What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because if the consensus is right this year it may well be the first time ever. We got a few things right last year but it wasn’t from predicting anything; it was from observing. Late in 2021 we made a decision to completely avoid US growth stocks because valuations had become so extreme. It was, frankly, one

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, commodities, currencies, Dollar, economy, Featured, Federal Reserve, Federal Reserve/Monetary Policy, growth stocks, Markets, Monetary Policy, newsletter, Real estate, Recession, stocks, valuations, value stocks, Warren Buffett

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because if the consensus is right this year it may well be the first time ever.

We got a few things right last year but it wasn’t from predicting anything; it was from observing. Late in 2021 we made a decision to completely avoid US growth stocks because valuations had become so extreme. It was, frankly, one of the easiest decisions I’ve ever made in my 30+ years in this business. Avoiding growth last year paid enormous dividends, but I didn’t predict that growth stocks would fall in 2022, just that I couldn’t own them and fulfill our fiduciary duty. Instead we owned – primarily – value and dividend oriented equities. That turned out to be a great decision but, again, it wasn’t based on any prediction about the future; it was just the flipside of our disdain for growth stocks. And it paid off as S&P 500 growth fell over 30% while the value version fell a little over 7% and Select Dividend fell just 1.6%. (Alhambra owns IVE, DVY and SDY)

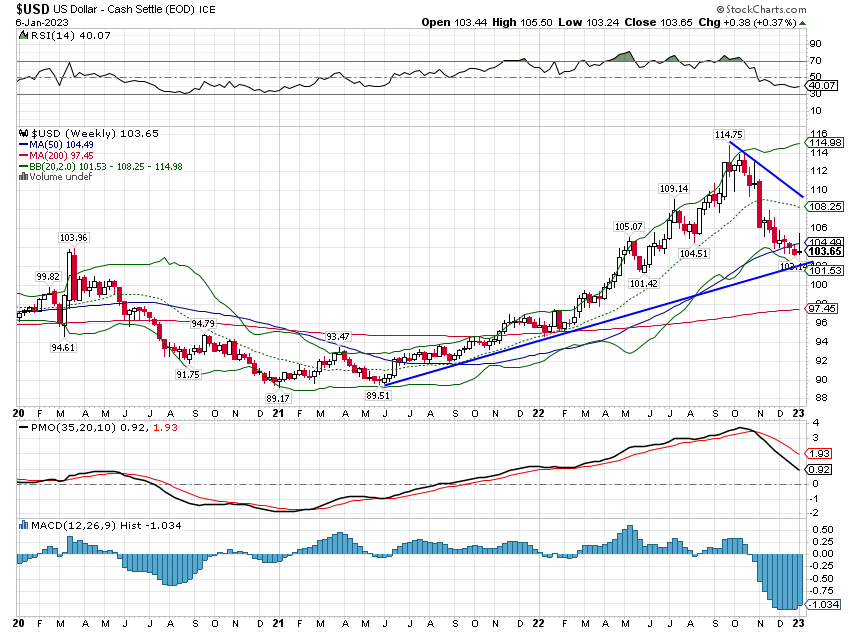

We also observed and wrote all year about the uptrend in both interest rates and the dollar. We didn’t predict anything but the trend was obvious and with the Fed aggressively hiking rates, it made no sense fight it. We kept the duration of our bond portfolio shorter than our strategic target and beat our fixed income benchmark by roughly 300 basis points on the year. (That varied by account/risk tolerance, etc. Some accounts beat by more and some by less but all outperformed)

The rising dollar was more difficult to apply to portfolios. We would normally expect commodities and gold to perform poorly in a rising dollar environment but both outperformed stocks. We would also expect international equities to underperform but that didn’t play out as expected either. On the commodity side we had exposure but less than our strategic target because of the dollar strength. We would have performed better on the year with larger allocations but historical precedent argued against it. As it turned out, we didn’t have an historical precedent that included Russia invading Ukraine.

