As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS getting past the Oval Office secretary might prove difficult. But if these turn out to be our own weather balloons, I will predict confidently now that President Biden will soon announce a program to replace them and a count of the jobs created to do so. The State of the Union address by the President

Topics:

Joseph Y. Calhoun considers the following as important: 10 year treasury yield, 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, autos, bonds, commodities, contango, Copper, Crude Oil, currencies, economic growth, economy, energy stocks, exports, Featured, GDP, growth stocks, Housing Market, imports, Interest rates, Markets, newsletter, Real estate, Recession, stocks, Taxes/Fiscal Policy, US dollar, value stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS getting past the Oval Office secretary might prove difficult. But if these turn out to be our own weather balloons, I will predict confidently now that President Biden will soon announce a program to replace them and a count of the jobs created to do so.

The State of the Union address by the President last week was further evidence, if anyone needed it, that the biggest lie ever told during one of these addresses was the one Bill Clinton told when he was trying to get re-elected, namely that the era of big government is over. It might have been wounded in the 90s but the Big Guv beast is back. And truthfully, it wasn’t Joe Biden who revived the thing but he is certainly making sure it doesn’t falter again. The SOTU was a laundry list of things the Biden administration is investing in despite having no evidence that such government led investment has ever been anything but a good way to waste a bunch of capital.

The President also insisted throughout the speech that we would “Buy American!” as we go about investing money we don’t actually have without taking it away from someone who might use it more productively. He proclaimed that the infrastructure would be built with “American-made lumber, glass, drywall, fiber optic cables” and, of course, American labor. I don’t know if we have the capacity to provide those raw materials but I’m pretty sure we don’t have a bunch of spare workers right now. If government is going to take on the responsibility for building infrastructure then maybe they ought to focus on getting it done as fast as possible at the best cost. Infrastructure should be about the need for infrastructure not the need to hire workers with the unemployment rate at 3.6%.

I will not be surprised if the Biden administration’s spending spree makes GDP growth look better in the short term. Government spending is, after all, part of the GDP equation. But in the long run it will mean lower growth and higher prices. There is no doubt that there is infrastructure that needs repairing or upgrading or building anew. But government’s track record on doing such things on time and on budget – remember the Big Dig in Boston or the cost of adding some stations to the NYC subway – is lousy.

With little of this infrastructure spending actually underway, it isn’t likely that it is the source of any incipient reacceleration of the US economy. There does seem to be some optimism seeping into the narrative over the last couple of weeks but frankly there isn’t a lot of evidence to support it. The jobs report certainly seemed good but everyone who’s been doing this a while knows that January is one of the months that often gets revised a lot. The others are February, March, April, May, June, July, August, September, October, November and December.

We have seen housing stabilize somewhat as prices have dropped for 5 months in a row while mortgage rates have fallen from over 7% to just over 6%. New home sales ticked up a little last month and are up 13% since July. The pending sales index was up in December and inventory is a mere 2.9 months at the currently depressed sales rate. Homebuilder stocks are all near their highs.

We’ve also seen some improvement in the auto sector with sales up 28% since hitting the low for the cycle in September of 2021. Sales are up 4.1% year over year and at 15.7 million units would appear to have further room to rise to get to a more normal level of 16 to 18 million. New orders for durable goods surged 5.6% in December. The gains are concentrated in transportation but last I checked that was part of the economy too.

Now, I’m not saying everything is wonderful and that recession is out of the picture. But markets have pushed out the recession start date quite a bit over the last two weeks. Eurodollar and SOFR futures – short term rates markets – show rates peaking in either late Q3 or Q4 and I wouldn’t expect rates to be still rising if recession is imminent. The Fed funds market has started to price in another 25 basis point hike in May and doesn’t see the first cut until December. The Fed will surely be late to recognize recession is coming – they always are – but they’ll get it reasonably close. And reasonably close is usually good enough for investors’ purposes.

Unfortunately though, this increased interest in a better economy has pushed interest rates higher and as we found out last year, stocks don’t like that all that much. So, stocks are pulling back some and I think probably have some more to go but unlike last year, the magnitude of any additional rate hikes is likely to be small and so should any correction. A 5-10% pullback in the S&P 500 from here would be pretty normal.

