When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really. All markets – stocks, bonds, currencies, commodities – provide us with valuable information about the economy. The stock market generally reflects corporate profit growth and interest rates which provides us with important feedback about economic growth and inflation. The broader the index, the more representative of the economy as a whole. The way indexes are constructed makes a big difference in the information you can extract about the economy. The

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Research, Featured, Markets, Nasdaq 100, newsletter, S&P 500, S&P 500, stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really.

All markets – stocks, bonds, currencies, commodities – provide us with valuable information about the economy. The stock market generally reflects corporate profit growth and interest rates which provides us with important feedback about economic growth and inflation. The broader the index, the more representative of the economy as a whole.

The way indexes are constructed makes a big difference in the information you can extract about the economy. The S&P 500 and the NASDAQ are capitalization weighted, meaning the companies with the highest market value get a bigger weighting. As a company’s stock rises in value the index is forced to buy more to keep the index properly ordered. In short, cap weighed indexes are momentum indexes, with the index continually adding to the stocks that perform the best. That means the index’s performance is more a reflection of the largest and best performing stocks in the index. Everyone by now has heard about the Magnificent 7 so I won’t rehash all that but the fact is that the performance of these two indexes is distorted because in the US we have a small group of very successful companies.

The Dow is price weighted which means that the stocks with highest per share price get the highest weights. That means that United Health Group has the largest weighting in the Dow but only ranks 14th in the S&P 500. In the case of the Dow, companies are rewarded for not splitting their stock (which has no impact on the value of the company) and it also means that some great companies get excluded because they would make up too large a part of the index. It also means the index has to sell shares of companies that split their stock, which make no sense. In some ways, the index does act like the S&P in that the best performing stocks make up ever larger parts of the index – as long as they don’t split their stock.

Most of the indexes in the world are capitalization weighted but there are now a lot of indexes that are weighted based on a factor, like quality or value or growth. You can invest in just about any way you want by purchasing the proper index but I think that, in some ways, distorts the purpose of index or passive investing. In its simplest form – and simple is almost always better – indexing should give you exposure to the broad market. You don’t get that with capitalization weighted indexes and you don’t get it with factor indexes. But cap weighted is the standard so it’s what most people use.

