Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, ...

Topics:

GoldCore considers the following as important: ATM, Aussie, Bank of England, Bitcoin, British Pound, Business, Central Banks, China, CPI, Credit Crisis, currency, economy, European Central Bank, Germany, Gold, Gold as an investment, headlines, Hong Kong, Hyperinflation, India, inflation, Italy, Jim Rickards, Lloyds, Money, Pound sterling, Precious Metals, purchasing power, Reuters, Silver as an investment, Southern Europe, United States dollar, Zimbabwean dollar, Zurich

This could be interesting, too:

investrends.ch writes Bitcoin sackt immer weiter ab

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

- Gold hedge against currency devaluation - cost of fuel, food, housing

- True inflation figures reflect impact on household spending

- Household items climbed by average 964%

- Pint of beer sees biggest increase in basket of goods - rise of 2464%

- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%

- Gold rises 2672% and hold's its value over 40 years

- Savings eaten away by money creation and negative interest rates

- Further evidence of gold’s role as inflation hedge and safe haven

Editor: Mark O'Byrne

Gold hedges against rising cost of living

Remember when you were taught about the inflation of the Weimar Republic in Germany at school? More recently I was taught about the inflation of Zimbabwe. In both instances we were given examples of how much the staple food of people cost - the humble loaf of bread.

We were all supposed to be horrified and thank our lucky stars we didn’t live in such times. We thanked God that those days were gone and long in the past, never to be seen again.

Obviously we are not unfortunate enough to live in a country where the price of bread changes from us walking into the bakery to paying for the loaf. Nor do we have to carry huge wads of bank notes around in bricks as we saw in Zimbabwe.

Worthless 1 Trillion Zimbabwe Dollar Note (Wikimedia Commons)

Worthless 1 Trillion Zimbabwe Dollar Note (Wikimedia Commons)

But, there has still been a whopping devaluation in the pound, the dollar and all major fiat currencies - as much as of over 90% devaluation in some in the last forty or so years. Food items have increased on average by 964% in the UK.

A form of hyperinflation is has happened globally but just over a much longer time period.

Back in 2014 we wrote about the impact of inflation on household spending and the cost of living due to the devaluation of the pound since 1973. Needless to say three years on that the impact of inflation is even greater and the pound worth even less - especially after sterling's sharp fall after Brexit.

Today a British Pound from 1973 is worth just eight pence. When we first reported on this issue in 2014 the value of a 1973 pound was worth nine pence. In contrast, since 1973, one ounce of gold has climbed by a whopping 2,673%. Today, the £100 of 1973 is worth just £9.01, compared to £9.48 in 2014.

These numbers show just how much damage has been done to the British pound and therefore the value of our medium of exchange and savings.

They also show how well you would have been protected by investing in gold. Had you done so you would have enjoyed the benefits of this time tested hedge against the long term ravages of inflation.

