This week, 120,9017 new Covid-19 cases were reported in Switzerland, up 24% from the 97,335 cases reported a week earlier. In addition, the reported number of Covid-19 patients hospitalised edged up slightly from 340 to 352 compared to the week before. Photo by cottonbro on Pexels.comThe 7-day average case number had been in constant decline since the end of January. However, the number began to turn upwards in the days leading up to the end of February. On 4...

Read More »Why Switzerland doesn’t want to join the European Union

Switzerland and the European Union have a complicated relationship. The recent decision by the Alpine nation to definitively shut the door on a framework agreement with the EU reaffirms its attachment to its independence. It shows that 30 years after refusing to join the EU, Switzerland’s stance has only been reinforced. We look at some of the main reasons why. For years Bern and Brussels have been working to recast their long-term relationship. In the...

Read More »Chart of the week: Swiss retirement age compared

Switzerland’s retirement age of 65 for men and 64 for women puts its state pensioners in the youngest half of OECD retirees. Photo by MART PRODUCTION on Pexels.comThis week, when a Swiss parliamentarian asked in which direction pension reform was heading, he received a written response that said the state pension system could be stabilised from 2030 with a rise in the retirement age to 68 for both men and women, reported the NZZ newspaper. Many nations have...

Read More »For The Fed, None Of These Details Will Matter

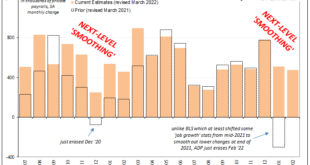

Most people have the impression that these various payroll and employment reports just go into the raw data and count up the number of payrolls and how many Americans are employed. Perhaps the BLS taps the IRS database as fellow feds, or ADP as a private company in the same data business of employment just tallies how many payrolls it processes as the largest provider of back-office labor services. That’s just not how it works, though. In fact, sampling and...

Read More »ECB Meeting and US and China’s CPI are the Macro Highlights in the Week Ahead

One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp. Even after the Russian invasion, the market had discounted a 75% chance that...

Read More »Asiatische Börsen schließen Russland aus

Die Sanktionen gegen Russland gehen weiter. Inzwischen schließen sich weltweit Finanzinstitute, Banken und Börsen an. Vier der größten Cryptobörsen Südkoreas haben sich gestern entschieden, russische IP-Adressen zu blocken, zusätzlich wurden bereits 20 Konten eingefroren. Crypto News: Asiatische Börsen schließen Russland ausZu den Börsen gehören Gopax und Upbit, zwei der größten Börsen im ostasiatischen Raum. Und auch in Japan bereiten sich einige Börsen darauf vor...

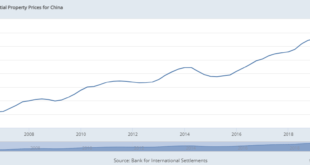

Read More »China Needs to Pop Its Property Bubble

The financial woes of the giant real estate developer Evergrande, which carries an estimated debt of $300 billion, have rekindled global fears that China’s property bubble is about to burst. Such predictions have occurred repeatedly in the past, in particular since 2010, and have been fueled by the rapid rise of property prices, construction volumes, and real estate debt. Today, many analysts fear that if the property bubble collapses, the impact on the real economy...

Read More »Switzerland builds business case for non-fungible tokens

NFTs have hit the headlines with spectacular sakes of digital artworks, such as the wildly popular CryptoPunks. Keystone / Obs/4artechnologies The latest blockchain phenomenon, the non-fungible token (NFT), has generated vast profits for artists and a raft of fraudulent scams. Several Swiss NFT projects have set out to prove that the technology can have a lasting impact beyond the spectacular headlines. This content was published on March 5, 2022 - 09:00 March 5,...

Read More »SWIFT Ban: A Game Changer for Russia?

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT. We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT. What is SWIFT and Why Russia is Being Excluded SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries. The system doesn’t move actual money between the banks but...

Read More »Keith Weiner: Silver Manipulation Doesn’t Exist

In this clip, Keith Weiner, founder of Monetary Metals, and I talk about the manipulation of silver. According to Keith, silver price manipulation doesn't exist to the extent where it would prevent silver from already being above $100/oz. He explains that more in-depth, in his article "Thoughtful Disagreement with Ted Butler", linked here: https://monetary-metals.com/thoughtful-disagreement-with-ted-butler/ During the full interview, Keith Weiner and I talked about the what's...

Read More » SNB & CHF

SNB & CHF