I don’t think, by the way, that you’ll see that big a move in small cap, dividend or value stocks. They’ve all worked off most of their overbought condition already and probably won’t fall as much as large cap growth. International stocks’ performance will be mostly about the dollar which is currently trying to gain some upside strength but is still in a short term downtrend.

It seems very hard to believe that we will escape the current environment without a recession. I suppose anything is possible though and the Biden administration seems determined to find out if they can spend our way to prosperity. It won’t work long term but I don’t think Joe Biden is worried much about the long term.

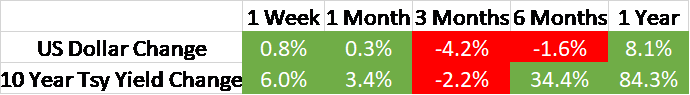

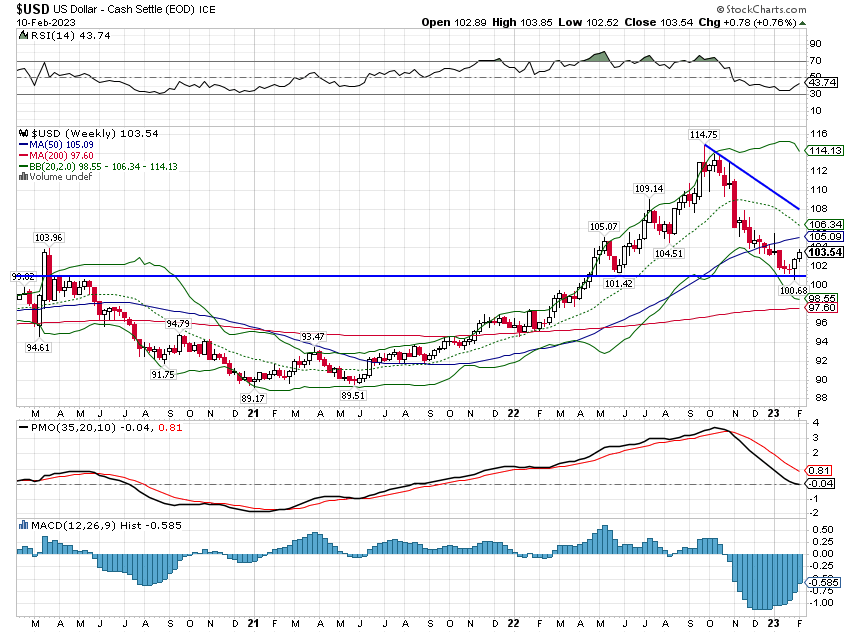

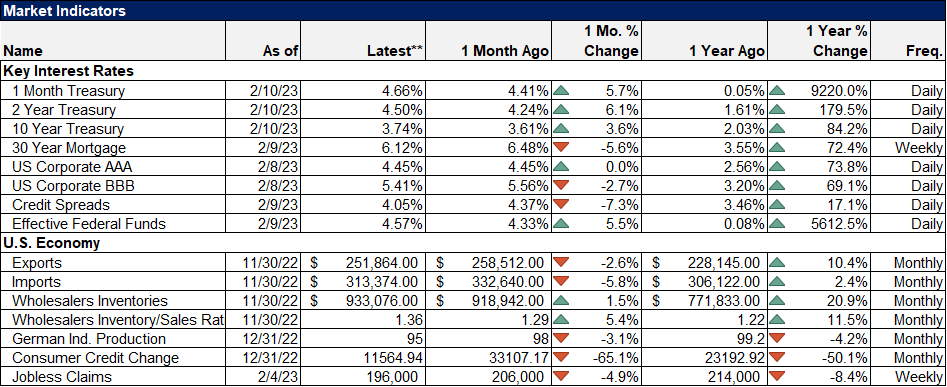

EnvironmentInterest rates and the dollar were both higher last week. Both the 2 year and 10 year Treasury yields broke their short term downtrends. The dollar rise was, as I said last week, just an attempt to relieve an oversold condition; the rebound was pretty feeble. The short term trend for rates now shifts back to up, the intermediate term trend remains up and long term remains neutral. I still expect these rates to turn decisively lower prior to or at the onset of recession. That is not the case today obviously and the action of the last two weeks appears to have pushed expectations for recession out to the end of this year or early next. Remember though that this is just a snapshot of expectations today and it could change rapidly if the economic data deteriorates. |

|

| This move in rates is what we expected and why we didn’t do any buying in January. The motivating factor for stocks last year was rates – not recession fears – and I don’t think that has changed. Rising rates puts stocks on the back foot and that won’t change until strong NGDP growth is viewed as a positive rather than a negative. In other words, when rising rates is more about real growth than inflation. I don’t think we’re there yet.

