With Tamon Asonuma and Romain Ranciere. Journal of International Economics 140, 103689, January 2023. PDF. We document that creditor losses (”haircuts”) during sovereign debt restructurings vary across debt maturity. In our novel dataset on instrument-specific haircuts suffered by private creditors in 1999-‒2020 we find larger losses on short- than long-term debt, independently of the specific haircut measure we use. A standard asset pricing model rationalizes our findings under two...

Read More »“Sovereign Bond Prices, Haircuts and Maturity,” UniBe, 2022

With Tamon Asonuma and Romain Ranciere. UniBe Discussion Paper 22-13, November 2022. PDF. We document that creditor losses (”haircuts”) during sovereign debt restructurings vary across debt maturity. In our novel dataset on instrument-specific haircuts suffered by private creditors in 1999-‒2020 we find larger losses on short- than long-term debt, independently of the specific haircut measure we use. A standard asset pricing model rationalizes our findings under two assumptions, both...

Read More »Long-Term Real Rates of Return

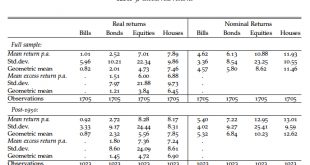

More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.) Return data for 16 advanced economies over nearly 150 years … …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills. Real returns average 7% p.a. for equity, 8% for housing,...

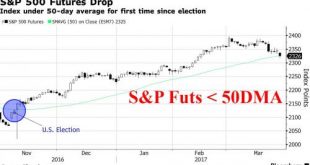

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org