We did buck historical precedent with an allocation to foreign stocks but, again, that was about our view on growth stocks. We wanted to own value stocks because the spread between growth and value had moved to an extreme without historical precedent. We decided that a tilt to value should include non-US stocks primarily because US value stocks, as measured by the popular indexes, were not particularly cheap compared to history. Even today, the S&P 500 value index, at nearly 16 times expected earnings and 1.6 times sales, is not cheap. We found ways to invest in cheaper value through some other funds but the easiest way to buy cheap stocks was to buy international value which trades at roughly 9 times earnings and 0.75 times sales. Now that is cheap and international value did outperform the S&P 500 by falling just 9%.

We outperformed and we are proud of that but we still lost money last year. The standard 60/40 stock/bond model we track was down nearly 17% and our moderate risk accounts were down roughly half that which is considered a win in this business. But I have to say, it didn’t and doesn’t feel very good to me. I hate losing money and I have a hard time calling any down year a “win”.

So, before I get to what the consensus is and what that means for the new year, let me just remind everyone of Warren Buffett’s rules of investing:

- Don’t lose money

- Don’t forget Rule #1

Of course, one can argue about the time frame of those rules and everyone who has done this for any time will tell you that down years happen and all you can do is minimize the damage. I think we did a pretty good job of that last year but I don’t want to be back here next year saying the same thing. The goal is to make money for our clients. Period.

The consensus coming into last year was that growth would come in at 3 to 4%, interest rates would rise modestly as the Fed started a hiking campaign and inflation would moderate as supply chain issues resolved themselves. Stocks were expected to rise roughly 10%. And none of that came true. Growth was negative in the first two quarters of the year and while it did improve in the second half, it didn’t come anywhere near 3 or 4% for the full year. The Fed didn’t just start to hike, they kicked the rate hikes into a higher gear than ever seen before. And of course, stocks were down nearly 20% for the full year and 25% at the lows. Wall Street had a perfect track record; they whiffed on everything.

So what’s the consensus this year that will be wrong? Well, first and most obvious is that a recession is expected by everyone. It isn’t just consensus on Wall Street, it is consensus by everyone from company CFOs to your local bartender. Everyone knows the yield curve is inverted and everyone knows what that means (or thinks they do). To narrow it a little I’d say the consensus is that the recession arrives somewhere around mid-year. Interest rates are expected to peak in the spring at 5% and fall in the second half to end the year at 4.5%. Or at least that’s we find if we look at futures markets. The question is how this might be wrong. Some possibilities:

- There is no recession in 2023

- The recession arrives sooner than mid year

- The recession arrives later than mid year

I can’t tell you which of those will right but if I had to bet, I’d probably go with #2.

The other consensus view about the economy is that whenever the recession starts it will be mild. That is based on the observation that household balance sheets – and corporate to a lesser degree – are in fine shape with still lots of COVID cash left in the bank. That’s a point I made several times last year and it is still true. Still, the fact that individuals have money in the bank doesn’t mean they will spend it so I’m not sure it says much about the severity of any recession. So, how could this be wrong?

- There is no recession in 2023

- The recession is deep and broad

Given those two choices I’d probably go with #1.

The last consensus view about the economy is that any recession will be short because the Fed will come to the rescue with rate cuts. This could be wrong by:

- There is no recession in 2023

- The recession lasts longer than average (average = about 10 months)

- Fed rate cuts aren’t the magic everyone thinks they are

Given those choices I’d go with #1. #3 is true but if #1 is true too, it won’t matter because the Fed won’t cut.

I don’t know what the economy will do next year but there are some things I feel pretty comfortable saying. First is that the labor shortage isn’t going away so getting unemployment to rise as much as the Fed claims to want would require a very deep recession. And I don’t think the Fed could take the political heat that comes with that. The labor shortages are driven by demographics and no matter how leaky the southern border we aren’t going to solve that anytime soon. Second is that with 80% of economists predicting recession in 2023 and given their past track record in predicting such events, getting through the year without one would not surprise me in the least. That isn’t a prediction.

