The FOMC sounded quite cautious and surprised at its meeting yesterday as it markedly revised down its Fed funds rate median projection for the end of this year. As widely expected, at yesterday’s FOMC meeting, the Fed chose to ‘stand pat’. Although yesterday's FOMC meeting was perceived as sounding ‘dovish’ and Fed funds rate projections were cut, the Fed still expects to hike at least twice this year. On our side, we continue to look for two rate hikes this year, the first probably in June and the second in December. A cautious FOMC At yesterday’s meeting of the Federal Open Market Committee (FOMC), the Fed chose to leave its monetary policy unchanged, in line with consensus expectations. Fed Chair Yellen explained that two main reasons lay behind this decision: (1) the implications for the US economy of a softer pace of growth abroad; and (2) increased financial market volatility and somewhat tighter financial conditions. As far as the economic situation is concerned, in its statement the Fed modestly upgraded its assessment of economic activity and of the labour-market situation. However, with no great surprise, it slightly cut its GDP growth forecast for 2016. The median projection for y-o-y GDP growth in Q4 was revised down from 2.4% to 2.2%. More surprisingly, the projection for core PCE inflation in Q4 2016 was left unchanged at 1.6%.

Topics:

Bernard Lambert considers the following as important: FED, Macroview, United States, US monetary policy

This could be interesting, too:

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

investrends.ch writes Jerome Powell: «Es gibt keinen risikolosen Weg»

investrends.ch writes Fed senkt Leitzins wie erwartet

The FOMC sounded quite cautious and surprised at its meeting yesterday as it markedly revised down its Fed funds rate median projection for the end of this year.

As widely expected, at yesterday’s FOMC meeting, the Fed chose to ‘stand pat’. Although yesterday's FOMC meeting was perceived as sounding ‘dovish’ and Fed funds rate projections were cut, the Fed still expects to hike at least twice this year. On our side, we continue to look for two rate hikes this year, the first probably in June and the second in December.

A cautious FOMC

At yesterday’s meeting of the Federal Open Market Committee (FOMC), the Fed chose to leave its monetary policy unchanged, in line with consensus expectations. Fed Chair Yellen explained that two main reasons lay behind this decision: (1) the implications for the US economy of a softer pace of growth abroad; and (2) increased financial market volatility and somewhat tighter financial conditions.

As far as the economic situation is concerned, in its statement the Fed modestly upgraded its assessment of economic activity and of the labour-market situation. However, with no great surprise, it slightly cut its GDP growth forecast for 2016. The median projection for y-o-y GDP growth in Q4 was revised down from 2.4% to 2.2%. More surprisingly, the projection for core PCE inflation in Q4 2016 was left unchanged at 1.6%. This figure actually appears quite low. Core PCE inflation already picked up to 1.7% in January and February’s core CPI – published yesterday – surprised on the upside. Our own forecasts are that core PCE inflation will reach 1.9% in December and 1.8% on average in Q4 (see our 29 February post). Overall, there were only minor revisions in the economic projections. Actually, Chair Yellen emphasised that “the Committee’s baseline expectations for economic activity, the labor market, and inflation have not changed much since December”.

However, importantly, in its statement and in the press conference, the Fed pointed out the downside risks on the economy. In the statement, the FOMC added a sentence saying that “global economic and financial developments continue to pose risks”. And, as in January, the Fed decided to avoid giving an assessment on the balance of risks. To cut a long story short, Chair Yellen explained basically that the Committee judged that there were too many downside risks to say that risks were balanced, but probably not enough to explicitly note that risks were tilted on the downside.

