In dieser Woche kam es zu einer weiteren Preiskorrektur für den BTC. Heute ging es sogar seit langem wieder unter die Marke von 20.000 US-Dollar. Ist das ein weiteres Bärensignal oder kommt es zur Trendwende? Bitcoin News: Bitcoin stürzt unter 20K Seit Mitte Juli lag der Preis nicht mehr in diesen Regionen, zuletzt konnte der BTC sogar weiter zulegen. Doch der Preisaufschwung führte uns nicht über 30K. Der Kurs stagnierte, ehe er in der aktuellen Woche sogar...

Read More »Newsquawk Week Ahead – Highlights: US jobs report, ISM; China PMIs; EZ inflation

The US jobs report and ISM data will be key in shaping expectations for the September 21st FOMC meeting. MON: EU Defence Ministers Meeting (1/2), UK Summer Bank Holiday; Australian Retail Sales (Jul), Swedish Trade Balance (Jul). TUE: EU Defence Ministers Meeting (1/2), NBH Policy Announcement; Japanese Unemployment (Jul), German CPI Prelim. (Aug), UK BoE Consumer Credit (Jul), EZ Consumer Confidence Final (Aug), US Consumer Confidence (Aug), JOLTS (Jul). WED:...

Read More »Swiss panoramic train to debut in December

MOB – GoldenPass The GoldenPass Express (GPX) panoramic train, which will link Montreux to Interlaken without any station changes, will make its debut on December 11. The train will link three popular tourist destinations: Montreux, Gstaad and Interlaken, Montreux Oberland Bernois Railway Company (MOB) said in a statement on Thursday. The journey will take three hours and 15 minutes and passengers can choose between three classes (First, Second and Prestige). The...

Read More »The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk. What we have seen among some central bankers applies to market...

Read More »Money Does Matter: The End of the Gold Standard Led to a Lower Standard of Living

On August 15, 1971, Richard Nixon announced that the US dollar (USD) would no longer be redeemable in gold. This was supposed to be temporary. And yet, 51 years later, here we are. The gold standard was gradually destroyed in the twentieth century. Now people are experiencing the consequences: less purchasing power, more economic cycles, and a weaker economy. In the chapter 4 of his book What Has Government Done to Our Money?, Murray Rothbard goes over the steps the...

Read More »History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions. From what we can learn from the Romans through to why we need to consider gold’s utility rather than its price, this is an interview bringing a new perspective as to why we...

Read More »Malcolm McLean: The Unsung Capitalist Hero Who Changed the World One Container at a Time

Ask the average person what they believe to be the most economically important innovation of the twentieth century, and they’ll probably point to the internet. The internet has certainly disproved Paul Krugman’s prediction that it would have no greater impact on the economy than the fax machine, but even this transformative technology may only warrant a silver medal when compared to something much more banal: the intermodal shipping container. The shipping container...

Read More »Cabal Of Insiders Control Money Jeff Snider Crypto Interview

Cabal Of Insiders Control Money Jeff Snider Crypto Interview Bitcoin News Bitcoin Crash Crypto News In this eye-opening interview Jeff Snider reveals some critical insights into our current financial and monetary system and how euro dollar system has evolved. If you enjoy this highlight videos, please kindly subscribe and help share this video for us to share more of this valuable content. Thank you. Hello, everyone, today our guest is Jeff Snider. Jeff Snider is co-host of the Eurodollar...

Read More »Is a Recession Simply a Decline in GDP? What Does That Mean?

According to the National Bureau of Economic Research (NBER), the institution that dates the peaks and troughs of the business cycles: A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP [gross domestic product], real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the...

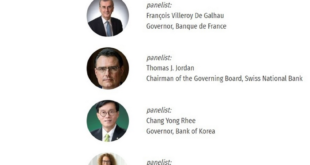

Read More »Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea. We may get some clues on what’s coming up from the ECB: Powell’s speech at Jackson Hole is the second-most important Saturday’s item of interest (1625 GMT) [embedded content] Tags:...

Read More » SNB & CHF

SNB & CHF