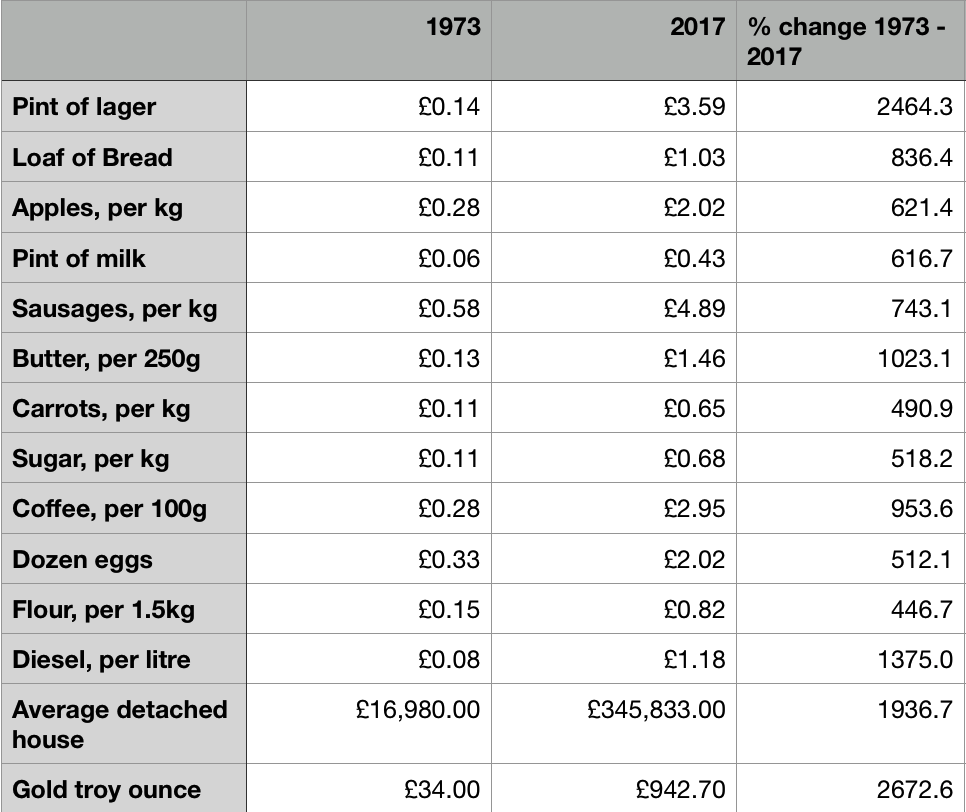

Cost of household goods rises by average of 964%

The £9.01 today wouldn’t get you too far given the prices found in the July 2017 RPI and CPI price list.

The price list also shows how many producers have been forced to lower prices thanks to supermarkets’ buying and pricing power. Bread and milk are just two key items which have been forced down in price since 2014. Despite this, their prices remain highly inflated since 1973.

A pint of a beer has felt the biggest surge of the food and drink items we selected, it has shot up by 2,464.3% from 14p to £3.59 per pint.

A sliced loaf of white bread has come down from £1.30 to £1.03 since 2014, but it is still up a huge 836% since 1973. The processed, mass produced bread of today is unlikely to be of the quality of the bread of then.

The butter your parents might have once slathered onto your morning toast might just have to be lightly dabbed on, given it costs nearly 11 times more than it did in 44 years ago. A 250 gramme slab of butter went from 13p to £1.46 or over 1000%.

Perhaps your fancy crepes for breakfast instead of toast. A dozen eggs are now 5 times what they once were, setting you back £2.02 when they once would have been a bargain at 33p. The flour to help you make those crepes has climbed almost as much in price, by 446% to 82p for 1.5kg.

That morning coffee you love so much? 100g of its instant form costs nearly 10 times more from 28p to £2.95. And the milk to make it a latte costs over 6 times more, climbing from 6p to 43p. Don’t forget the sugar, a kilo bag of sugar will now set you back now costs 68p, up from 11p – up over 500%.

Apples cost have climbed in price by 621%, from 28p per kilo to £2.02 per kilo. Other vegetables have also increased. Carrots - those magic vegetables to help you see in the dark will now cost you nearly 8 times what they would have in 1973. A kilo bag of carrots now costs 91p, up from 11p or a rise of 723%.

Sadly after beer and butter, the items which have climbed the most in this list of household essentials are not food and drink items. Instead, they’re the items which keep us safe and warm, and help us keep earning an increasingly valueless wage - home prices and fuel.

Diesel costs nearly 14 times more, from 8p in 1973 to to £1.18 in July this year. If you have even glanced at house prices recently then you won’t be surprised to hear they are practically unaffordable or that the price of the average detached house went from £16,980 to £345,833. The family home now costs nearly 2,000% more than in 1973.

Of course, what has beaten all of these in a climb in price? An ounce of gold, which has gone from £34 to £1051, an increase of over 2,600%.

What about from 50 years ago?

