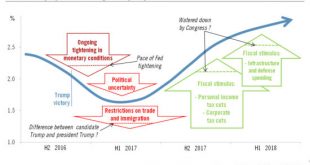

Read More »U.S. growth to slow in H1 2017 before rising again in H2

The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed...

Read More »Core US inflation should rise only modestly

Amid conflicting wage signals and low inflation expectations, core US prices look like rising only gradually to end 2017.Core US personal consumption expenditure (PCE) inflation remained stable at 1.7% year on year (y-o-y) in September, in line with consensus expectations. We continue to believe that core PCE inflation will pick up modestly over the coming months. Our forecast that it will reach 1.9% y-o-y by year-end and 2.1% in December 2017 remains unchanged.Labour market slack has...

Read More »U.S. data remain mixed

Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%. According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.Other US data published in recent days has been mixed. Pending home...

Read More »US GDP growth expectations tilted to the upside

Healthy consumer spending figures lead us to believe that US GDP growth might actually be better than we have been forecasting. Inflation pressures look likely to remain modest for a while Real consumer spending in the US rose by a healthy 0.3% month over month in May, according to the Bureau of Economic Analysis (BEA) on 29 June, beating consensus expectations. Moreover April’s number was revised up, so that between Q1 and April-May, US personal consumption grew by an astonishing 4.8%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org