One of the American Economic Association sessions in this year’s ASSA Meetings focused on “Modern Monetary Theory” (MMT) and (maybe somewhat unfairly in the same session) on last year’s presidential address by Olivier Blanchard, which suggested that persistently low interest rates on public debt render government budget constraints non-binding. Greg Mankiw concluded in his paper that “MMT contains some kernels of truth, but its most novel policy prescriptions do not follow cogently from...

Read More »Interest Rates Since 1310

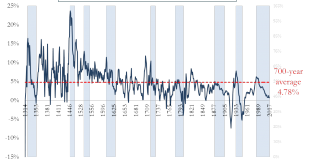

Figure III in Paul Schmelzing (2019), Eight Centuries of Global Real Interest Rates, R-G, and the ‘Suprasecular’ Decline, 1311–2018. SSRN.

Read More »Monetary Paradigm Reset, Report 5 August 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Explaining a new paradigm can be both simple and impossible at the same time. For example, Copernicus taught that the other planets and Sun do not revolve around the Earth. He said that all the planets revolve around the Sun, including Earth. It isn’t hard to say, and it isn’t especially hard to grasp. Indeed, one of its...

Read More »Real Interest Rates in the Long Run

On Bank Underground, Paul Schmelzing looks at real interest rates over the last 700 years and finds that … the past 30-odd years more than hold their own in the ranks of historically significant rate depressions. But the trend fall seen over this period is a but a part of a much longer ”millennial trend”. It is thus unlikely that current dynamics can be fully rationalized in a “secular stagnation framework”.

Read More »Long-Term Real Rates of Return

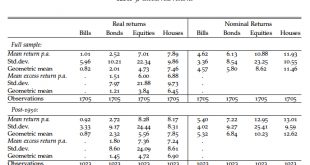

More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.) Return data for 16 advanced economies over nearly 150 years … …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills. Real returns average 7% p.a. for equity, 8% for housing,...

Read More »Sources of Low Real Interest Rates

In a (December 2015) Bank of England Staff Working Paper, Lukasz Rachel and Thomas Smith dissect the global decline in long-term real interest rates over the last thirty years. A summary of their executive summary: Market measures of long-term risk-free real interest rates have declined by around 450bps. Absent signs of overheating this suggests that the global neutral rate fell. Expected trend growth as well as other factors affecting desired savings and investment determine the neutral...

Read More »“Secular” Stagnation, A Return to Trend

On Bank Underground, Gene Kindberg-Hanlon criticizes the secular stagnation hypothesis: Real interest rates have fallen by around 5 percentage points since the 1980s. Many economists attribute this to “secular” trends such as a structural slowdown in global growth, changing demographics and a fall in the relative price of capital goods which will hold equilibrium rates low for a decade or more (Eggertsson et al., Summers, Rachel and Smith, and IMF). In this blog post, I argue this...

Read More »Determinants of (Low) Real Interest Rates

On his blog, James Hamilton summarizes a Bank of England working paper by Lukasz Rachel and Thomas Smith on the determinants of low real interest rates.

Read More »Nominal and Real Interest Rates over the Medium Term

From the NZZ:

Read More »Secular Stagnation Skepticism

I was asked to play devil’s advocate in a debate about “secular stagnation.” Here we go: Alvin Hansen, the “American Keynes” predicted the end of US growth in the late 1930s—just before the economy started to boom because of America’s entry into WWII. Soon, nobody talked about “secular stagnation” any more. 75 years later, Larry Summers has revived the argument. Many academics have reacted skeptically; at the 2015 ASSA meetings, Greg Mankiw predicted that nobody would talk about secular...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org