One last thing about the economy, expectations for recession and the yield curve(s). I wrote last year about my concerns that widespread knowledge of the yield curve’s recession predictive power may have rendered it less than previously useful. Put simply, when I got in this business several decades ago, no one paid any attention to the yield curve. The research linking the inverted yield curve to recession was done in the late 80s by Campbell Harvey for his dissertation at U of Chicago. But today, everyone knows about the yield curve and that common knowledge may have changed people’s behavior such that the curve is no longer as useful as it was in the past. That is not a consensus view by the way and I got a lot of pushback when I wrote about it. And so it is noteworthy that Dr. Harvey had this to say recently:

My yield-curve indicator has gone code red, and it’s 8 for 8 in forecasting recessions since 1968 — with no false alarms. I have reasons to believe, however, that it is flashing a false signal.

He cited two factors in saying that the US seems likely to avoid recession. First is the same one I cited:

One of the reasons is the fact the yield curve-growth relation has become so well known and widely covered in popular media that now it impacts behavior, he said. The awareness induces companies and consumers to take risk-mitigating actions, such as increasing savings and avoiding major investment projects — which bode well for the economy.

The other is that most people didn’t actually read his dissertation and so have no idea what it really says. His model was based, partially, on inflation adjusted yields and as he points out, if you adjust current yields for inflation expectations, it isn’t inverted at all. That’s because inflation expectations are inverted with short term expectations higher than long term. That adjustment puts real 3 month bill rates deeply negative while the 10 year real yield is solidly positive. He thinks the economy may continue to slow some but avoid recession.

I have been thinking of this as a rolling recession where certain sectors do contract but others continue to expand so the overall growth rate is around zero. That is consistent with what I’ve expected for the last year+, mainly that the economy is going back to its pre-COVID growth trends. That will require a slowing in goods consumption (already underway) and a continued recovery in services spending. That isn’t a sure bet as the sub-50 ISM Services index showed last week but I’d be careful about that one report. In case you’ve forgotten already December was pretty darn cold and services spending isn’t generally done on line in the comfort of your warm den.

That’s the economic consensus but what about the consensus about markets? Well that is driven by the economic consensus which is, in my mind, a mistake but that’s how most people think about markets. In reality, near term stock market performance is negatively correlated with economic growth. That’s because stocks start to rise before things get better and they start to fall before things get worse – markets anticipate. I recently did some research on the University of Michigan consumer sentiment poll and stock market returns which you can read here. In short, consumer sentiment is coincident with the economic cycle but stock market performance is strongly contrarian. Low readings of consumer sentiment are associated with weak economic growth and higher subsequent stock market returns. It’s a hard concept to accept, very hard to act on and most people don’t. But it was the 50 year low in consumer sentiment last year that spurred me to write, starting in the summer, that investors needed to shift from wondering what to sell to wondering what to buy.

The consensus on stocks for 2023 is that the first half of the year will be down as markets anticipate the recession arriving at mid-year. The second half is reckoned to be better as the Fed cuts rates in response to weak growth. As is often the case, the full year is expected to show a gain of about 10%. The easiest way that could be wrong is:

- The full year is up strongly as inflation fades and the economy avoids recession

- The first half is up because the recession doesn’t arrive on schedule while the second half is down as we get closer to recession

- The full year is anything other than 10% which is the long term average and almost never happens in any one calendar year

I would just point out that back to back down years in stocks are fairly rare although that did happen in the dot com bust when 2000, 2001 and 2002 were all negative. Before that you have to go back to 1973/74, 1946-48, 1939-41 and 1929-1932.

As for other markets, with recession the consensus, bonds are expected to rally (rates fall) and commodities are expected to fall.

What’s odd about this year is that there really isn’t anything obvious like last year. It was easy to avoid growth stocks last year because valuations were stupid. With inflation hitting an annualized rate of 7% in December of 2021, it was a pretty safe bet that rates were going up. The dollar was, as always, a more difficult call because it isn’t just about how the US does but how it does relative to the rest of the world. This year, there is nothing that is so easy. Valuations are not cheap but they aren’t ridiculous like they were at the end of 2021. The economy has defied all predictions of doom over the last year and looks to have accelerated in the fourth quarter. It enters the year slowing but still resilient, especially from the viewpoint of labor. Interest rates may have peaked (see below) but that doesn’t mean they are going to fall a lot. Sentiment is neutral, neither excessively bearish or bullish.

