Companies will no longer have to prove there are no Swiss job candidates in some sectors. Moves to cut red tape for non-EU foreign workers in Switzerland will not necessarily lead to more work visas being issued. On Friday, the government announced measures to make it easier to hire skilled workers from such countries as India, Britain, China and the United States. By making it simpler to award B and L work permits, Switzerland hopes that the “innovative power of...

Read More »Switzerland triggers wide range of sanctions against Russia

More than a million Ukrainians have fled their country since the Russian invasion. Switzerland said it is activating sanctions against Russia on Friday, including a ban on many industrial exports and wide-ranging restrictions on financial activities, which includes cutting Russian banks from the SWIFT financial messaging system. The Swiss government also confirmed it is freezing the assets of people and companies with connections to Russian President Vladimir...

Read More »Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia, and India managed...

Read More »Hiking Rates Into Peak Valuations Is A Mistake

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article. Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be “tightening into an...

Read More »The Roundtable Insight with Charles Hugh Smith on The Great Reset Agenda

Here is the link to the article referenced in the podcast - http://financialrepressionauthority.com/2022/02/10/the-great-awakening-an-alternative-great-reset-based-on-the-principles-of-the-austrian-school-of-economics/

Read More »European Currencies Continue to Bear the Brunt

Overview: Russia’s invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next. The recovery in US stocks yesterday may have helped lift Asia Pacific shares today (China and India are notable exceptions). However,...

Read More »Ukrainer nutzen Cryptocoins in der aktuellen Krise

Während die Medien weiterhin versuchen, Cryptocoins mit kriminellen Machenschaften in Verbindung zu bringen, zeigt die Krise in der Ukraine, wie Cryptocoins den Bürgern helfen können, sich vor den Folgen eines Krieges zu schützen. Bitcoin News: Ukrainer nutzen Cryptocoins in der aktuellen KriseMit der Auseinandersetzung im Osten der Ukraine wird nun auch der Kollaps des nationalen Bankensystems erwartet. Nicht nur eine Kapitalflucht steht bevor, sondern auch die...

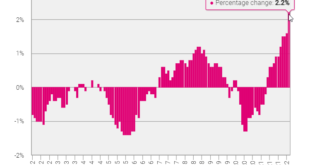

Read More »Swiss Inflation Rises to 2.2%

Swiss Inflation rises to 2.2%. This for Swiss levels very high inflation means that the Swiss franc has still upwards potential, in particular given the current political events. What is particular worrysome for the SNB is that prices for private services have risen by 1.4%. It is hence not only oil that drives the high price increases. Details in German Swiss Consumer Price Index in February...

Read More »URGENT⚠️: You Must Own Gold To Avoid Crisis Ahead | Keith Weiner Gold Forecast

URGENT⚠️: You Must Own Gold To Avoid Crisis Ahead | Keith Weiner Gold Forecast #Gold #goldprice #goldforecast #goldpriceprediction Subscribe To Our Channel ➤➤➤➤ shorturl.at/vBYZ9 Welcome to Investors Hub, an exclusive community of finance enthusiasts that are interested in understanding the ins and outs of the investment space. At Investors Hub, we are constantly on the lookout for great opportunities to buy Silver, Gold, crypto and other financial instruments. Through silver &...

Read More »SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

Read More » SNB & CHF

SNB & CHF