In today’s political discourse, the minimum wage is frequently mentioned by the more progressive members of Congress. On a basic level, raising the minimum wage appears to be a sympathetic policy for low-income wage earners. Often kept out of the conversation, however, are the downstream effects of this proposal. The consensus among economists has always been that a price floor on “low-skilled labor” leads to unemployment “among the very people minimum wage...

Read More »Revolutionary idea to store green power for the grid

The first commercial prototype from Energy Vault is 60 metres tall and will be built next year. (Energy Vault) Stacking blocks of concrete with a crane to store energy and use the force of gravity to keep producing electricity when renewable sources are lacking: simple but revolutionary, the battery solution proposed by the Ticino start-up Energy Vault is attracting investors and customers from around the world. What do we do when there is no sun or wind? Energy...

Read More »Swiss government makes it easier to get paid for work done on the train

© Nuvisage | Dreamstime.com From 1 January 2020, it will be much easier for Switzerland’s 38,000 federal government employees to get paid for working on the train, according to the newspaper Tages-Anzeiger. Until the beginning of this year, working on the train on the way to and from work was only rewarded in exceptional instances and even then it was only partially counted. Now federal government staff only require approval from their immediate manager for the time...

Read More »2019: The Year of Repo

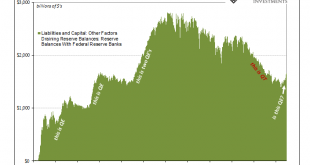

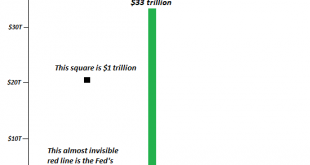

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated. To be frank, every year should be the year of repo. But by and large nobody cares because no one can see...

Read More »Understanding Money Mechanics

Dr. Bob Murphy joins the Human Action Podcast to discuss one of the most important issues of all: how money and credit work in today's society. Jeff Deist recently commissioned Murphy to write a series of articles on money mechanics, an exceedingly important topic for critics of the Fed—and today's podcast serves as an introduction to the project. The articles will be compiled into an e-book, with plenty of graphics to simplify the basic process of money creation in...

Read More »FX Daily, January 03: Geopolitics Saps Risk Appetite

Swiss Franc The Euro has fallen by 0.10% to 1.0837 EUR/CHF and USD/CHF, January 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Iran’s Ayatollah Ali Khamenei has threatened “severe retaliation” for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea’s Kim Jong Un is no longer pledging to halt its nuclear weapons...

Read More »The Two Charts You Need to Ignore or Rationalize Away in 2020 (Unless You’re a Bear)

If you believe you’ve front-run the herd, you’re now in mid-air along with the rest of the herd that has thundered off the cliff. We’re awash in financial charts, but only a few crystallize an entire year. Here are the two charts that sum up everything you need to know about the stock market in 2020. Put another way–these are the two charts you need to ignore or rationalize away–unless you’re a Bear, of course, in which case you’ll want to tape a printed copy next to...

Read More »USD/CHF Technical Analysis: Eyes on short-term rising trendline after US strikes in Baghdad

USD/CHF drops after the news broke that the key members of Iran have been killed in by the US attack near Baghdad airport. 200-hour EMA, resistance line of immediate rising channel guard adjacent upside. December month low adds to the support. USD/CHF declines to 0.9700 during the early Friday’s trading. The quote recently slipped as the Swiss Franc (CHF) strengthened, due to its safe-haven appeal, after the US-Middle East tensions are about to get worst. Read: US...

Read More »Running a Swiss business – changes in 2020

© Lovelyday12 | Dreamstime.com Every year brings changes for business owners and managers. In May 2019, a majority of Swiss voters accepted a package of changes to the way companies are taxed known as The Federal Act on Tax Reform and AHV Financing (TRAF). Many of the changes flowing from this begin on 1 January 2020. 1. Social insurance taxes Swiss social security taxes have several elements. The first three fund old age pensions (AVS/AHV), disability insurance...

Read More »Wealth Consumption vs. Growth – Precious Metals Supply and Demand

GDP – A Poor Measure of “Growth” Last week the prices of the metals rose $35 and $0.82. But, then, the price of a basket of the 500 biggest stocks rose 62. The price of a barrel of oil rose $1.63. Even the euro went up a smidgen. One thing that did not go up was bitcoin. Another was the much-hated asset in the longest bull market. We refer to the US Treasury. The spread between Treasury bonds and junk bonds narrowed this week. It is now close to its post-crisis low....

Read More » SNB & CHF

SNB & CHF