Swiss Franc The Euro has risen by 0.16% at 1.1424 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six...

Read More »Washington State Politicians Drop Cynical Attempt to Impose Taxes on Gold & Silver

Well, here’s some encouraging news… Efforts in Washington State to impose sales taxes on gold and silver were SHUT DOWN today thanks to intense efforts by the Sound Money Defense League, a group of in-state coin dealers led by Dan Duncan, the Association of Washington Businesses, and a large number of vocal grassroots supporters. Here’s the backstory… Since last month, a few misguided Washington State senators and...

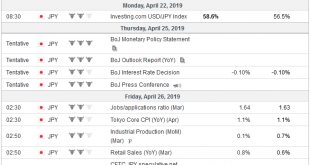

Read More »FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

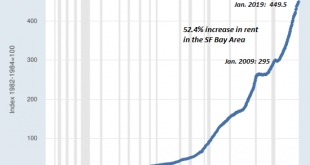

Read More »America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities

The forced flight from unaffordable and dysfunctional urban regions is as yet a trickle, but watch what happens when a recession causes widespread layoffs in high-wage sectors. For hundreds of years, rural poverty has driven people to urban areas: cities offer paying work and abundant opportunities to get ahead, and these financial incentives have transformed the human populace from largely rural to largely urban in the...

Read More »Swisscom switches on its 5G mobile network

© Mykhailo Polenok | Dreamstime.com This week, Swisscom became the first Swiss mobile phone company to switch on its 5G network, according to a press release. Swisscom spokesperson, Esther Hüsler, said that at midnight on Wednesday Swisscom flipped the switch to become the first Swiss operator to put its 5G network into service. It’s 5G network went live across 102 locations across the country, including most of...

Read More »Good Friday, bad Gotthard traffic

Spot the difference: traffic queues at the motorway A2 southbound at the Gotthard tunnel between Goeschenen and Erstfeld, northbound is largely free Long queues have been reported at the Gotthard tunnel in central Switzerland as holidaymakers head south for the Easter break. The traffic jam at the northern end of the tunnel stands at 12 kilometres, with a wait of almost two hours, the Touring Club of Switzerlandexternal...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in. The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest...

Read More »Rail bosses worried over train punctuality

Passengers boarding a train in Bern station The national railway operator, Swiss Federal Railways, has set up a taskforce to look into train punctuality – currently 90.1% – after the rate slipped slightly last year. News of the taskforce was broken by CH-Media groupexternal link and confirmed by the Federal Railwaysexternal link to the Swiss public broadcaster SRFexternal link. The group, made up of experienced...

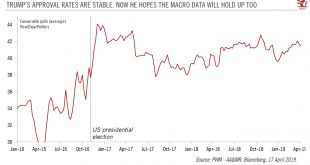

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices. As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting...

Read More »MACRO ANALYTICS – 04 18 19 – Forced Migration in America w/Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: America's Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities April 22, 2019 --- https://www.oftwominds.com/blogapr19/forced-flight4-19.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all...

Read More » SNB & CHF

SNB & CHF