In the NBER working paper “Dissecting Green Returns,” Lubos Pastor, Robert Stambaugh, and Lucian Taylor argue that excess returns on green assets during recent years are unlikely to predict expected excess returns. At least that’s what theory suggests: … green assets have lower expected returns than brown, due to investors’ tastes for green assets, yet green assets can have higher realized returns while agents’ tastes shift unexpectedly in the green direction. … green tastes can...

Read More »Long-Term Real Rates of Return

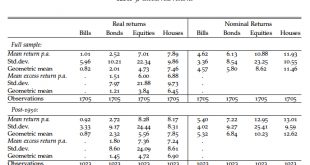

More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.) Return data for 16 advanced economies over nearly 150 years … …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills. Real returns average 7% p.a. for equity, 8% for housing,...

Read More »The Residential Real Estate Premium (Puzzle)

On Alphaville, Matthew Klein discusses recent work by Jorda, Knoll, Kuvshinov, Schularick, and Taylor (“The Rate of Return on Everything, 1870–2015“) according to which Residential real estate, not equity, has been the best long-run investment over the course of modern history. … but they didn’t calculate the returns most homeowners actually experience. Most people borrow to buy housing and most people live in their properties without renting them out. This makes a big difference. … Net...

Read More »On the Performance of Swiss Portfolio Managers

In the NZZ, Michael Schaefer reports on a study about the performance of Swiss portfolio managers in 2016. The median portfolio returns in all investment strategies except those not investing in stocks fell short of the corresponding benchmark returns. Only a fifth of the portfolios generated returns in excess of their benchmark. These numbers do not yet account for management fees. No portfolio manager generated high returns across all strategies. But some managers consistently generate...

Read More »Chile’s Fully Funded Pension System

On Project Syndicate, Andres Velasco argues that one of the sources of the current problems with the Chilean pension system are the high fees charged by fund managers: A government-appointed commission recently concluded that managers have generated high gross real returns on investments: from 1981 to 2013, the annual average was 8.6%; but high fees cut net returns to savers to around 3% per year over that period. The commission’s report.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org