More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.) Return data for 16 advanced economies over nearly 150 years … …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills. Real returns average 7% p.a. for equity, 8% for housing, 2.5% for bonds, and 1% for bills. Housing returns are much less volatile than equity returns. Real interest rates have been volatile over the long-run, sometimes more so than real risky returns. Real interest rates peaked around 1880, 1930, and 1990. Current low real interest rates are “normal.” Risk

Topics:

Dirk Niepelt considers the following as important: Bond, equity, Notes, Real estate, Real interest rate, Rental income, Return, risk, Risk Premium

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.)

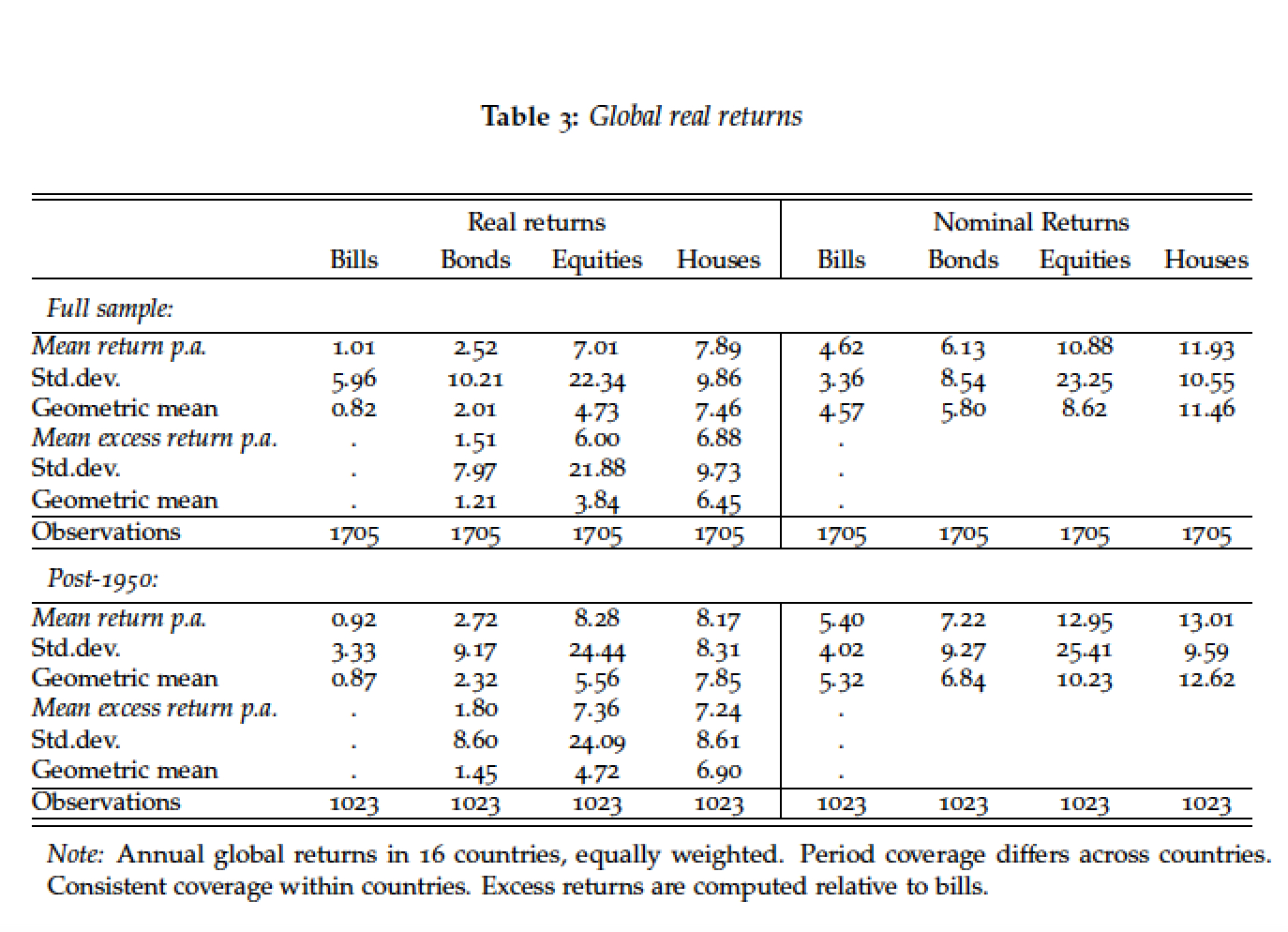

- Return data for 16 advanced economies over nearly 150 years …

- …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills.

- Real returns average 7% p.a. for equity, 8% for housing, 2.5% for bonds, and 1% for bills.

- Housing returns are much less volatile than equity returns.

- Real interest rates have been volatile over the long-run, sometimes more so than real risky returns. Real interest rates peaked around 1880, 1930, and 1990. Current low real interest rates are “normal.”

- Risk premia have been volatile, but at lower than business cycle frequencies.

- r − g is rather stable in the long run and always positive. The difference rose during the end of the 19th and 20th century.