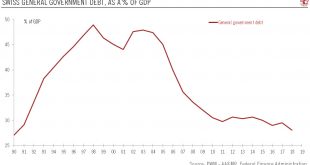

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of...

Read More »Cool Video: Trump Ahead in 2020?

Marc Chandler - Goldman Predicts Trump Win - Click to enlarge Goldman Sachs opined that President Trump had an edge to win the 2020 presidential election and Fox Business thought it was newsworthy and invited to me join the discussion. First, I tried playing down the significance of Goldman’s call. The markets have anticipated this. redictIt.Org has shown the President to be an easy favorite since the start of the...

Read More »Swiss pension funds ended 2018 in the red

The gap between income and expenditure for Switzerland’s old age pension system continues to widen. (© Keystone/Christian Beutler) Pay-outs by Switzerland’s main state pension plan, which comprises old age insurance and other schemes, far exceeded income last year. Overall, the old age pension scheme recorded a deficit of CHF2.2 billion ($2.2 billion) in 2018 compared with a surplus of CHF1.1 billion the previous year,...

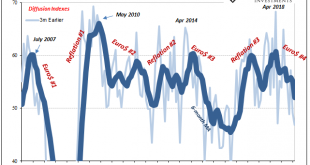

Read More »Green Shoot or Domestic Stall?

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

Read More »Round Table with Gordon T. Long & Charles Hugh Smith #4299

Financial experts Gordon T. Long and Charles Hugh Smith join FSN for a discussion on what went/is going wrong with the American Experiment. Obviously among the culprits, corrupt government, corporatization, financialization and inflation to name just a few. The solution is very straight forward and simple. Go back to localization, bring back the institutions that once made America great. The mom and pop stores and merchants who had a connection with their communities. The bankers who lived...

Read More »FX Daily, April 16: The Dollar and Stocks Catch a Bid

Swiss Franc The Euro has risen by 0.14% at 1.1366 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with...

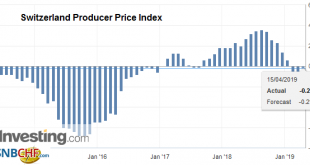

Read More »Swiss Producer and Import Price Index in March 2019: -0.2 percent YoY, +0.3 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »What happens next on GBP/CHF exchange rates?

The pound to Swiss franc exchange rate has been rather volatile, oscillating in a tight range between 1.2942 and 1.3336 in the last month. There is an expectation that we could see the pound losing further ground with the market bracing for worse news in the future for sterling. Sterling has somehow managed to remain reasonably buoyant amidst all the political uncertainty that lies ahead. This is principally down to...

Read More »New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.” There are eight necessary ingredients, without which milk cannot be...

Read More »Swiss leaders upbeat after talks in US on tax and trade

Swiss National Bank chief Thomas Jordan (left), economics minister Guy Parmelin (second from left), president Ueli Maurer and communications manager Peter Minder give a press conference in Washington. Obstacles to implementation of a revised double-taxation agreement between Switzerland and the United States may soon be removed, according to Swiss president and finance minister Ueli Maurer. Maurer was speaking after a...

Read More » SNB & CHF

SNB & CHF