Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

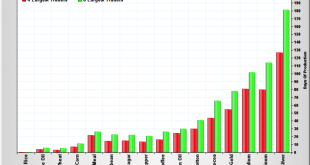

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

Read More »Silver Analysts Forecast $20 In Bloomberg Silver Price Survey

Silver Analysts Forecast $20 In Bloomberg Silver Price Survey - Bloomberg silver price survey - Large majority bullish on silver- Silver median "12 month-forecast" of $20- Precious metal analysts see silver "24 percent rally from current levels"- Investors are pouring money into silver ETFs- Speculative funds bearish even as ETF assets rise to record- Spec funds being bearish is bullish as frequently signals bottom- Important to focus not just on silver price but on silver...

Read More »Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

Gold Investing 101 - Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint - a royally expensive way to help the government Unallocated gold - unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion - Reduce counter parties, Don’t over complicate Yesterday we...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More »Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org