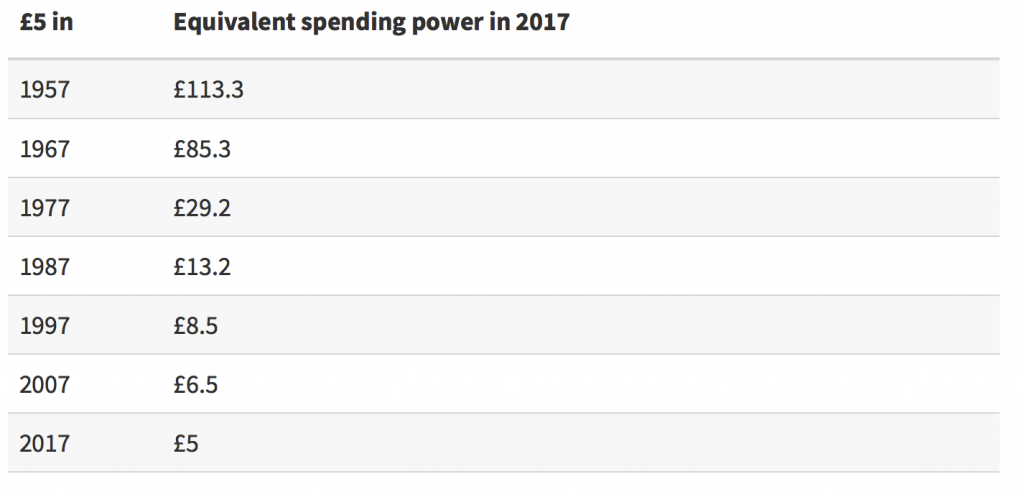

We have been going through a spate of changes here in the UK, of new paper notes some of which haven’t been changed (in design) since the 1950s. But, their spending power certainly has.

One of these is the fiver. Interestingly it was once standard to be able to get a £5 note from a cash machine. I don’t recall this (I was born in the 1980s) and when I was at university there was one cash machine which was almost a novelty because it did dispense of the notes. When the financial crisis hit banks and ATM companies decided to start reissuing £5 notes in order to ‘help people with their budgeting.’

Equivalent spending power 2017 (Source CityAM)

Equivalent spending power 2017 (Source CityAM)

Why had the fiver stopped being issued in ATMs? Because the £5 had become small change. When you look at the figures in terms of what the £5 of today would have bought you back in 1957 then you really do get a good look at the damage that has been done to the British pound’s spending power.

Our American subscribers and clients will relate to this as the $5 note (USD) today does not buy what it bought 20, 30 or 40 years ago.

Households and savers hit from all angles

Every month we hear about where inflation is. Headlines are always screaming about whether or not inflation has hit the Bank of England MPC’s target. Rarely do we here about the ongoing damage being done to the value of the pound over a long term period.

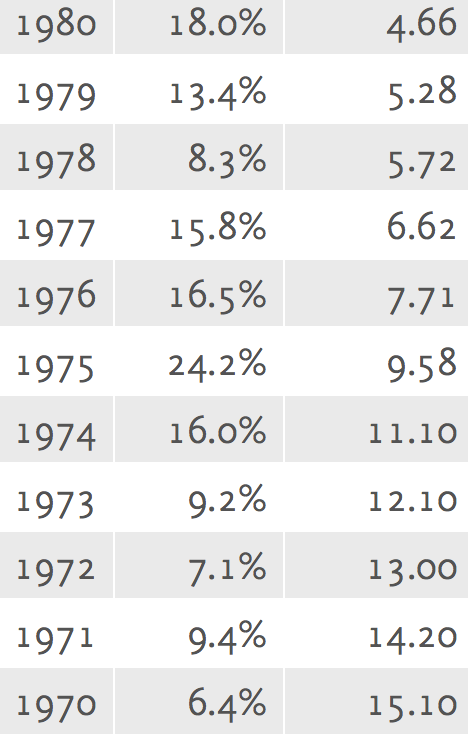

On an annual basis we are not suffering as much today as perhaps we would have been in the 1970s to early 80s. My grandfather retired in the 1970s, he died just last year. The first few years of his retirement were fraught with inflation as the average rate was around 13%.

Annual Inflation Rate & Multiplier (1970 -1980)

Annual Inflation Rate & Multiplier (1970 -1980)

Source Stephen Morley.org

Of course, a retirement as long as my grandfather’s will be near unimaginable for generations since. This is partly do with lifestyle choices but also thanks to the fact that we can no longer afford to save enough in order to enjoy such a break. Many retire in the hope that their pension pots and savings will grow thanks to interest rates. As we know from the last ten years, this just isn’t possible anymore.

As we wrote back in 2014, ‘If retail prices were to rise by 2.8% annually – in line with government targets – the value of money would decline by a further 67% over the next 40 years.'