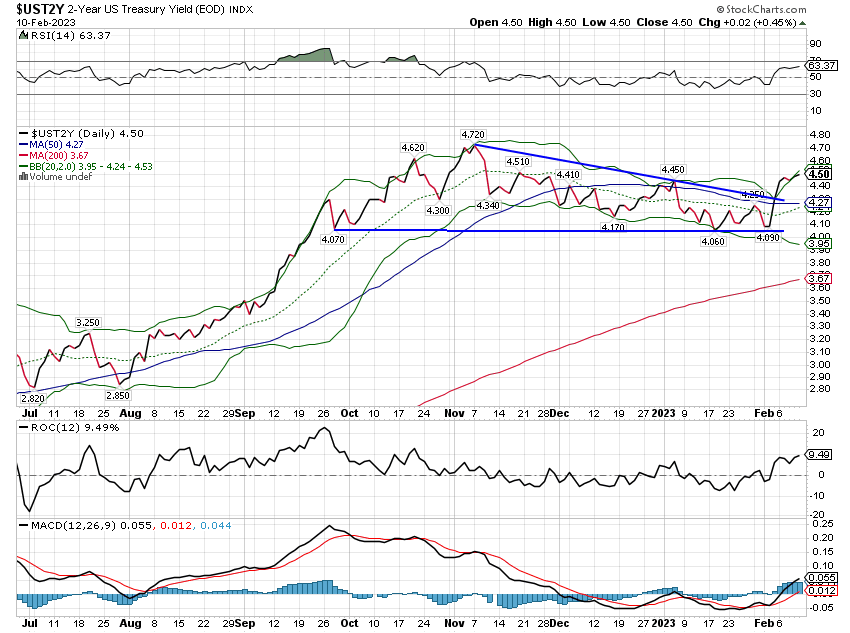

Unlike rates, the dollar remains in a short term downtrend. The intermediate term trend is neutral and the long term trend is still up. The economic data last week wasn’t particularly impressive – there really wasn’t much data at all – and from that viewpoint the weak dollar rally makes sense. |

|

| The dollar is also influence by real yields that have not been keeping pace with nominal rates recently. That is seen in shorter term inflation breakevens with the 5 year moving up nearly 40 basis points since January 18th. I’ve said this before and I’ll say it again – knocking down NGDP growth is not going to be easy. And that is likely why the market is starting to price in another 25 basis point hike at the May meeting.

With rates still rising (rising NGDP) the key to asset allocation is the dollar. If the dollar is falling in a rising rate environment we would tend to favor international stocks and bonds as well as commodities and gold. But if the dollar is rising in that environment we would favor US stocks and bonds and minimize commodity exposure. Today’s conditions require a split the baby solution of owning both US and international stocks and keeping our commodity/gold exposure less than the strategic target. It is this shifting environment that keeps us holding a cash reserve. At least we’re getting paid to hold cash now. |

