Downward pressure on growth persists amid ongoing trade tensions.Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades.The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from 6.1% in the previous quarter.From an expenditure perspective, consumption...

Read More »Multi-generational wealth

[embedded content] Making sound investments and steering a company through today’s political and economic waters can be tricky. At Pictet’s 2019 European Family Master Class in Zürich, a line-up of eminent guest speakers and the Swiss bank’s own financial experts unpacked the world of geopolitics, business governance, economic forecasts, technology innovation and one’s responsibility – whether social or environmental – as a player in today’s markets. Guest panellists included former prime...

Read More »Pictet — Multi-Generational Wealth

Making sound investments and steering a company through today’s political and economic waters can be tricky. At Pictet’s 2019 European Family Master Class in Zürich, a line-up of eminent guest speakers and the Swiss bank’s own financial experts unpacked the world of geopolitics, business governance, economic forecasts, technology innovation and one’s responsibility – whether social or environmental – as a player in today’s markets. Guest...

Read More »Pictet — Multi-Generational Wealth

Making sound investments and steering a company through today’s political and economic waters can be tricky. At Pictet’s 2019 European Family Master Class in Zürich, a line-up of eminent guest speakers and the Swiss bank’s own financial experts unpacked the world of geopolitics, business governance, economic forecasts, technology innovation and one’s responsibility – whether social or environmental – as a player in today’s markets. Guest panellists included former prime ministers Matteo...

Read More »Is the Fed too focused on corporates?

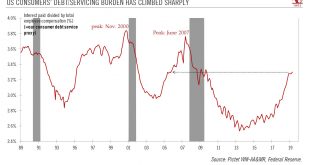

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch.The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s.Low Fed interest rates tend to percolate quickly down to the...

Read More »Weekly View – SHOW TIME

The CIO Office's view of the week ahead.In his testimony to Congress last week, Fed chairman Jerome Powell delivered a dovish report, reinforcing current expectations for a rate cut later this month. He focused on mounting risks to the US economy due to slowing global growth and persistent trade uncertainty over June’s strong US jobs report. Despite a higher-than-expected CPI inflation print for June, consistently low inflation remains the central bank’s main concern. Because the Fed is...

Read More »Uncertainty mounts over Mexico’s direction

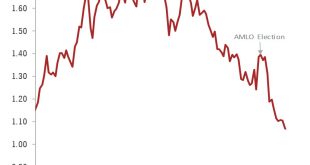

The resignation of the Mexican finance minister raises further questions over prospects for Mexican assets.Carlos Urzúa, the Mexican Finance Minister, unexpectedly quit on Tuesday. His resignation, announced in a letter in which he set out the “many” disputes he had had with the administration of president Andrés Manuel López Obrador (AMLO), is meaningful from several standpoints. A respected official, Urzúa was seen by financial markets as a moderate, whose commitment to fiscal prudence...

Read More »The US-Iranian snake pit

Iran has begun increased its stockpiles of uranium and increased its uranium enhancement in response to the pressure being applied by the US since the latter withdrew from the 2015 nuclear deal. What are the chances for further escalation of tensions between the US and Iran and what do these tensions mean for investors?Iran has sought to goad Europe, Russia and China into providing relief from sanctions introduced since the Americans withdrew from the Joint Comprehensive Plan of Action last...

Read More »Powell’s Congressional testimony sets the scene for rate cut

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September.During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July.Powell’s priority is to preserve the economic expansion, now 10 years old: the coming monetary easing is about...

Read More »Asian manufacturing sector in contraction

The latest Asian PMIs point to continued deceleration of growth momentum in the region, but domestic-driven economies are more resilient than export-dependent ones.The average of manufacturing purchasing manager indices (PMIs) for Asia (excluding Japan) came in at 49.6 in June, down from 49.9 in May. This was the second consecutive month in which this measure fell below the 50 threshold and indicates that manufacturing activity in Asia is contracting.China is the largest contributor to the...

Read More » Perspectives Pictet

Perspectives Pictet