One thing I do expect this year is to have more opportunities to make money. Last year was driven by rapid changes in interest rates and as such correlations were very high; everything went up and down together. Yes, some things performed better than others but directionally there wasn’t much differentiation. I don’t expect big moves in interest rates this year since most of the rate hikes are over; inflation moderation is pretty obvious to everyone at this point, even the Fed one hopes. If bond volatility eases, it seems likely the volatility of other assets will follow suit, something I’m sure everyone would be happy to see. If I get nothing else right this year, let it be that.

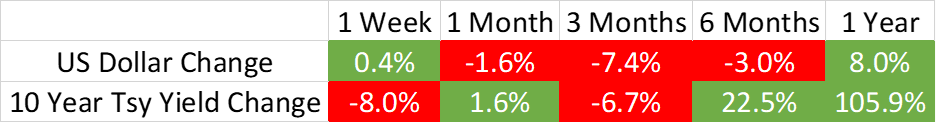

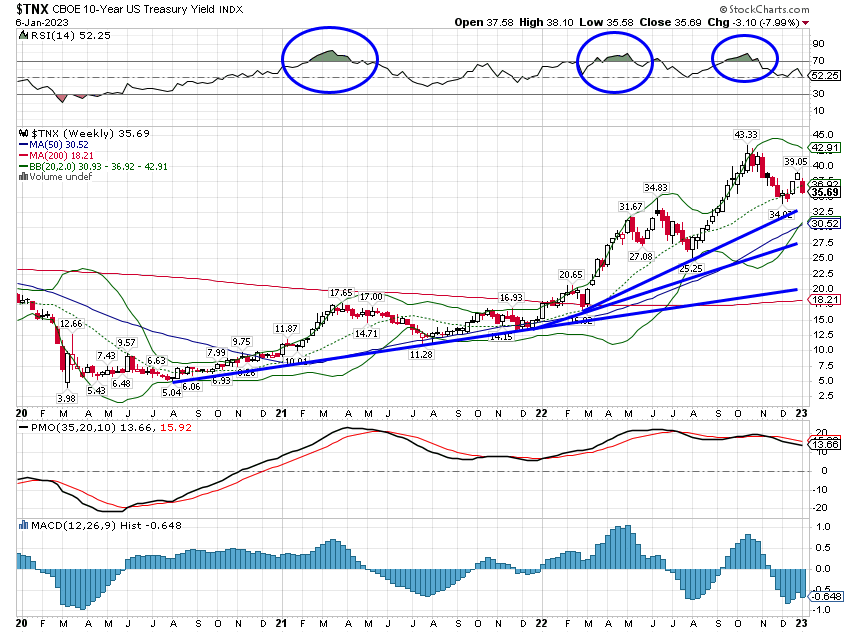

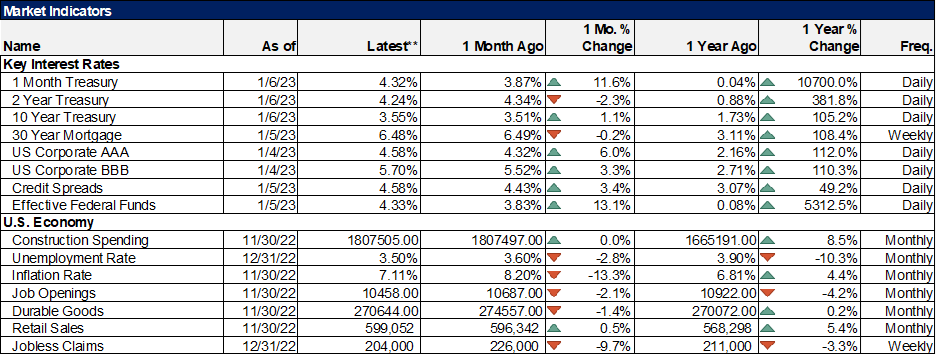

EnvironmentThe short term trend for long term interest rates and the dollar have not changed since my last update about a month ago. Both continue to trend lower on the daily charts. Intermediate term trends are also still intact and up. |

