Die Stimmung in der deutschen Wirtschaft hat sich unerwartet eingetrübt. Der Ifo-Geschäftsklimaindex sank im September von 88,9 auf 87,7 Punkte. Es war der erste Rückgang nach sechs Anstiegen des Frühindikators.

Read More »Deutschland: Auftragsmangel steigt auf höchsten Wert seit 15 Jahren

In der deutschen Wirtschaft macht Auftragsmangel immer mehr Unternehmen zu schaffen. 41,5 Prozent der Betriebe klagten darüber in einer aktuellen Umfrage des Münchner Ifo-Instituts. Seit der Finanzkrise 2009 gab es keinen so schlechten Wert mehr. Der höchste während der Corona-Krise erhobene Auftragsmangel wurde erstmals knapp übertroffen.

Read More »Deutsche Exporteure hoffen auf neuen Schwung

Die Stimmung unter den deutschen Exporteuren ist so gut wie seit fast einem Jahr nicht mehr. Das Barometer für die Exporterwartungen kletterte im Januar um 2,3 auf 4,3 Punkte, wie das Münchner Ifo-Institut mitteilte.

Read More »An Anti-Inflation Trio From Three Years Ago

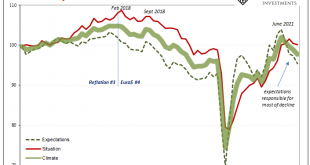

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential. So said all in the media, opinions written for everyone in it by none other than central bank models. It was going to be awesome. Straight away, however,...

Read More »Stagnation Never Looked So Good: A Peak Ahead

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

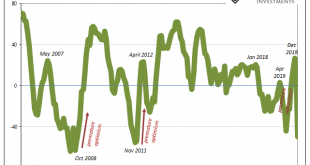

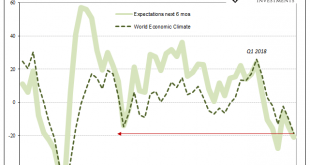

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work. On the other side, though, there’s not nearly the same level confidence. Earnings are derived from several factors but chiefly the economic climate in which companies operate....

Read More »Euro area business surveys regain some momentum in March

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external...

Read More »Business surveys in the euro area: disappointing, but still resilient in terms of activity

Despite a drop in January, the composite PMI remains resilient in terms of real activity. We continue to expect the pace of euro area growth to speed up from 1.5% in 2015 to 1.8% in 2016. Euro area business surveys (PMIs and IFO) disappointed in January, partly as a reflection of global uncertainty related to EM growth and market volatility so far this year. PMIs survey: easing, but still at a high level According to Markit’s preliminary estimates, the euro area composite PMI eased from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org