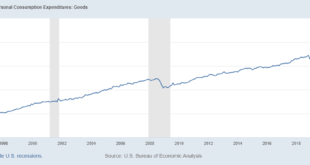

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More »87,000 New IRS Agents Will Reduce Inflation?

REMINDER: I will be speaking at the Ron Paul Institute’s annual conference, which this year is being held at the The Westin Washington Dulles Airport. The theme of the conference is “Anatomy of a Police State.” See my blog post of yesterday. If you can make it, I am sure you’ll be happy you did. If you do attend, please come up and say hello. Register here. — Jacob ****** Just about everyone, including the most ardent proponents of public (i.e., government) schools,...

Read More »Hackers Tap Cross-Chain Bridges Vulnerabilities; Whopping US$2B Worth of Crypto Stolen

Hackers and cybercriminals are exploiting vulnerabilities found in cross-chain bridge protocols to siphon billions of dollars worth of cryptocurrencies out of wallets and smart contracts, a new report by blockchain analytics firm Chainalysis claims. A total of 13 separate cross-chain bridge hacks have been recorded so far, netting criminals about US$2 billion, according to the firm. Most of these attacks took place this year, showing that the trend is proliferating...

Read More »Bitcoin Hashrate steigt, doch Nutzeraktivität bleibt niedrig

Nachdem zu Beginn der Woche die Nutzeraktivität sank, folgte auch der Kurs. Bei 20K fand der BTC seinen Support. Nun gibt es widersprüchliche Signale, die es schwer machen vorherzusagen, ob der Markt eine Trendwende erleben oder doch weiter in einer Bärenphase bleiben wird. Bitcoin News: Bitcoin Hashrate steigt, doch Nutzeraktivität bleibt niedrigDie Nutzeraktivität bleibt niedrig und erholte sich im bisherigen Wochenverlauf nicht, was ein klarer Indikator für einen...

Read More »September 2022 Monthly

The highlights of September include continued substantial rate hikes by the major central banks, save Japan. The Tories will pick a new leader, who will become the next prime minister of the UK. Italy looks determined to have a right-wing government. Sweden goes to the polls in mid-September. The price of defeating the Social Democrats, who have governed since 2014, maybe for the center-right to form an alliance with the nationalist Sweden Democrats. Like Brother of...

Read More »“War on cash” update: A brighter outlook

Part II of II, by Claudio Grass, Switzerland Finally, a victory for the State Central planners and paper pushers of all stripes are not generally known for their acumen or their ability to recognize and successfully seize opportunities in time. They always tend to lag behind more or less every other member of society: from the innovators and entrepreneurs, to the criminal masterminds, which is why all upstanding citizens still...

Read More »Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Als Dividendenzahlerin weiterhin beliebt: Die Waadtländer Kantonalbank. Die beste Jahresperformance der Schweizer Banken hat die Waadtländer Kantonalbank. Vor allem hohe Dividendenrenditen machen auch andere Schweizer Banken interessant – solange man bereit ist, auch Risiken zu tragen. Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen...

Read More »New Lockdown in China and the First Drop in South Korea’s Chip Exports in 2 years Euthanizes Animal Spirits

Overview: The precipitous fall in equities continues while the dollar remains buoyant. Nvidia’s warnings about US curbs on sales to China and the first drop in South Korea’s chip exports in two years, coupled with the largest lockdown in China since Shanghai encouraged investors to move to the sidelines. Most of the major equity markets in the Asia Pacific region were off 1-2%. The Stoxx 600 is off for the fifth consecutive session and the second session of more than...

Read More »PODCAST: Das Märchen von den begrenzten Ressourcen – von Rainer Zitelmann

Nachdem das U.S. Geological Survey nichts aus seinen früheren falschen Behauptungen gelernt hatte, sagte es 1974, dass die USA nur noch über einen 10-jährigen Vorrat an Erdgas verfügten. … Nicht nur beim Erdöl, bei fast allen relevanten Rohstoffen taxierte der Bericht des „Club of Rome“ den Zeitpunkt ihrer Erschöpfung völlig falsch ein. Erdgas, Kupfer, Blei, Aluminium, Wolfram: Nichts davon würde man – weiteres Wirtschaftswachstum vorausgesetzt – nach den damaligen...

Read More »Swiss population urged to save energy to mitigate winter shortages

Turning down heating in households could help stave off energy rationing, the government says. © Keystone / Gaetan Bally The Swiss government has appealed to the population to save on household energy ahead of anticipated electricity and gas shortages this winter. On Wednesday, the government launched a campaign entitled “Energy is scare, let’s not waste it” along with the formation of an Energy Saving Alliance. The plans are backed by cantons, business associations,...

Read More » SNB & CHF

SNB & CHF