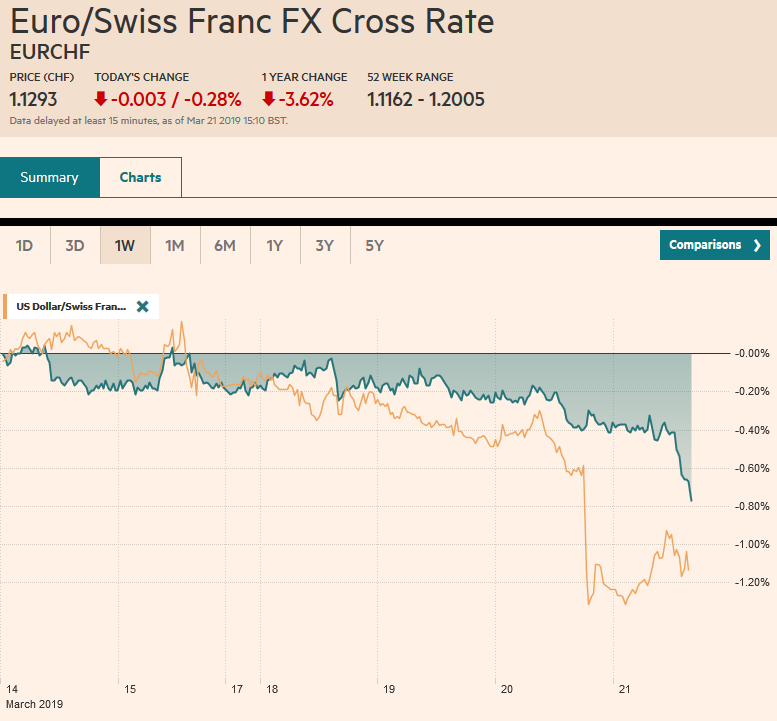

Swiss Franc The Euro has fallen by 0.28% at 1.1293 EUR/CHF and USD/CHF, March 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dovishness of the Federal Reserve sent ripples through the capital markets. US equities reversed initial gains, but Asia Pacific equities edged higher, though Japanese markets were closed for a national holiday. European shares are struggling, as financials and consumer discretionary lead the 0.3% push lower. US shares are also trading with a heavier bias. Yields have come off and the US 10-year yield that had finished last week a little below 2.60% is now testing 2.50%. European 10-year yields are falling three to five basis

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.28% at 1.1293 |

EUR/CHF and USD/CHF, March 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

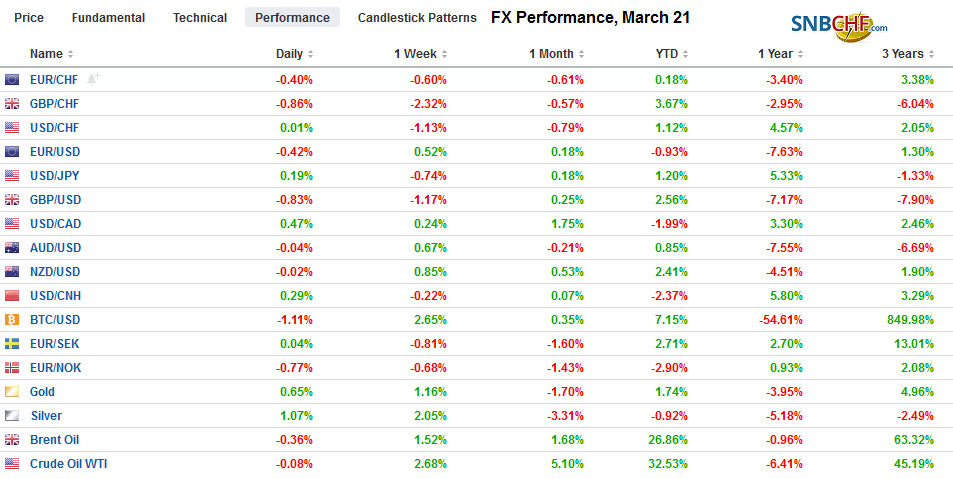

FX RatesOverview: The dovishness of the Federal Reserve sent ripples through the capital markets. US equities reversed initial gains, but Asia Pacific equities edged higher, though Japanese markets were closed for a national holiday. European shares are struggling, as financials and consumer discretionary lead the 0.3% push lower. US shares are also trading with a heavier bias. Yields have come off and the US 10-year yield that had finished last week a little below 2.60% is now testing 2.50%. European 10-year yields are falling three to five basis points and puts the benchmark 10-year German Bund yield below five basis points for the first time since 2016. The US dollar is softer against the Antipodean currencies but is consolidating yesterday’s losses against most of the other majors. |

FX Performance, March 21 |

Asia Pacific

The decline in Australia’s unemployment rate concealed a deterioration of conditions a few days after the central bank underscored the importance of the labor market. The unexpected fall in unemployment to 4.9% from 5.0% reflected a decline in the participation rate (65.6% vs. 65.7%). Australia created a third of the jobs forecast (4.6k vs.15k) and there was a loss of 7.3k full-time posts. Similarly, in New Zealand, the optics look good but the details are less inspiring. Growth in Q4 accelerated from 0.3% in Q3 to 0.6%. However, the year-over-year pace slowed to 2.3% from 2.6%, its slowest pace since 2014.

