Swiss Franc EUR/CHF - Euro Swiss Franc, December 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF. Sterling had moved through 1.29 only a few days ago before retracting to the current levels of 1.2650, providing those clients holding CHF with a window of opportunity before the markets shut for Christmas this weekend. Whilst the CHF likely to find protection under 1.30, the Pound has certainly gained a foothold across the board in recent weeks. Sterling has benefited from an upturn in the UK economy, which was confirmed by Bank of England (BoE) governor Mark Carney. Whether this trend will continue into 2017 is difficult to say, as I feel the UK’s upcoming Brexit will continue to drive market sentiment in the months ahead.

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada consumer price index, EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, GBP/CHF, newslettersent, SEK, U.S. Gross Domestic Product QoQ, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 22(see more posts on EUR/CHF, ) |

|

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF. Sterling had moved through 1.29 only a few days ago before retracting to the current levels of 1.2650, providing those clients holding CHF with a window of opportunity before the markets shut for Christmas this weekend. Whilst the CHF likely to find protection under 1.30, the Pound has certainly gained a foothold across the board in recent weeks. Sterling has benefited from an upturn in the UK economy, which was confirmed by Bank of England (BoE) governor Mark Carney. Whether this trend will continue into 2017 is difficult to say, as I feel the UK’s upcoming Brexit will continue to drive market sentiment in the months ahead. Personally, I would avoid gambling on the current market and until we have a clear picture of how the UK will facilitate its exit from the EU, the current instability and uncertainty is likely to remain. Therefore I would be looking to take advantage of any short-term opportunities for both buyers and sellers and avoid the potential pitfalls that lie ahead. If you have an upcoming GBP or CHF currency exchange to make and you are concerned by the increased market volatility of late, it may be wise to look at protecting the gains you’ve made, or limiting your losses with one of our forward contracts, rather than gamble on what has become an increasingly volatile and unpredictable market. |

GBP/CHF - British Pound Swiss Franc, December 22(see more posts on GBP/CHF, ) |

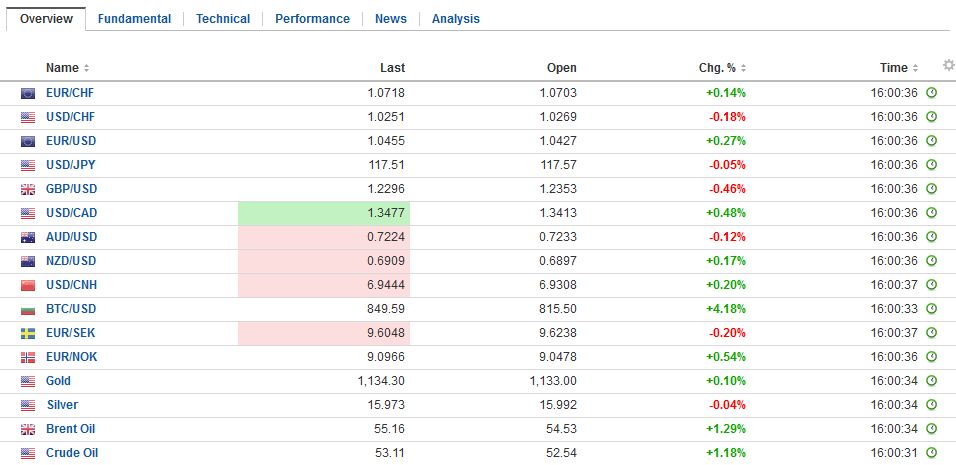

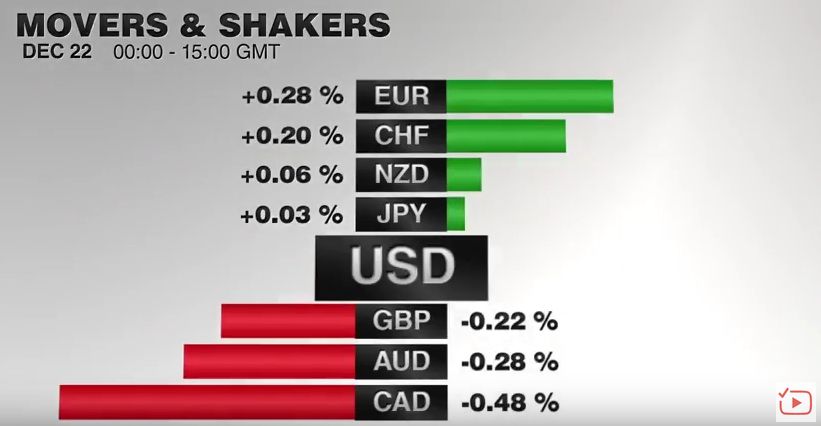

FX RatesTurnover in the capital markets is falling, and the light new stream encourages further thinning of the holiday markets. In broad strokes, equities are lower, bond yields higher and the dollar, mixed. The Swedish krona, which rallied yesterday after the Riksbank tapered its bond purchases, though refrained from cutting rates, is continuing to shine today. Yesterday’s 1.2% rally has been extended another 0.3% today. The euro, which had fallen to nearly $1.0350 a couple of days ago, traded near $1.0470 in European morning. This nearly meets the measuring objective of a possible head and shoulders pattern on the hourly bar charts. To lift the tone further, it must take out the $1.05 area, which does not look particularly likely today. |