‘If inflation follows this pattern, consumers would need £311 in 2053 to have the same spending power as an individual with £100 today – or more than £3 million to enjoy the equivalent lifestyle of a millionaire today.’

This isn’t just a problem for those who have retired. It is a daily problem for British households. Recently we wrote about shrinkflation and the impact it is having on British households. But even where size of common household items remains constant, consumers are seeing a huge fall in the amount they get for their money and what they are earning.

There are very few households in the UK at present who are not feeling badly hit from all angles. From the increased rise in the cost of living to their wages which are not keeping up with inflation. Even those who can afford to save are suffering thanks to the devaluation of the pound, low interest rates and the threat of negative rates.

Conclusion - what’s the real story?

Laughingly the Bank of England’s website reads ‘Price stability is defined by the Government’s inflation target of 2%’. In other words, climbing prices and a falling purchasing power of the sovereign currency is considered to be price stability.

Tell that to parents who are struggling to clothe, feed, transport, educate and look after the health care needs of their children. They might welcome a little bit of mild deflation. Especially those struggling to rent basic housing or buy a home.

The study which originally inspired us to look at this situation in more details was carried out by Lloyds, who at the time stated that ‘in 40 years, an individual would need £3 million to enjoy the same lifestyle as a millionaire today.’

To that we say, it’s a lot more simple than worrying about accumulating £3 million in the right time period in order to be able to retire comfortably or very comfortably.

Instead, look at the table again and realise what has held its value and protected people's purchasing power - gold.

As it has throughout recorded history, gold has acted as hedge against inflation and a financial insurance against irresponsible and reckless governments and central banks. No matter what level of currency devaluation your country has seen, one ounce of gold is one ounce of gold, is recognised and liquid everywhere and has remained a store of value globally.

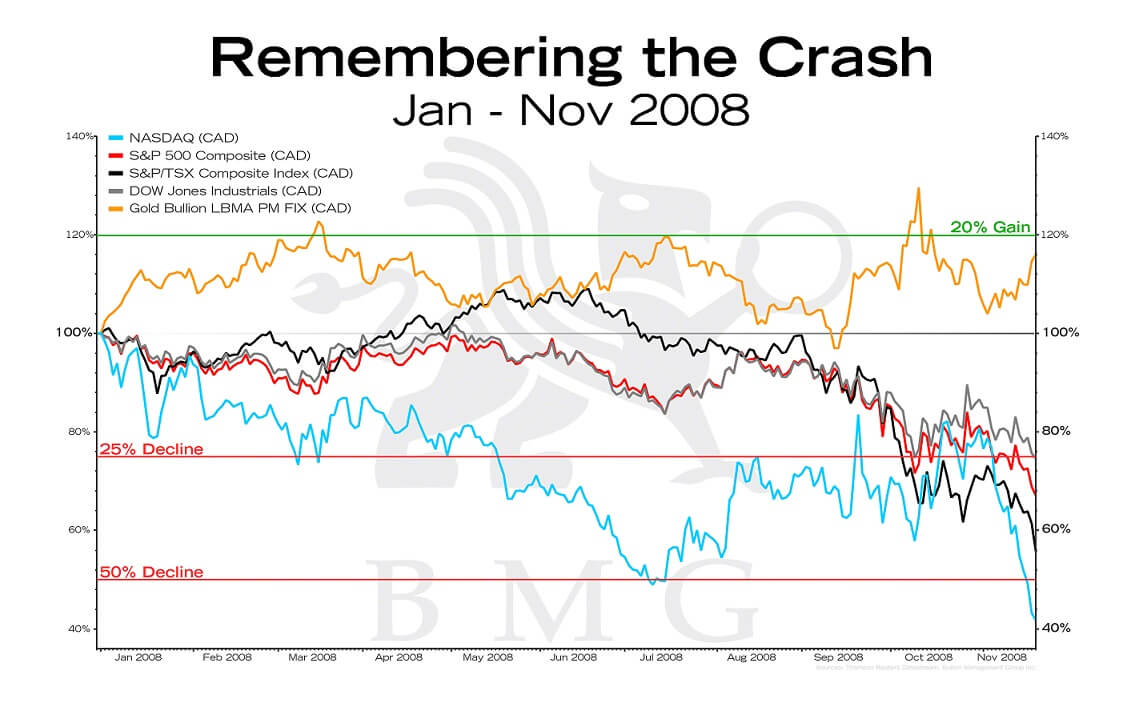

Gold is flat this year after falling 40% in recent years. However, it rose 8% last year but it is has performed very well over the long term - a 10, 20, 30 and 40 year time period.

