The Russian central bank recently announced that it will stop buying gold at a fixed rate and will instead buy them at the negotiated rate from banks. Following the numerous sanctions which were imposed on Russia. The Ruble had fallen tremendously against the US dollar, to get out of such a situation it had announced that it would buy gold at a fixed price of 5,000 rubles a gram until June 30. Since that announcement, the ruble has strengthened sharply against the...

Read More »Rising US Rates Sends the Yen Lower, but 50 bp Hikes Didn’t Deter Kiwi and Loonie Selling

The dollar rose against the major currencies last week, but the British pound, which eked out a small gain in the holiday-shortened week. The weakest was the Japanese yen, where rising US yields exerts an irresistible tug lifting the dollar to new 20-year highs. Yet, the 50-basis point hikes from the Reserve Bank of New Zealand and the Bank of Canada did not prevent their currencies from succumbing to the greenback’s surge, falling around 1.1% and 0.35%,...

Read More »Social Media Financial Scams Balloon

Around the world, fraudsters are turning to social media platforms like Facebook and Instagram to reach billions of potential victims. As losses continue to pile up, regulators are voicing their concerns, with one going as far as suing a social media giant for not taking sufficient steps to tackle the rampant issue. Just last month, Australia’s Competition and Consumer Commission (ACCC) instituted Federal Court proceedings against Facebook owner Meta Platforms for...

Read More »Darshan Mehta: Insights Are Game Changers For Business

What drives customer behavior and customer choices? It’s the existential question for business; you’ve got to know the answer. But it’s a mystery, hard to unlock. The solution to this answer lies in what market researchers call insights, based on the Austrian deductive method that we summarized in episode #164 with Per Bylund (Mises.org/E4B_164). In episode #165, we talk to Darshan Mehta, a lifelong professional in the field, an advisor to global and local brands,...

Read More »China More and More Beyond ‘Inflation’

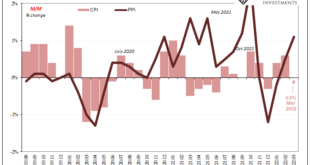

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

Read More »Alabama Passes Sound Money Law, Expands Sales Tax Exemption Involving Gold and Silver

(Montgomery, Alabama – April 14, 2022) – With Governor Kay Ivey’s signature on sound money legislation today, Alabama has become the second state this year to expand its sales tax exemption involving gold and silver. Alabama Senate Bill 13, championed by Sen. Tim Melson and Rep. Jamie Kiel, passed with unanimous support out of the Alabama Senate and then passed unanimously through the Alabama House before making it to the Governor’s desk. In 2019, Alabama originally...

Read More »Are the days of morally neutral corporate decision-making over?

New rules of the game have consequences be they sanctions, laws, court rulings or even public opinion. The stakes have never been as high for multinationals when it comes to doing the right thing. The war in Ukraine has tested the moral compass of big firms worldwide. Sanctions against Russia came with little notice along with heavy penalties for those who don’t toe the line. Low profile industries can suddenly no longer operate under the radar. Take Swiss steel...

Read More »Central Banks on a Preset Course Reduces Significance of High-Frequency Data

Arguably the most important data next week is the flash PMI. It is not available for all countries, but for those generally large G10 economies, the preliminary estimate is often sufficiently close to the final reading to steal its thunder. Moreover, and this applies to high-frequency data more broadly, given the overshoot of inflation in most counties, with some exceptions, notably in Asia, central banks appear to be on set courses. The near-term data are...

Read More »NFT des ersten Twitter-Tweets verliert massiv an Wert

Der Hype scheint ungebrochen. NFTs sprießen aus dem Boden wie nie zuvor und viele Unternehmen haben ihre eigenen NFT-Programme bereits in der Mache. Doch kommen die heutigen Adopter bereits zu spät? Viele NFTs der ersten Stunde haben nämlich inzwischen deutlich an Wert verloren. Crypto News: NFT des ersten Twitter-Tweets verliert massiv an WertEs ist noch nicht lange her, da verkaufte sich ein NFT des weltweit ersten Twitter-Tweets für 2,9 Millionen US-Dollar. Der...

Read More »Is The Ruble Backed By Gold Now?

Over the past couple of weeks, we reviewed the U.S. government confiscation of gold by Executive Order in 1933. (see “Gold Confiscation: Will History Repeat Itself?” and “The Facts of Gold Confiscation: The Saga Continues”). One of the points was that the difference between 1933 and today is that gold is not money for banks today. This means banks are not on a gold standard. Some observers have stated that the announcement by Russia’s Central Bank on March 25 to...

Read More » SNB & CHF

SNB & CHF