We expect the BoE to cut rates in November, even if a Brexit deal is reached by October.UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its...

Read More »World growth forecast revised down

Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast.The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data as well. In particular, fixed investment in advanced economies plunged...

Read More »Semaña grande for Sánchez

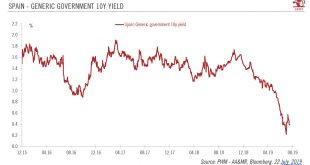

The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well.April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a government, with a parliamentary vote due to take place on July 23. To be...

Read More »DM credit caught between opposing forces

Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019.Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional return from taking more risk remains thin.As cracks continue to appear in both...

Read More »HAS Modern Monetary Theory ALREADY TAKEN HOLD IN WASHINGTON?

The interest in Modern Monetary Theory has grown as the limitations of ‘mainstream’ economic theories have become ever plainer to see since the financial crisis.Modern Monetary Theory (MMT) is a theory, initially emanating from left-wing US economists, that argues that since governments, and in particular the US government, issues its own currency, it can never run out of funding.The corollary is that it is possible for the government to spend more to push the economy towards its full growth...

Read More »Brexit – Boris Johnson vs parliament

With Boris Johnson likely to become prime minster this week, our base case is for another extension to the 31 October Brexit deadline, probably for several months.Boris Johnson looks likely to be succeed Theresa May as prime minister, after the internal Tory party contest. Johnson prominently waves the no-deal Brexit flag (the possibility of exiting the EU without a deal) by the 31 October deadline, in order to get more concessions from the EU – a relatively perilous negotiation...

Read More »Weekly View – Easing spreads

The CIO Office's view of the week ahead.When the Apollo 11 mission landed on the moon 50 years ago, the 13-minute descent was “rampant with unknowns” according to Neil Armstrong. Today, central bankers are on their own outer space mission, navigating unchartered monetary policy territory. As they wait for interest rates to land, investors await terra firma in markets. The dovishness that swept across all major central banks is now spreading to emerging markets (EM). Last week, the central...

Read More »The ECB is preparing for delivery

After Draghi’s shift in Sintra, we still see the ECB rate cuts as a starter and a first step before the implementation of a broader policy package.We expect the European Central Bank (ECB) to prepare markets for the delivery of fresh monetary stimulus following Mario Draghi’s unequivocal signal in Sintra. An adjustment to forward guidance is the most natural path for the ECB to take, by signalling that policy rates will remain at present levels “or lower”, paving the way for a 10 bp deposit...

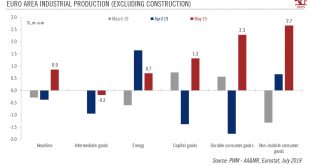

Read More »Euro area manufacturing is not out of the woods

Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead.After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and energy also increased. However, output of intermediate goods slipped.While the...

Read More »US FX intervention still someway off

The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates.The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Donald Trump. Indeed, the Fed’s broad dollar index was recently back close to its December 2016...

Read More » Perspectives Pictet

Perspectives Pictet