Projection for Fed funds rate was cut noticeably

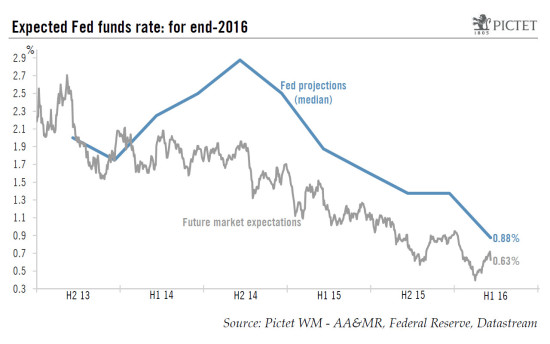

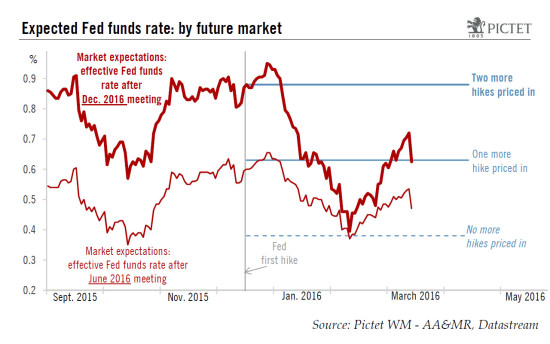

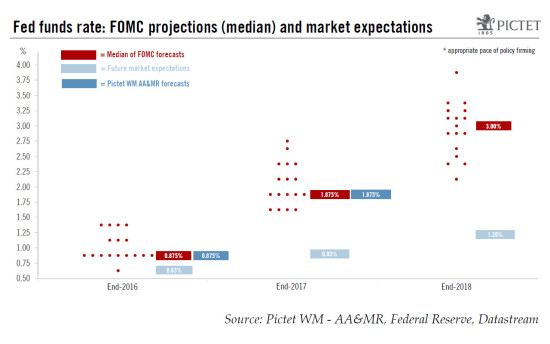

Turning to the projections for the Fed funds rate, the median forecast for the end of 2016 was revised down by 50bp from 1.375% to 0.875%, which implies ‘only’ two hikes of 25bp before the year is out (against a forecast of four hikes back in December). That was certainly the main surprise yesterday. Most specialists were expecting a median forecast 25bp higher.

However, we would not interpret these new projections too ‘dovishly’. Seven out of 17 (41%) of the participants still expect three or more 25bp hikes in 2016, and although the median forecast was cut by 50bp, the mean of individual projections declined by ‘only’ 27bp to 1.02%.

Looking beyond 2016, median projections were trimmed by 50bp, to 1.875% for end-2017 and by 25bp to 3.0% for end-2018.

In any event, these rate forecasts are strange beasts (see chart hereunder). On the one hand, they are nothing more than the sum of several forecasts (17 yesterday) from voting and non-voting Fed members. These projections can change fairly quickly and depend on which FOMC members attend the meeting. Moreover, although it was thinner in yesterday’s projections, the breadth of the range of forecasts generally looks quite wide. As a result, the significance of the median forecast is limited. On the other hand, Fed rate forecasts increasingly form part of its forward guidance. In any case, it is worth remembering that at the end of 2014, the median of projections was for four 25bp hikes… in 2015. We ended up with just one.

Our forecasts for the Fed funds rates remain unchanged

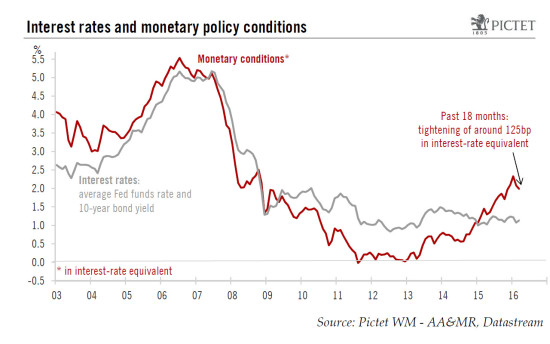

At the press conference, Chair Yellen did her best to explain the apparent contradiction between an almost unchanged economic scenario and a relatively marked downward revision in the expected path for Fed funds rates. She said that “these unanticipated developments [softer growth abroad and tighter financial conditions at home], however, have not resulted in material changes to the Committee’s baseline outlook. One reason for this is that market expectations for the path of policy interest rates have moved down, and the accompanying decline in longer-term interest rates should help cushion any possible adverse effects on domestic economic activity. Janet Yellen concluded by saying that “…most Committee participants now expect that achieving economic outcomes similar to those anticipated in December will likely require a somewhat lower path for policy interest rates than foreseen at that time”.

We agree. Given the reactivity of financial markets and exchange rate markets to Fed behaviour, and with even more divergence with other central banks’ policies recently, a pace of tightening as envisaged in December (four hikes in 2016) would probably have generated a sharp downturn in the US economy during the course of this year.

Overall, yesterday’s meeting confirmed what we have repeated many times: the trajectory of monetary policy will be highly data-dependent and the Fed will act very carefully in trying to avoid any unwanted tightening of monetary conditions. Moreover, as Janet Yellen put it yesterday, “such caution is appropriate given that short-term interest rates are still near zero, which means that monetary policy has greater scope to respond to upside than to downside changes in the outlook”.

However, we do not view yesterday’s set of messages as really so dovish. Financial markets were certainly fearing a hawkish surprise, so there was a kind of relief when this appeared not to be the case. However, given the overall current very uncertain backdrop, we do not see a median projection of two hikes this year – with 41% of the participants actually still expecting three hikes or more – as particularly dovish. The Fed is keeping a tightening bias.

On our side, our scenario for US monetary policy remains unchanged. With inflation quickening, the slack in the labour market continuing to be mopped up and GDP growth probably set to remain above potential growth, the Fed should continue along the road of monetary-policy normalisation. It will, however, continue to tread very warily, seeking to avoid excessive tightening of monetary and financial conditions. We continue to look for two further rate hikes this year, the first probably in June and the second in December. Considering the uncertainties weighing on the global economy and the fragile state of financial markets, the chances that the Fed might bide its time till September before acting are far from negligible.