Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external environment, and the services sector. Flash PMIs above consensus expectations According to Markit’s preliminary estimates, the euro area composite PMI increased from 53.0 in February to 53.7 in March, better than consensus expectations (53.0). The upturn in March was mainly led by the services PMI (+0.7 to 54.0), while manufacturing PMI (+0.2 to 51.4) rebounded only slightly. The breakdown by sub-indices showed encouraging signs for services, with the business expectations index climbing (+1.4 to 64.4) to reach the second-highest level seen in the past 11 months. Forward-looking indices for manufacturing showed more subdued dynamics, with new orders barely improving from the one-year low seen in February. Overall, in terms of real activity, the average composite PMI is consistent with real GDP rising at a quarter-on-quarter (q-o-q) rate of around 0.3% in Q1, slightly below our forecast.

Topics:

Nadia Gharbi considers the following as important: central bank policy, ECB, euro area, Eurozone, GDP, growth, Ifo, Macroview, oil prices, PMI

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time.

Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external environment, and the services sector.

Flash PMIs above consensus expectations

According to Markit’s preliminary estimates, the euro area composite PMI increased from 53.0 in February to 53.7 in March, better than consensus expectations (53.0). The upturn in March was mainly led by the services PMI (+0.7 to 54.0), while manufacturing PMI (+0.2 to 51.4) rebounded only slightly. The breakdown by sub-indices showed encouraging signs for services, with the business expectations index climbing (+1.4 to 64.4) to reach the second-highest level seen in the past 11 months. Forward-looking indices for manufacturing showed more subdued dynamics, with new orders barely improving from the one-year low seen in February.

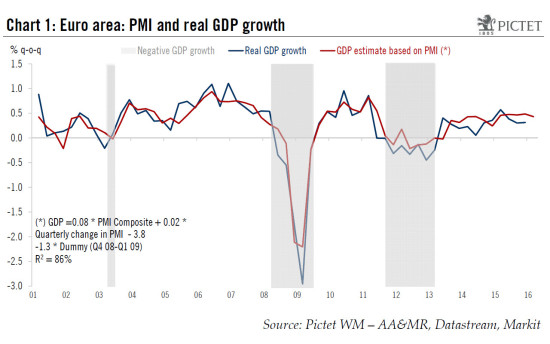

Overall, in terms of real activity, the average composite PMI is consistent with real GDP rising at a quarter-on-quarter (q-o-q) rate of around 0.3% in Q1, slightly below our forecast. We continue to expect a gradual pick-up in the pace of economic expansion, with GDP in the euro area set to rise from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand. While private consumption is likely to remain robust, we also expect a credit-led rebound in investment to support aggregate demand. At the same time, the impact of subdued global dynamics on euro area manufacturing remains a downside risk for our scenario.

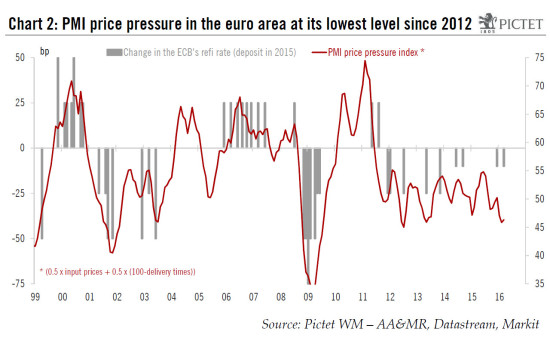

Looking at price dynamics, deflationary forces remain intense. Both input (+0.3 to 49.6) and output (+0.1 to 48.6) price indices increased slightly in March, but still indicate contraction. It is worth highlighting that our simple gauge of (dis)inflationary pressures have marked only a marginal increase from the low levels seen in 2012 (see chart 2).

In Germany, sentiment among businesses has brightened slightly. The flash composite PMI was unchanged at 54.1 in March, in line with consensus expectations, but the IFO business survey was more upbeat. Indeed, the IFO headline business climate index rose from 105.7 in February to 106.7 in March, better than consensus expectations (106.0) and marking an end to three consecutive months of weakening. March’s improvement was driven by a rise in both components: the current assessment index (+0.9 to 113.8) and the expectations index (+1.1 to 113.8). In terms of sectors, the German manufacturing sector continued to be dented by the poor outlook for exports, whereas the services sector has remained resilient so far this year. Overall, the German surveys are consistent with GDP growth of around 0.4% q-o-q in Q1.

In France, the private sector ended the first quarter on a positive note. The flash composite PMI increased to 51.1 in March from 49.3 in February, much stronger than consensus expectations (49.7). The rise was essentially due to a surge in the flash services PMI (+2 to 51.2). In contrast, the negative surprise came from the flash manufacturing PMI, which decreased by 0.8 point to 49.6 in March. The components of manufacturing were mixed, with sharp drops in new orders (-1.0 to 47.8) and employment (-2.2 to 47.8), but a decent increase in output (+1.3 to 50.8). Overall, the composite PMI for Q1 suggests a further modest rise in French GDP.

In other euro area countries where no flash estimates are provided, Markit indicated that “the rate of business activity growth improved on February’s five-month low, but nevertheless rounded off the slowest quarterly expansion seen for a year”.