Someday in the future… perhaps on a particularly cold night… … America’s entire energy system will collapse. Fuel won’t get delivered. Rolling blackouts will sweep the land. Pipes will freeze. Food in the freezer will go bad. You may shiver in the dark… praying for a little power – for weeks. You’ll be one of the lucky ones. Others – with less margin of error – may fare worse. Experts tell us if diesel fuel is cut off, it...

Read More »Bitcoin and Gold in 2022 | Webinar w/ Keith Weiner, Monetary Metals

We welcome the brilliant Keith Weiner to the Bitcoin & Gold in 2022 series. Keith is the Founder of Monetary Metals, a platform which has taken investment in gold to a new level, pioneering yield generation and gold financing. He will be talking to Charlie Morris about the "Money Illusion" and the importance of gold. ByteTree Gold Valuation: https://terminal.bytetree.com/gold/valuation Monetary Metals: https://monetary-metals.com/ The BOLD Chart Book:...

Read More »The Dollar Heads into the Weekend Well Bid

Overview: The dollar is well bid. It has risen to new two-year highs against the dollar bloc and Chinese yuan. Aided by worse than expected retail sales, sterling, on its anniversary of leaving the European Exchange Rate Mechanism fell to its lowest level since 1985. This fits into the broader risk-off move. The S&P 500 fell to new two-month lows yesterday, and FedEx warnings after the bell yesterday add to the string of worrisome comments from leading US...

Read More »Insatiable Government

[This essay, which exposes the big-government policies of the Hoover administration, was first published in the Saturday Evening Post, June 25, 1932.] In the minutes of the Chicago City Council, May 12th last, is the perfect example of how commonly we regard public credit. From bad taxation, reckless borrowing and reckless spending, the city of Chicago had so far prejudiced its own credit that for months it had been unable to meet its municipal payrolls either out...

Read More »The many perils of “Stockholm syndrome” politics

It’s been a tumultuous couple of months in UK politics. After a troubled time in office, plagued by scandal, internal party frictions and much public embarrassment, Boris Johnson exited the stage leaving behind a big old mess for his successor to clean up. An economy in tatters, inflation at record highs and an energy crisis the likes of which this generation hasn’t seen before. It’s a miracle that anyone in the kingdom could be found that would be...

Read More »Switzerland braces for winter energy crunch

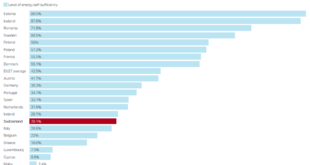

Despite being one of the world’s richest countries, Switzerland also faces the threat of an energy shortage in the coming months. The authorities are scrambling to prepare. SWI swissinfo.ch has gathered answers to some of the most pressing questions on electricity supply, Switzerland’s dependence on Russian gas, and measures being taken to get the country through the winter. Is Switzerland self-sufficient in meeting its energy needs? No. Domestic electricity...

Read More »Swiss parliament okays purchase of F-35 jets from US

Switzerland’s House of Representatives has approved the purchase of new F-35 fighter jets from the United States. The decision clears the path for Bern to sign the purchase contract, even though an initiative to prevent the deal has not been voted on by Swiss voters. Keystone-SDA news agency reported on Thursday that the majority was convinced the contract should be signed by the bid closing date: March 30, 2023. The jet purchase is part of the Army’s 2022 budget,...

Read More »August’s Price Inflation Soared, and That Means Earnings Fell Yet Again

The federal government’s Bureau of Labor Statistics released new price inflation data today, and the news wasn’t good. According to the BLS, Consumer Price Index (CPI) inflation rose 8.3 percent year over year during August, before seasonal adjustment. That’s the seventeenth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s six months in a row of price inflation above 8 percent. Month-over-month inflation rose as well, with...

Read More »Silver Fever, or Silver Fading?

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. ? Silver Basis and the Dollar This graph goes back one year, through...

Read More »Military Self-Delusion on the Constitution

Several former U.S. defense secretaries and retired generals recently published an open letter about the current political environment in America. The letter stated, among other things: “Military officers swear an oath to support and defend the Constitution, not an oath of fealty to an individual or to an office.” That’s just pure nonsense and self-delusion. Oh, sure, technically it’s true that military officers swear such an oath, but they don’t follow it. Instead,...

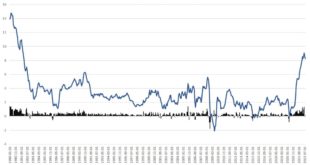

Read More » SNB & CHF

SNB & CHF