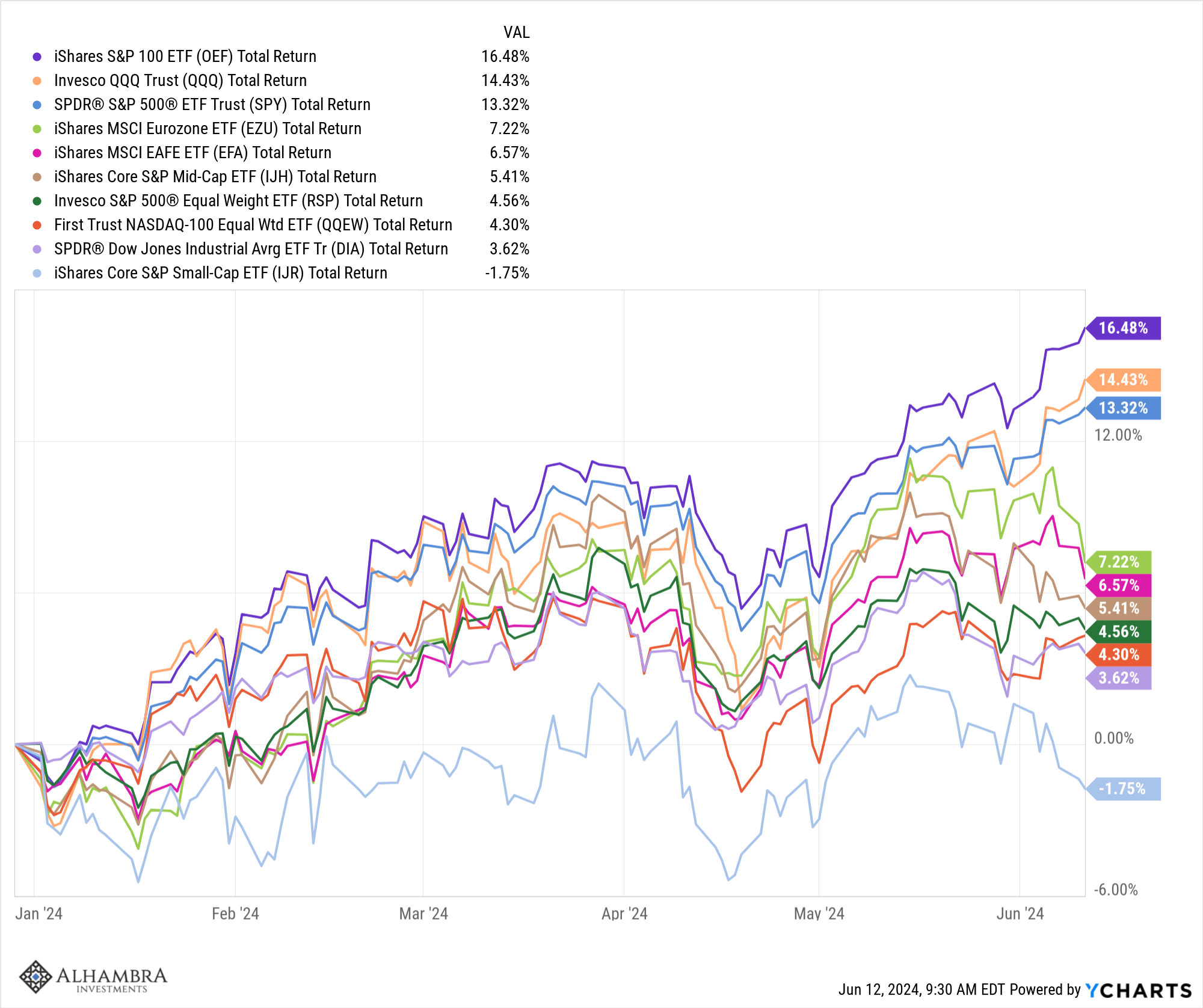

If what you want is information about the economy though, I think it makes sense to look at a variety of indexes and when you do that for 2024 YTD, you get an interesting result. The S&P 500 and the NASDAQ 100 have produced the best result by far which isn’t surprising when you see their top 10 holdings:

NASDAQ 100 (QQQ): Microsoft, Nvidia, Apple, Amazon, Meta, Broadcom, Alphabet (Google) class A and B, Costco and Tesla

S&P 500: Microsoft, Nvidia, Apple, Amazon, Meta, Alphabet (Google) class A and B, Berkshire Hathaway, Eli Lilly and Broadcom

8 of the top 10 holdings are the same so the performance of the two is very similar. The top 10 make up 35% of the S&P 500 and 49% of the NASDAQ. If you want a better comparison you can use the S&P 100 which is the top 100 of the S&P 500. The top 10 in that case makes up 50% of the index.

I don’t think one can make a good argument that these 12 companies represent the US or global economy. If we equal weight the members of each index we get a much different result. While the cap weighted indexes are up in the mid-teens percent range, the equal weight versions are up a lot less: S&P 500 equal weight +4.56% and NASDAQ 100 equal weight +4.3%. Outside the top 12 the rest of the market is not performing nearly as well. Although not really representative of the economy as a whole either – arguably I suppose – the Dow is also drastically underperforming the largest companies, +3.62%.

We get similar results if we look at mid and small sized companies in the US and indexes outside the US: Midcap +5.41%, Small Cap -1.75%, Europe +7.22% and International Developed markets (EAFE) +6.57%.

| “The market” is still doing pretty good this year, with the exception of the smallest company stocks, but the 12 largest companies are doing a lot better. And that, in a microcosm, represents the US economy with a few companies doing really well and the rest of the economy doing a lot worse but still okay. Is that a problem? I think so but that doesn’t mean I think we need a big push on antitrust to break up these big companies. I’m not generally in favor of government intervention because the market will take care of this eventually, There is considerable turnover in the top 10 holdings of the S&P and the NASDAQ as successful companies with high margins get lots of competition. And sometimes they just don’t perform well themselves – see Tesla, down by roughly half since the beginning of 2022.

But that is different than deciding whether you should invest in these indexes. There is plenty of evidence that the S&P 500 has been even more concentrated in the past than it is today. But people weren’t buying the SPDRs or the Qs in 1960. The warning sign for me in the S&P 500 is its similarity with the NASDAQ. If I wanted to invest in the biggest, riskiest – and arguably most innovative – companies in the US I would buy the QQQ. Today the S&P 500 and the NASDAQ are nearly indistinguishable. The US and global economy is doing pretty well right now with the US slowing some and the rest of the world, in general, getting a bit better. “The market” reflects that. The S&P 500 and the NASDAQ 100 reflect how the biggest companies in the world are doing. It was once said that what’s good for GM is good for America. I’m not sure you can say the same thing about Microsoft, Nvidia, Amazon, Google and Meta. |

Tags: Alhambra Research,Featured,Markets,Nasdaq 100,newsletter,S&P 500,stocks