|

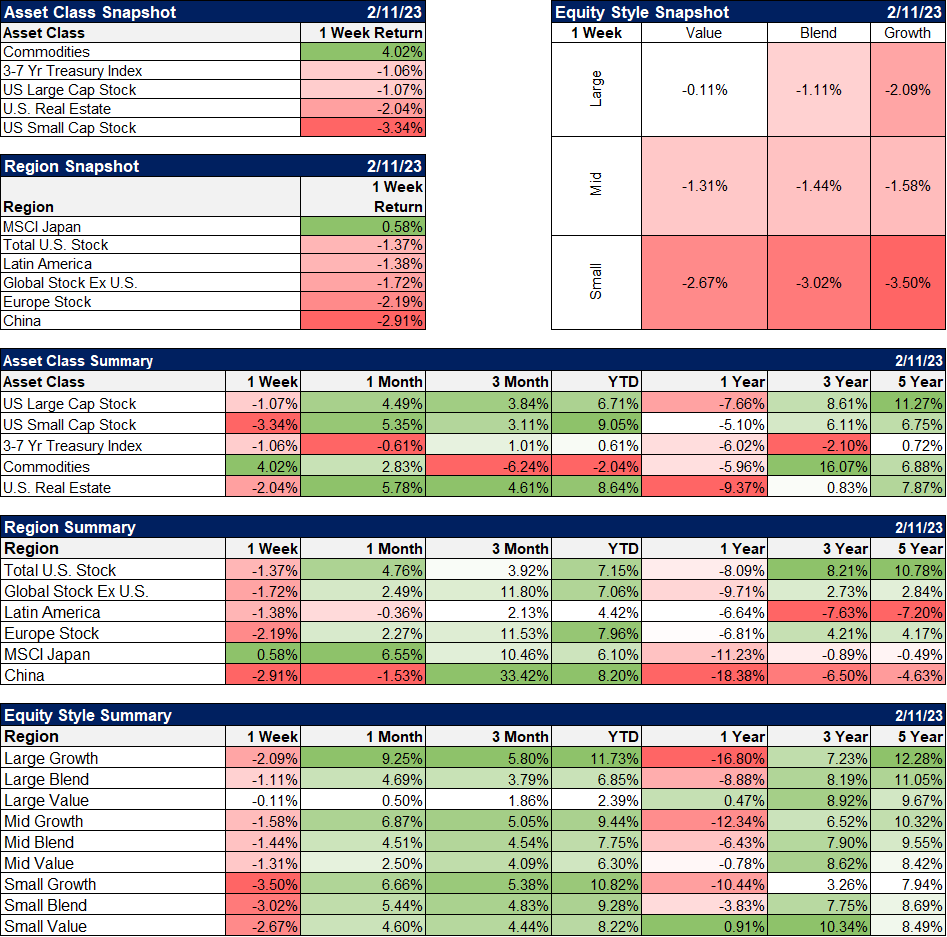

MarketsRising rates pulled down stocks and bonds last week but commodities had a good week. Crude oil was up 8.6% but WTI futures remain in contango. I said in mid-January that it looked like crude had put in a bottom and maybe it has but the contango continues to be a worry. The contango in Brent crude has been reversed and the Brent/WTI spread has moved from under $2 to over $6 since late December. But contango continues in copper, aluminum and nickel. I’m not sure exactly why this is happening now but it is usually an indication of weak near term demand. As I said, that is worrisome and I continue to watch this situation closely. With the dollar up, international markets were also down on the week with China pulling back the most. There is a growing consensus that China’s reopening will be a bust but it is way too premature to make such a declaration. I don’t think much of the Chinese economy long term but governments can goose any economy for a while and I expect the Chinese to do exactly that. How much impact that has on the rest of the world is hard to say but my guess is that normalizing the supply chain in China isn’t going to prove negative. The growth stocks that were all the rage just a couple of weeks ago were not last week as value resumed its outperformance. Value stocks were still down but less than growth and large cap outperformed small cap. Again, the future here will likely be determined to some degree by the course of the dollar. A weak dollar tends to favor small caps and value, as well as the obvious international. |

