Echo der Zeit, SRF, 12 May 2023. HTML with link to audio file. Implications of capital injections and liquidity assistance for the federal government, the SNB, and Switzerland.

Read More »Redrawing the Map of Global Capital Flows

Redrawing the Map of Global Capital Flows: The Role of Cross-Border Financing and Tax Havens, by Antonio Coppola, Matteo Maggiori, Jesse Schreger, and Brent Neiman: We start with the dataset of global mutual fund and exchange traded fund (ETF) holdings provided by Morningstar and assembled in Matteo Maggiori, Brent Neiman and Jesse Schreger (2019a, henceforth MNS). For each position in the data, we link the security’s immediate issuer to its ultimate parent. The resulting data can then be...

Read More »I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term… This is not a satisfactory...

Read More »“Sinnvoller wäre, den Benzinverbrauch zu besteuern (Better Tax Carbon Emission),” Der Bund, 2019

Der Bund. March 5, 2019. HTML. Short newspaper interview about corrective taxes, tackling problems at the root, and equity vs. efficiency.

Read More »“Sinnvoller wäre, den Benzinverbrauch zu besteuern (Better Tax Carbon Emission),” Der Bund, 2019

Der Bund. March 5, 2019. HTML. Short newspaper interview about corrective taxes, tackling problems at the root, and equity vs. efficiency.

Read More »Blockchain Based Equity Settlement in Australia

In the FT, Jamie Smyth reports that the Australian Securities Exchange plans to introduce a blockchain based equity clearing and settlement system. ASX will operate the system on a secure private network with known participants. The participants must comply with regulation, according to the ASX, which said its system had nothing to do with blockchain technology deployed by cryptocurrencies such as bitcoin.

Read More »On 100%-Equity Financed Banks

On his blog, John Cochrane argues that banks could, and should be 100% equity financed. His points are: (1) There are plenty of safe assets—government debt—out there and banks do not need to “create” additional safe assets—deposits. I share this view partly. First, I don’t know what amount of safe assets are sufficient from a social point of view. Second, I don’t consider government debt to be a safe asset. Third, debt has safety and liquidity properties. The question is not only whether...

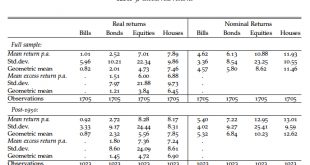

Read More »Long-Term Real Rates of Return

More from the recent working paper by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor (“The Rate of Return on Everything, 1870–2015“). (Previous blog post about the return on residential real estate.) Return data for 16 advanced economies over nearly 150 years … …on the income and capital gains (and thus, total returns) from equities, residential housing, government bonds, and government bills. Real returns average 7% p.a. for equity, 8% for housing,...

Read More »The Residential Real Estate Premium (Puzzle)

On Alphaville, Matthew Klein discusses recent work by Jorda, Knoll, Kuvshinov, Schularick, and Taylor (“The Rate of Return on Everything, 1870–2015“) according to which Residential real estate, not equity, has been the best long-run investment over the course of modern history. … but they didn’t calculate the returns most homeowners actually experience. Most people borrow to buy housing and most people live in their properties without renting them out. This makes a big difference. … Net...

Read More »Have Banks Become Less Risky?

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org