So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good–right up to the seizure and collapse. Some readers occasionally make the point that I’ve been predicting a market crash for ten years and been dead-wrong for ten years. I’m all for mocking presumptuous pundits of either the tin-foil hat or mainstream variety, but that’s not quite what I’ve been saying for 13 long, tedious years. What I’ve been saying is that living on junk food and sugar-cocaine speedballs isn’t “health” just because a handful of pills has dropped cholesterol readings to “healthy” levels. If we define “health” by a metric that is easily manipulated, then the illusion of “health” can be maintained right up until the

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good–right up to the seizure and collapse.

Some readers occasionally make the point that I’ve been predicting a market crash for ten years and been dead-wrong for ten years. I’m all for mocking presumptuous pundits of either the tin-foil hat or mainstream variety, but that’s not quite what I’ve been saying for 13 long, tedious years.

What I’ve been saying is that living on junk food and sugar-cocaine speedballs isn’t “health” just because a handful of pills has dropped cholesterol readings to “healthy” levels. If we define “health” by a metric that is easily manipulated, then the illusion of “health” can be maintained right up until the supposedly “healthy” individual has a seizure and drops dead.

Since the 2008-2009 financial-coronary and emergency-intervention that revealed the abjectly poor health of the global financial system, central banks and states have jacked up stocks and other assets as the metric of a “healthy” economy. Just as banging down cholesterol doesn’t actually make a chronically ill person subsisting on junk food, sugar and cocaine healthy, jacking stocks to new highs doesn’t make the economy or financial system healthy.

All it does is mask the decay of real health and amplify the eventual reckoning.

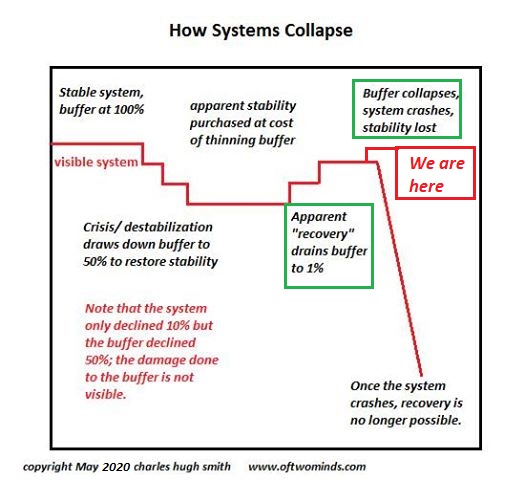

There are three dynamics at work in the artifice that ever-greater monetary and fiscal stimulus and jacked-up stock markets will restore the health of a decaying, sickly economy. One is that sugar-cocaine speedballs generate miraculous results at first: the manic rush of energy and the delusional confidence in god-like powers looks like robust health if viewed through a distorted lens that filters out all the hidden trade-offs and costs to depending on speedballs to function.

|

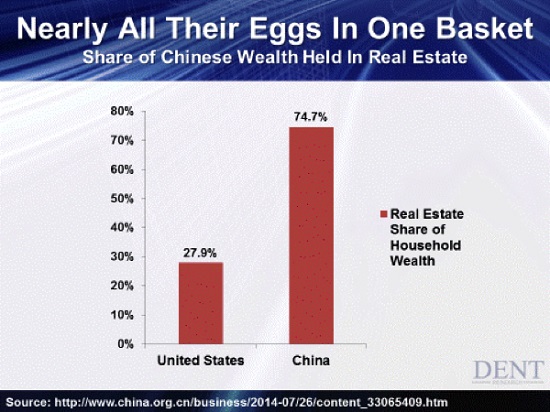

The second is the addiction to stimulus and manipulated metrics of “health” is unfailingly fatal. If the economy / market continue relying on sugar-cocaine speedballs to keep racing higher, the second-order consequences and distortions eventually trigger a seizure and collapse. (Please read What Will Surprise Us in 2022 for an explanation of how addiction to stimulus triggers second-order consequences). But going cold-turkey and stopping the speedball stimulus and manipulation of metrics will also trigger seizure and collapse. This is the downside of depending on feel-good stimulus and faking metrics of “health”: once the artificial stimulus becomes the lifeblood, withdrawing it leads to collapse. Once ginned-up metrics are worshiped as “proof” of health, when the manipulation finally fails then all the confidence and trust in the metrics and those doing the manipulation is lost. The third dynamic is the greater the initial buffers of wealth available, the longer the fake “health” can be propped up. Consider Japan’s three decades of stagnation and largely hidden decay. Japan continues to hold vast overseas wealth and cultural cohesion, and these sources of wealth enable Japan’s state and central bank to conjure trillions of yen out of thin air and trade the yen for natural gas to maintain the illusion of “health.” Less wealthy nations without central bank-issued “money” can only sustain the sugar-speedball illusion of “health” for a few years before reality intrudes and the artifice collapses. |

|

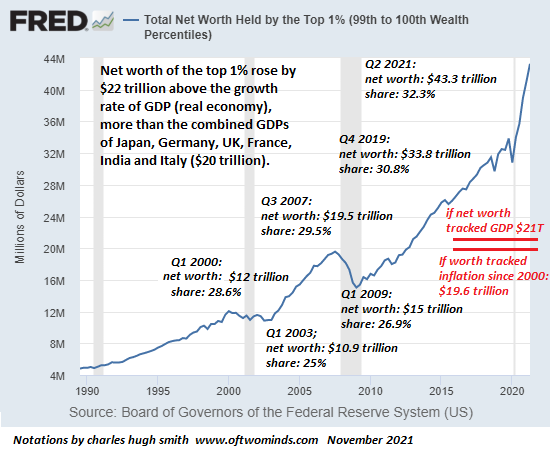

| The United States has burned virtually all of its social cohesion and trust in institutions in the past 13 years of sugar-cocaine speedball stimulus and artifice. All the sugar-cocaine speedball stimulus did was enrich the already-rich and impoverish everyone else, to the point that the top few collect 97% of all income generated by capital and own more wealth than the bottom 80%.

This extreme distortion and inequality is tearing apart the economy, society and political order–all to keep ‘the key metric of “health”–the stock market–soaring to new highs. It’s frustrating watching the doped-up wreck living on Cheetos, sugar and cocaine proclaiming how much energy he has and how his portfolio is soaring, as we all know his demise is inevitable. Just as the body keeps trying to compensate for the ravages of junk food, sugar and cocaine and re-establish homeostasis, the real-world economy staggers on as the people left behind by the sugar-cocaine wealth boost keep doing the real work of keeping the whole rotten edifice functioning. But the efforts of all those keeping the real-world economy glued together can’t put off the consequences of our total dependence on sugar-cocaine speedballs and the artifice of asset bubbles being “proof” of “health. The junkie living on speedballs keeps going right up until the moment they have a seizure and collapse. Right up until this sudden demise, the junkie insists they’re healthy because “look at my low cholesterol reading.” The decay is hidden and gradual, but the collapse is sudden and irreversible. So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good–right up to the seizure and collapse. |

Tags: Featured,newsletter