Investors are closely watching Asian trade figures for signs of a recovery. South Korea reported that exports for the first 20 days of March fell 4.9% year-over-year. Here the news is really better than the optics. This decline shows a recovery from the first 10 days when exports cratered nearly 12%. Imports were off 3.4% after a 17.3% slump in the first 10 days. Separately, after keeping rates on hold as expected (note that Indonesia, Taiwan, and the Philippines also kept policy steady today), Thailand reported an unexpected 5.9% gain in February exports year-over-year. They had fallen 5.65% in January. Imports, on the other hand, imploded, falling 10% after a 14% rise in January. The trade balance swung into surplus. The $4 bln surplus is the second largest since at least the early 1990s.

The Hong Kong Monetary Authority again intervened today to support the Hong Kong dollar. The size of the intervention remains modest and its take time for the cumulative effect to take hold. Part of the pressure is coming from interest rate differentials so the dovish Fed may help take some near-term pressure off. However, some of the pressure appears to be coming from capital flows into the mainland bond and stock markets. Consider that the mainland premium over the US on 10-year bonds has widened to over 60 bp a nearly 20 bp increase over the past month.

The Australian dollar approached $0.7170, its best level this month. The momentum could carry it closer to $0.7200, but we expect it to be seen as a lower risk sale near there. The dollar reversed lower against the yen yesterday (outside down day) and slipped a little more today (~JPY110.30), though local markets were on holiday. We suspect we have seen or approached the low and expect Japanese investors to take advantage of the yen’s gains to buy foreign assets. There is an expiring (~$415 mln) option struck at JPY110.60 that could be in play. China set the reference rate for the dollar at its lowest level since July (dipping below CNY6.67, but throughout the mainland session the dollar gradually clawed back some of the losses to closed a little above CNY6.69.

Europe

Brexit remains a mess. Reports suggest that EC President Juncker cautioned the UK Prime Minister against requesting a delay past the European Parliament elections (end of May). Prime Minister May went ahead and sought a delay until the end of June. That little episode offers a microcosm of the entire process. May did not offer anything new and, of course, some other countries are balking. Just like Labour leader, Corbyn walked out of a meeting with the Prime Minister because he did not think that former Labour Umunna, who now heads up his own small party, is not legitimate, so too does Corbyn’s talk with EU officials amount to much. His plan is to stay in the customs union, but he is not authorized to speak for the UK. Indeed, despite the mess of Brexit, Labour under Corbyn continues to trail in national polls behind the Conservatives. A third vote on the Withdrawal Bill looks likely next Tuesday or Wednesday, according to reports. There is headline risk from today’s EU summit. There will likely be another summit next week.

Norges Bank, the central bank of Norway raised rates 25 bp today. It is the second hike in the cycle. The first was delivered last September. It signaled additional hikes were likely. Underlying inflation is a little above target and the oil sector is doing well. We are less sanguine. Industrial output fell 2.2% in the month of January and although January mainland GDP rose 0.3%. it was flat in November and December. Separately, the Swiss National Bank stood pat as widely anticipated. Its deposit rate remains at minus 75 bp.

The UK reported a 0.4% rise in retail sales. The median forecast from the Bloomberg survey was for a 0.4% decline. It follows a 0.9% rise in January. It is consistent with a recent string of constructive data. A month ago, the market was nearly split over the chances of a rate hike by the end of the year. Now there is about a one in five chance. As widely expected the BOE left policy on hold today.

There has been little market impact from center-right Dutch government losing its Senate majority yesterday. FvD, anti-immigration populist party has moved into second place. It shows that the appeal of populism is not simply in southern Europe. It is finding root in prosperous, successful countries as well. The wave does not look as if it has crest yet (see European Parliament elections).

The euro traded almost to $1.1450 yesterday after the FOMC but has not seen follow-through buying today. We had anticipated a test on $1.1400 this week after the ECB-induced drop below $1.12. While acknowledging the Fed was more dovish than expected, we don’t see the euro sustaining an upside break above the upper end of the $1.13-$1.15 range that continues to confine most of the euro’s price action. The 200-day moving average is found near $1.1480. There are 2.5 bln euro in options between $1.1415 and $1.1430 that expire today. Support is pegged in the $1.1360-$1.1370 area. Sterling is trading sideways at the lower end of yesterday’s ranges and failed to get a lift from the better-than-expected retail sales. It may be in a one-cent range of roughly $1.3115-$1.3215.

America

The FOMC was more dovish than expected. The one rate hike many economists, including ourselves, anticipated was pushed into next year. The balance sheet unwind will be taper sooner than expected, and the confirmed end in September, the earliest date expected. The Fed’s forecasts reflect an economy that is perceived to be past its cyclical peak. Powell said the US economy is fundamentally strong and the outlook was positive. Despite projecting above-trend growth this year and next and below 4% unemployment, with inflation remaining around the 2% target, the Fed deems it necessary to still provide monetary stimulus. The narrative that the Fed typically is slow to respond than overreacts to inflation choking off the expansion is far from the mark, though it is repeated ad nauseam. The last three downturns were the function of financial excess and crisis (S&L, tech bubble, and the Great Financial Crisis).

The US sees the March Philly Fed manufacturing survey. It is expected to rebound from February’s -4.1 reading. Weekly initial jobless claims should slip a little and the February Leading Economic Indicator may post its first increase since last November.

The large drawdown of US oil stocks, sending May WTI above $60 a barrel, coupled with the dovish Fed, saw the greenback drop from around CAD1.3320 to about CAD1.3260. The reversal in equities saw the Canadian dollar pare its gains. It is trading quietly around CAD1.33 today. The Bank of Canada’s rhetoric is also in transition and an easier bias in the coming period would be surprising. We still like the US dollar higher. The Dollar Index closed below its 200-day moving average yesterday for the first time since last April. However, it is snapping back above it (~95.85) today. We see scope for a recovery and our first target is 96.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter