It has been perhaps the most astonishing divergence in the first two decades of 21st century history. In late 2017, Western economic officials (mostly central bankers) were taking their victory laps. They took great pains to tell the world it was due to their profound wisdom, deep courage, and, most of all, determined patience, that they had been able to see their policies through to the light of day (no thanks to voters around the world). This set up the third...

Read More »Economic Stats Won’t Tell Us What Really Causes Recessions

Most economists are of the view that by means of economic indicators it is possible to identify early signs of an upcoming recession or prosperity. What is the rationale behind this opinion? The National Bureau of Economic Research (NBER) introduced the economic indicators approach in the 1930s. A research team led by W. C. Mitchell and Arthur F. Burns studied about 487 economic data to ascertain the mystery of the business cycle. According to Mitchell and Burns,...

Read More »Presseschau vom Wochenende 52 (28./29. Dezember)

NATIONALBANK: Die Schweizerische Nationalbank (SNB) dürfte gemäss Schätzung der SonntagsZeitung für das laufende Jahr einen Gewinn von gegen 50 Milliarden Franken ausweisen, nachdem 2018 noch ein Verlust von fast 15 Milliarden resultiert hatte. Für die ersten drei Quartale 2019 hatte die Nationalbank bereits einen Gewinn von 51,5 Milliarden Franken ausgewiesen, dies dank Wertsteigerungen auf den Anlagen als Folge sinkender Zinsen und steigender Aktienkurse. Im...

Read More »Technical problem shuts down Swiss nuclear power station

Leibstadt was built in 1984 and is one of four nuclear power stations in Switzerland (Keystone) The Leibstadt nuclear power station in northern Switzerland has been disconnected from the power grid and shut down because of a technical fault. Once the cause has been clarified, the plant will be put back into operation as soon as possible, the operator said. It is not clear when that will be. The shutdown at Leibstadt – built in 1984 and one of four nuclear power...

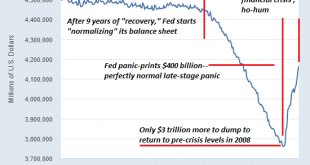

Read More »The Hour Is Getting Late

After 11 years of “the Fed is the market” expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan: So let us not talk falsely now the hour is getting late Bob Dylan, “All Along the Watchtower” The question is: what would happen if we stop talking falsely? What would...

Read More »USD/CHF drops to fresh four-month low as greenback extends losses

USD/CHF remains week for the fifth consecutive week. Cautious optimism surrounding the phase-one, a lack of major data and positive performance of commodities seem to weigh on the USD. Second-tier data from the US and Switzerland will be watched closely for fresh impulse. USD/CHF declines to 0.9720 amid mildly active trading session on early Monday. The pair has been weighed down by the broad US Dollar (USD) losses off-late. With the increasing optimism surrounding...

Read More »How to Write and Understand History

[Adapted from Chapter 2 of Human Action.] The study of all the data of experience concerning human action is the scope of history. The historian collects and critically sifts all available documents. On the ground of this evidence he approaches his genuine task. It has been asserted that the task of history is to show how events actually happened, without imposing presuppositions and values (wertfrei, i.e., neutral with regard to all value judgments). The historian’s...

Read More »EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired. AMERICAS Brazil reports November...

Read More »Signs Swirl All Around Us – The Monetary Reset Is At Hand

For most of this decade owning gold and gold-related investments has required the patience of Job, and the sector is so obscure that it is hard to be sure of anything. But for months now the unusual developments have been piling up so much that it may be possible to regain some optimism. There are indications of a shortage of metal not just at the New York Commodities Exchange, where for months now most contracts have been settled through a supposedly “emergency”...

Read More »To Be Useful, Data Needs Theory

For most so-called practical economists, information regarding the state of an economy is derived from data. Thus, if an economic statistic such as real gross domestic product or industrial production shows a visible increase, it is considered indicative of a strengthening of the economy. Conversely, a decline in the growth rate is regarded as weakening. It seems that by looking at the data one can ascertain economic conditions. Is this the case, though? The...

Read More » SNB & CHF

SNB & CHF