Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the monetary policy assessment of December 2018, the Swiss franc has depreciated slightly on a trade-weighted basis. Overall, however, it is still highly valued, and the situation on the foreign exchange market continues to

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, Featured, newsletter, SNB Press Releases, Switzerland inflation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

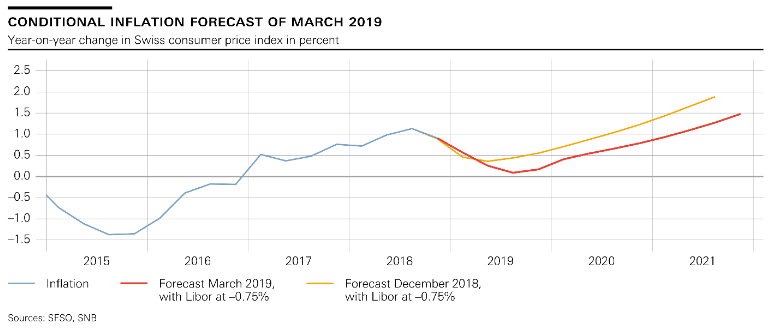

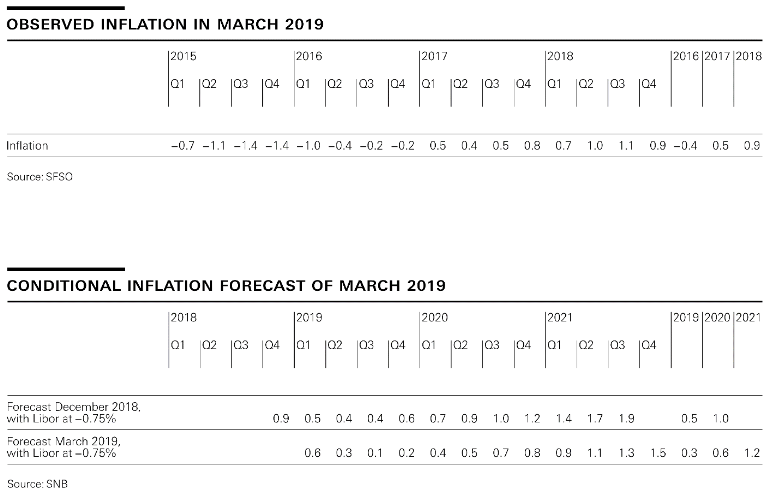

Swiss National Bank leaves expansionary monetary policy unchangedThe Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the monetary policy assessment of December 2018, the Swiss franc has depreciated slightly on a trade-weighted basis. Overall, however, it is still highly valued, and the situation on the foreign exchange market continues to be fragile. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market as necessary therefore remain essential. These measures keep the attractiveness of Swiss franc investments low and reduce upward pressure on the currency. The new conditional inflation forecast is lower than in December. This is primarily attributable to weaker outlooks for growth and inflation abroad, and the resulting reduction in expectations regarding policy rates in the major currency areas going forward. The forecast for the current year has been reduced marginally to 0.3%, from 0.5% in the previous quarter. For 2020, the SNB now expects inflation of 0.6%, compared to 1.0% last quarter. For 2021, it anticipates an inflation rate of 1.2%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at –0.75% over the entire forecast horizon. Global economic activity has weakened more than expected in recent months. Growth was curbed in part by temporary factors. However, the underlying momentum in many advanced economies also slowed. Production in the manufacturing industry, in particular, was sluggish in a number of countries. |

SNB Switzerland Conditional Inflation Forecast, March 2019(see more posts on Switzerland inflation, ) |

| Economic and political uncertainty increased volatility and risk premia on the financial markets at the end of 2018. In addition, growth and inflation in some countries was again weaker than generally anticipated. Both led to lower expectations regarding policy rates in the major currency areas.

Against this backdrop, in its new baseline scenario for the global economy the SNB has made a downward revision to its growth outlook for the advanced economies for the first half of 2019. Nevertheless, the global economy is still likely to grow in line with its potential in the coming quarters. In the advanced economies, expansionary monetary policy and the robust situation on the labour market are lending support, as is fiscal policy in some countries. However, the risks are still to the downside. Following strong expansion in the preceding quarters, GDP stagnated in Switzerland in the second half of 2018. However, growth for the year as a whole was robust at 2.5%. Companies’ production capacities were well utilised and the labour market situation improved continuously. Jobless figures fell further, and in February the unemployment rate stood at 2.4%. Economic indicators are currently po int ing to moderately posit ive mo mentum. After stagnating in the second half of 2018, GDP growth is thus likely to pick up again somewhat. For 2019 as a whole, the SNB continues to expect GDP to expand by around 1.5%. Imbalances persist on the mortgage and real estate markets. Both mortgage lending and prices for single-family homes and privately owned apartments continued to rise slightly in recent quarters, while prices in the residential investment property segment declined somewhat. Nevertheless, due to the strong price increases in recent years and growing vacancy rates there is the risk of a correction in this segment in particular. The SNB will continue to monitor developments on the mortgage and real estate markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer. |

Switzerland Observed Inflation and Conditional Inflation Forecast, March 2019(see more posts on Switzerland inflation, ) |

Tags: Featured,newsletter,Switzerland inflation