|

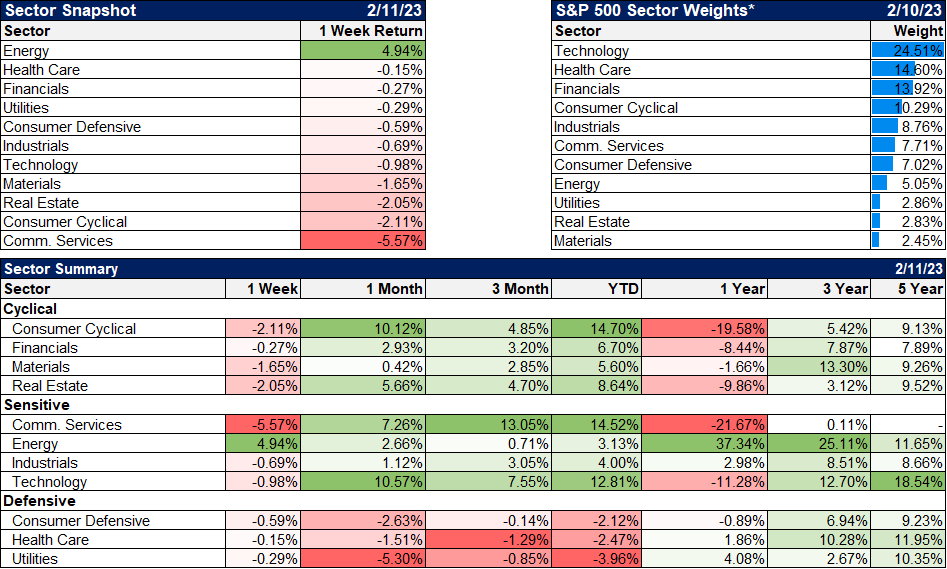

| Energy was the only sector positive for the week and that is despite what I see as some fairly disappointing earnings from the sector. With most of Q4 earnings season over only 64% of energy companies beat estimates, which is 10th of 12 sectors. But if crude prices rise, these stocks will probably move higher too. The energy sector has done well over the last 3 and 5 years, up 95.8% and 73.5% respectively. But it is still the worst performing sector over the last 10 years, up just 67.1%.

Communication services pulled back after leading for most of the year It is interesting that, from an earnings perspective, it is the worst of the 12 sectors for beat rate but the second best stock market performer. Companies missing on earnings though hasn’t been much of a problem this quarter. Stocks of companies missing earnings estimates have fallen an average of just 0.4% this quarter, well below the 5 year average of 2.2%. And this performance doesn’t seem to have anything to do with guidance. For the companies that issued guidance, 82% were negative. I’ve heard a lot this year about how poor earnings are going to kill stocks this year but this tells me the market has already priced in some significant negatives. By the way, never assume you know what something means without investigating it. You may believe earnings will fall this year but that is the consensus. And stocks historically do well when year over year earnings are negative, up roughly 3/4 of the years that was true. Stock prices move on surprises not things that are expected by everyone. |

|

| The data on exports and imports below didn’t update with the latest data so ignore them. Imports were up 1.3% while exports were down 0.9% and that is pretty good, if not spectacular news. Those were December numbers and based on what Mastercard and BofA had to say last week about consumption patterns, I would expect those import numbers to rise in January. The trade balance isn’t what most people think it is and I don’t care how much Joe Biden and the other politicians talk about reshoring, we aren’t going to get rid of our trade deficit. You can’t offset the budget deficit with industrial policy. The only times we’ve come close to balancing the trade account in my lifetime is during recessions. That is a bad solution to a non-problem, so an uptick in imports was nice to see.

The preliminary U of Michigan consumer sentiment was also out Friday and continued to tick higher. That is also good news, for the economy and stocks. Mortgage applications were up last week too as lower mortgage rates are having an impact. We’ll see how that goes if rates continue to rebound. Last to mention is one that isn’t good. Wholesale inventories were up in December by just 0.1% but that was better than sales which were flat. That means the inventory/sales ratio rose, up to 1.36 now and at levels that make me a tad uncomfortable. The ratio isn’t really a leading indicator – we’ve had it this high plenty of times outside of recession – but if it continues to rise then Houston, we have a problem. |

I have often written about the futility of trying to predict the future and that doesn’t just apply to markets or the economy. I don’t know of anyone who had shooting down UFOs in their 2023 outlook. It may turn out to be nothing, but it may also be something significant from a geopolitical standpoint. No, I don’t mean intergalactic but they could be Chinese or Russian or some other unfriendly nation. So, they may represent more of a threat than they appear now. Or maybe we really have been shooting down our own weather balloons because we’ve become a paranoid mess of a nation. I’ll guess we’ll just have to wait and see.

Tags: 10 year treasury yield,Alhambra Portfolios,Alhambra Research,autos,Bonds,commodities,contango,Copper,Crude Oil,currencies,economic growth,economy,energy stocks,exports,Featured,GDP,growth stocks,Housing market,imports,Interest rates,Markets,newsletter,Real Estate,recession,stocks,Taxes/Fiscal Policy,US dollar,value stocks