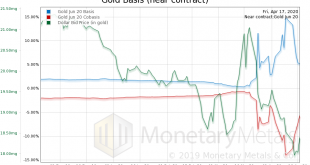

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »Cash is Toilet Paper, Market Report 23 March

The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession. Last week, we were warming up to silver, if not recommending it. We said: “While we would not recommend betting on silver with leverage at this moment, we certainly would not be short silver right now. If you don’t own any,...

Read More »Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned. The article asserts that the reasons for the...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org