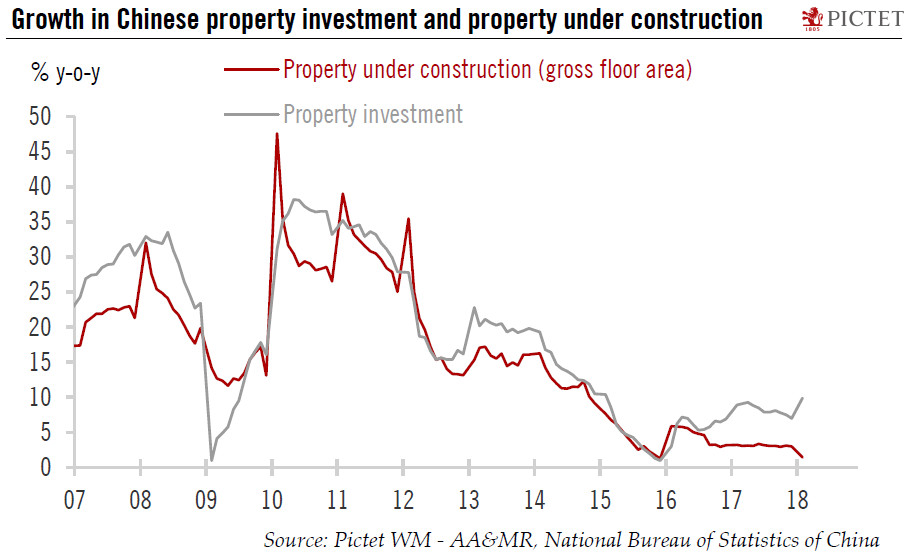

Early 2018 data releases are general upbeat, but some details indicate that growth momentum could slow.The first batch of 2018 Chinese data on investment and industrial production came in stronger than expected. However, details of the data suggest that actual growth momentum may not be as strong as the numbers indicate.Property investment rebounded to 9.9% y-o-y in the first two months of 2018 from 7.0% in 2017, while investment in the manufacturing sector and infrastructure moderated slightly. However, we do not expect the high growth in property investment to be sustainable.External demand continues to be supportive of Chinese manufacturing, but the outlook for Chinese exports is more uncertain as the Trump administration turns more protectionist.With the wealth effects from rising

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Early 2018 data releases are general upbeat, but some details indicate that growth momentum could slow.

The first batch of 2018 Chinese data on investment and industrial production came in stronger than expected. However, details of the data suggest that actual growth momentum may not be as strong as the numbers indicate.

Property investment rebounded to 9.9% y-o-y in the first two months of 2018 from 7.0% in 2017, while investment in the manufacturing sector and infrastructure moderated slightly. However, we do not expect the high growth in property investment to be sustainable.

External demand continues to be supportive of Chinese manufacturing, but the outlook for Chinese exports is more uncertain as the Trump administration turns more protectionist.

With the wealth effects from rising housing prices fading, we expect consumption growth to moderate in 2018, but the long-term trend of rising consumption in China remaining intact.

To summarise, the latest data releases regarding Chinese economic activity are general upbeat, especially for FAI and industrial production. However, the underlying growth momentum seems consistent with our expectation of some moderation in growth in 2018. As a result, we are keeping our GDP growth forecast of 6.5% for China in 2018 unchanged for now.