Pascal Salin is an economist, professor emeritus at the University of Paris-Dauphine, and was president of the Mont-Pelerin Society from 1994 to 1996. Among the extensive list of books Professor Salin has published, mention can be made of the following titles: La vérité sur la monnaie (Paris: Odile Jacob, 1990), Libéralisme (Paris: Odile Jacob, 2000), Français, n’ayez pas peur du libéralisme (Paris: Odile Jacob, 2007), Revenir au capitalisme pour éviter les...

Read More »How Sound Money Won the Battle of Yorktown—and Saved the American Revolution

Early this month, Congressman Alex Mooney of West Virginia introduced the Gold Standard Restoration Act (H.R. 9157). If enacted into law, it would require public disclosure of the federal government’s gold holdings and eventually define the dollar as a weight of gold. For the moment, the bill’s chances of passage are as nil as nil gets. Sound money, whether it’s gold or silver or paper that is “backed” by one or both metals, may not acquire a sizable constituency...

Read More »Bill Bonner’s 4th and Final Prediction: "America’s Nightmare Winter"

One of the most successful entrepreneurs in America over the past 50 years… Has gone public in recent weeks, with his “4th and Final Prediction”… about a scenario he calls: “America’s Nightmare Winter.” You’ve probably never heard of Bill Bonner--but in addition to owning an interest in businesses all over the globe, he also owns more than 100,000 acres, with massive properties in South America, Central America, the U.S.,… plus three...

Read More »The yen isn’t Japan’s problem, it is everyone’s problem. Because this crash isn’t the Fed.

Japan's yen like China's yuan is being pummeled by the dollar. Most people are led to believe the dollar is rising because of the Fed and its rate hikes. No sir. In fact, in just three charts we can easily show both why JPY is crashing and also how the Fed has nothing to do with it. And that's actually the most frightening part. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university...

Read More »Greenpeace mit Kampagne gegen Bitcoin

Wieder einmal versucht die Umweltschutzorganisation Stimmung gegen den Cryptomarkt und Bitcoin im Speziellen zu machen. Doch inzwischen stellt sich die Frage, ob tatsächlich Umweltschutz oder Politik hinter der Kampagne steckt. Bitcoin News: Greenpeace mit Kampagne gegen BitcoinVor allem das Proof of Work Prinzip hinter dem BTC soll laut Greenpeace die „Klimakrise verschärfen und der Gemeinschaft schaden“. Das Crypto-Mining gilt als das zu lösende Problem, laut den...

Read More »Turn Around Tuesday Aside, is the Dollar Topping?

Overview: Global equities moved higher in the wake of the strong gains in the US yesterday. US futures point to the possibility of a gap higher opening today. Most of the large Asia Pacific bourses rallied 1%-2%, with China’s CSI a notable exception, slipping fractionally. Europe’s Stoxx 600 is edging higher and is near two-week highs. If the gains are sustained, it will be the fourth consecutive advancing session, the longest in two months. Benchmark yields are...

Read More »Neuchâtel: where one woman broke the male monopoly on politics

The first woman in Switzerland ever to be elected to a cantonal parliament was Raymonde Schweizer. This Social Democrat came from the industrial town of La Chaux-de-Fonds in the Neuchâtel Jura. A trade unionist and feminist, she was elected on her first try in 1960, thereby becoming a trendsetter at a time when Swiss women were not even allowed to vote in national elections. Not once but twice was Neuchâtel the setting for key developments in the decades-long exclusion of women...

Read More »Edward Chancellor’s Much-Needed (But Not Heeded) Wisdom on Interest Rates

The subject of time and money has hit a boiling point. Just look at Sri Lanka and Iran, where food riots have turned deadly, or, shall we say, currency riots have. People can’t buy food, and “protesters angry at the soaring prices of everyday commodities including food, have burned down homes belonging to 38 politicians as the crisis-hit country plunged further into chaos, with the government ordering troops to ‘shoot on sight,’” reports invesbrain.com. Murray...

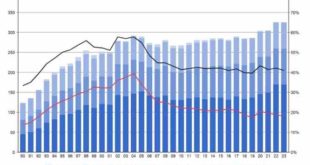

Read More »Switzerland expects government surplus in 2022 and lower public debt from 2023

After a roughly CHF 40 billion blow to Swiss public finances due to the Covid pandemic, Switzerland’s financial outlook is beginning to look positive, according to a recent government press release. © Photo4dreams | Dreamstime.com Figures from the Federal Finance Administration (FFA) forecast a surplus of CHF 1.5 billion in 2022, an amount equivalent to 0.2% of GDP. In 2023, a government surplus of CHF 0.6% of GDP is forecast. Government expenditure in Switzerland...

Read More »What Everybody Knows No Longer Matters

What nobody yet knows (or the few insiders who do know are keeping to themselves) is what will matter. Being a doom-and-gloom Bear stops being fun when the Bear Bar gets crowded. When everyone has moved to our side of the boat, the grizzled Bears get nervous, especially when they peer over at the Bull side of the boat and see a handful of dispirited Bulls ignoring the guy yelling at the bartender to “back up the truck.” The problem old-timers see is what everyone...

Read More » SNB & CHF

SNB & CHF