Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset allocationWhile dovish central banks have resulted in an impressive ‘everything rally’ this year, we now need to see an improvement in fundamentals, as 12-month forward earnings for global equities are still 2% below their highs of October 2018. We therefore remain generally cautious on equities, waiting for a correction before we increase exposure.Trading volumes have declined and market gains are...

Read More »Weekly View – Powell throws in the towel

The CIO Office's view of the week ahead.After a brief lull, Trump renewed escalating trade tensions with China by threatening new tariffs on USD 300bn of Chinese imports to the US. A global sell-off ensued and the Chinese authorities now appear less inclined to resist renminbi weakness relative to the dollar, having allowed the renminbi to break the CNY7/USD “psychological threshold”. Unsurprisingly, exporter-heavy indices were hit particularly hard in equities, as investors fled to safety,...

Read More »PUBG Mobile

每天都是 输输输

Read More »US-China: Trump’s tariff net expands

With additional tariffs in the pipeline, should the Fed take notice?US President Trump pre-announced a further expansion of the US tariffs on imports from China: the remaining half of imports not yet taxed will be at a rate of 10%. It was our central scenario that the tariff net would be increased before the 2020 elections, but we are surprised by the timing, so close on the heels of the G20 meeting in Osaka.Such tariffs further reduce the possibility of an encompassing trade deal with China...

Read More »JULY FED MEETING REVIEW

The Federal Reserve cut rates by 25bps on 31 July for the first time in 10 years. We continue to expect another rate cut in September.As expected and as telegraphed, the Fed cut rates by 25bps on 31 July – the first rate cut since December 2008 – and it ended prematurely its quantitative tightening programme (in August instead of September).Chairman Jerome Powell justified the rate cut as an “insurance” cut, i.e. to insure against the downside risks to US growth, mostly coming from weak...

Read More »DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year.The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1.While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy.Tentative signs of weakening domestic demand, the possibility of a hard Brexit, potential US tariffs...

Read More »Markets face a tug of war

With a lot of good news already priced in, but technicals painting a less rosy picture, equities could struggle to make headway in the short term.The world economy and financial markets are being influenced by two opposing forces engaged in a tug of war. On one side are trade tensions and an ageing economic cycle, factors that are eroding business confidence and holding back corporate investment, raising questions about an impending recession. On the other are central banks, which are...

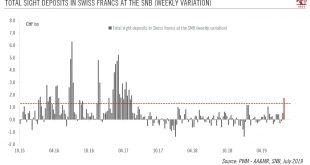

Read More »Looking for evidence of SNB intervention

Before any rate cut, intervention in the forex market is likely to remain the Swiss National Bank’s first line of defence to counter any appreciation of the CHF.Data published on Monday revealed that commercial banks’ sight deposits at the Swiss National Bank (SNB) rose by CHF1.7bn last week (see chart), the largest weekly increase since May 2017. The amount suggests the SNB intervened in the FX market, probably ahead of the ECB’s meeting last Thursday.Weekly releases of commercial banks’...

Read More »Weekly View – Enter Borisnomics

The CIO Office's view of the week ahead.There is a new sheriff in London Town and he is not shy with bold statements. So far as prime minister, Boris Johnson has not only pledged to take the UK out of the EU by 31 October – “no ifs or buts” – but has also signalled new tax cuts and spending plans, ranging from the police and the national public health service, to nationwide full-fibre broadband. While certainly popular issues, they also come with considerable price tags that government...

Read More »July FED MEETING PREVIEW

We still see the Fed's expected July rate cut as fundamentally of a “recalibration” nature.We expect the Federal Reserve (Fed) to cut its fed funds target rate range by 0.25%, and leave the door open for another cut later, after its two-day policy meeting ending on 31 July.Chairman Jerome Powell has a lot of explaining to do as to why the Fed is making this rate cut, only six months after the last rate hike: this explaining could condition the path of future interest rate moves.The Fed will...

Read More » Perspectives Pictet

Perspectives Pictet