FX Performance, December 22 2016 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The dollar is inside yesterday’s range against the yen, which is inside Tuesday’s range.It is in about a 30 tick range. A base has been established near JPY117.40. A move above JPY117.80 could spur a move toward JPY118.20. Note that Japanese markets are closed tomorrow, and are open on Monday (when European and US markets are closed). The Nikkei closed fractionally lower today. It is the first back-to-back lower close this month. However, a minor gain was still secured on the week, which extends that advancing streak to seventh consecutive week and nine of the past 10. Foreign investors have been net buyers of Japanese equities every week but one here in Q4.

Sterling continues to trade heavily. For the seventh consecutive session, it is recording a lower higher. It is moving lower for the fourth consecutive session and eight of the 10 sessions. It has weakened in 11 of the past 13 sessions. Still sterling has built a little base in front of $1.23. It looks capped in the $1.2380-$1.2400 area. |

FX Daily Rates, December 22 |

| The Australian and Canadian dollars are the heaviest of the majors today. The Aussie is off 0.5% near $0.7200. It slipped below there for the first time since the end of May. The May low was set near $0.7145, which is the next important target. Nevertheless, Australian equities joined the Shanghai Composite as the only Asia-Pacific bourse that is closed higher on the session. Recall that in the futures market; speculators were only net long the Australian dollar. Rising global rates take some shine off the Aussie.

The US dollar is also taking a leg higher against the Canadian dollar. After being stymied in the CAD1.3420-CAD1.3430 area, the US dollar pushed to CAD1.3460 in the European morning. It the greenback overcomes the CAD1.3480, there is potential to retest the mid-November high near CAD1.3600. With oil moving sideways, interest rate differentials may exert themselves again. |

FX Performance, December 22 |

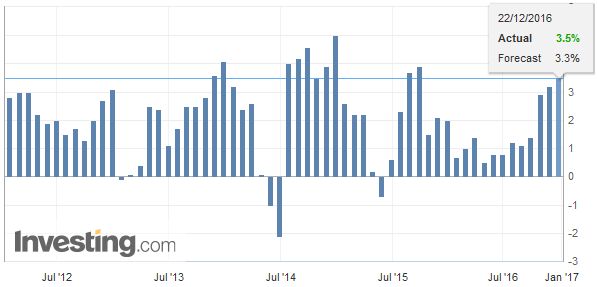

United StatesThe US has a full slate of data out today, but with few needing to trade now, look for a muted response. Of the highlights, we note that Q3 GDP may be tweaked higher, but Q4 estimates may be shaved after today’s durable goods and personal consumption reports. The headline durable goods orders are expected to be poor, but the details more supportive. After reasonably firm consumption in Q3 (~2.8%), a slower pace has emerged in Q4, and this warns of downside risks to the 0.3% gain the Bloomberg median forecasts. |

U.S. Gross Domestic Product (GDP) QoQ annualized, Q3 2016(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

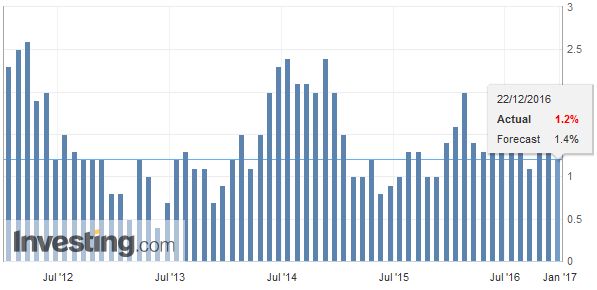

| Canada reports November CPI figures. Also remember that it will introduce new measures to replace its old core rate. The takeaway is that price pressures have eased in Canada, but the central bank is still optimistic that the recovery in the US will spill over and help lift the Canadian economy. Separately, Canada reports October retail sales. A 0.7% gain is expected, but may be closer to 0.3% when autos are excluded. |

Canada Consumer Price Index (CPI) YoY, November 2016(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Canada Consumer Price Index,EUR/CHF,Featured,FX Daily,GBP/CHF,newslettersent,SEK,U.S. Gross Domestic Product QoQ