Long term the value of your cash savings and deposits is being eaten away - especially in an era of zero percent and negative interest rates. Gold might continue to be unappreciated by the majority but a quick glance at these charts and all can see the protection it offers savers a

Related Content

Gold Hedges Against Surge In Cost Of Bread, Eggs, Beer and Fuel

News and Commentary

Gold steady, on track for second straight weekly gain (Reuters.com)

Gold at 3-week high as ECB comments lift euro, dollar falls (Reuters.com)

Gold Prices Boosted By Fresh Dollar Slide (EconomicCalendar.com)

Dollar Stays Weak on U.S. Politics; Aussie Falls (Bloomberg.com)

Gold marks longest win streak in 2 months as U.S. dollar sinks (MarketWatch.com)

Three things I wish I’d understood about money a long time ago (StansBerryChurcHouse.com)

The NEXT Credit Crisis Has Already Started (BonnerAndPartners.com)

Southern Europe's Next Tipping Point - Italy (ZeroHedge.com)

Real Reason Stocks Are Setting Records? (DailyReckoning.com)

Video: Qatar Doha Bank Says Central Bank Has Enough Cash, Gold (Bloomberg.com)

Gold Prices (LBMA AM)

21 Jul: USD 1,247.25, GBP 958.89 & EUR 1,071.39 per ounce

20 Jul: USD 1,236.55, GBP 953.63 & EUR 1,075.06 per ounce

19 Jul: USD 1,239.85, GBP 950.84 & EUR 1,074.83 per ounce

18 Jul: USD 1,237.10, GBP 949.47 & EUR 1,071.82 per ounce

17 Jul: USD 1,229.85, GBP 940.71 & EUR 1,074.03 per ounce

14 Jul: USD 1,218.95, GBP 940.54 & EUR 1,067.92 per ounce

13 Jul: USD 1,221.40, GBP 944.51 & EUR 1,071.05 per ounce

Silver Prices (LBMA)

21 Jul: USD 16.43, GBP 12.63 & EUR 14.11 per ounce

20 Jul: USD 16.18, GBP 12.50 & EUR 14.07 per ounce

19 Jul: USD 16.23, GBP 12.44 & EUR 14.08 per ounce

18 Jul: USD 16.17, GBP 12.41 & EUR 13.99 per ounce

17 Jul: USD 16.07, GBP 12.30 & EUR 14.02 per ounce

14 Jul: USD 15.71, GBP 12.11 & EUR 13.76 per ounce

13 Jul: USD 15.95, GBP 12.34 & EUR 14.00 per ounce

Recent Market Updates

- Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

- “Time To Position In Gold Is Right Now” says Jim Rickards

- Bloomberg Silver Price Survey – Median 12 Month Forecast Of $20

- “Bigger Systemic Risk” Now Than 2008 – Bank of England

- “Financial Crisis” Coming By End Of 2018 – Prepare Urgently

- Video – “Gold Should Probably Be $5000” – CME Chairman

- India Gold Imports Surge To 5 Year High – 220 Tons In May Alone

- “Silver’s Plunge Is Nearing Completion”

- China, Russia Alliance Deepens Against American Overstretch

- Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

- Precious Metals Are “Best Defence” Against Bail-ins In Economic Crisis

- Buy Gold Near $1,200 “As Insurance” – UBS Wealth

- UK House Prices ‘On Brink’ Of Massive 40% Collapse

"It is important to note that all portfolios under all conditions actually perform better with exposure to gold and silver" - David Morgan

In the short video above, David Morgan, the Silver Guru, speaks briefly about the importance of owning silver bullion coins and bars as financial insurance in an uncertain world. He speaks about GoldCore Secure Storage and how he recommends GoldCore's ultra secure allocated and segregated gold, silver, platinum and palladium bullion storage (Zurich, London, Singapore and Hong Kong) to his retail and high net worth clients.