“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

Read More »The Fed’s Capitulation: What It Means For Gold Investors

“Perhaps they think that they will exercise power for the general good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »No rate hike support in sight for antipodean currencies

The Australian and New Zealand dollar are among the most expensive currencies. The former looks especially vulnerable to a mild pullback.At their November monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at, respectively, 1.50% and 1.75%.The RBA sounded relatively cautious given low wage growth and high household debt. The RBNZ was more upbeat in light of the potential for more fiscal stimulus under...

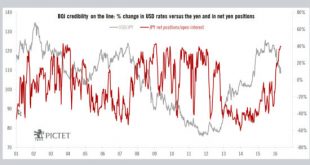

Read More »Central banks face test of credibility

Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been...

Read More »Euro area business surveys regain some momentum in March

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org