|

| The long term trend for rates is essentially neutral with the current level of 10 year yields at the top end of a range that has persisted since 2009. The breakout over 4% late last year may have been a head fake but we won’t know that for sure for quite a while. Right now, rates are pulling back from those highs and the intermediate term uptrend is in danger. A break below about 3.4% would do the trick in my opinion. | |

| The long term trend for the dollar is still up but like the 10 year yield, the intermediate term uptrend is in danger. It appeared that the dollar was due for at least a short term rally but Friday’s weak economic data (at least that’s how it was perceived) changed that pretty dramatically. Still the dollar did manage a small gain for the week. As I noted last month, speculators have been slowly liquidating their dollar longs and that has continued into the new year. I am skeptical that will continue if the US enters recession but the global economy is not operating in synchrony right now so I suppose it is possible that other economies look better relative to the US. History says that isn’t likely though so maintain some healthy skepticism on that front. | |

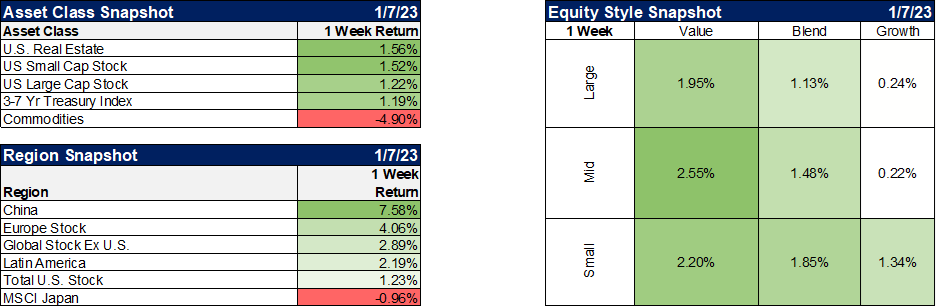

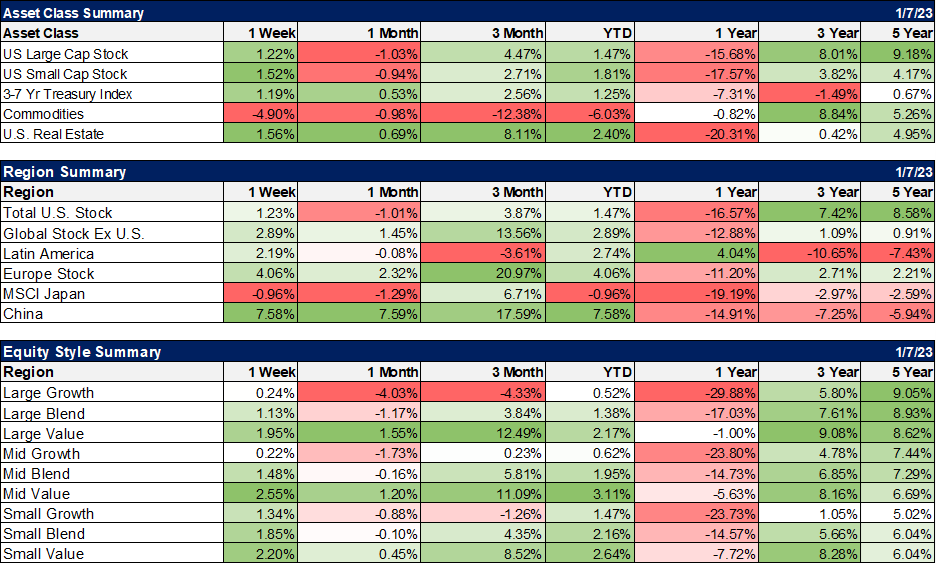

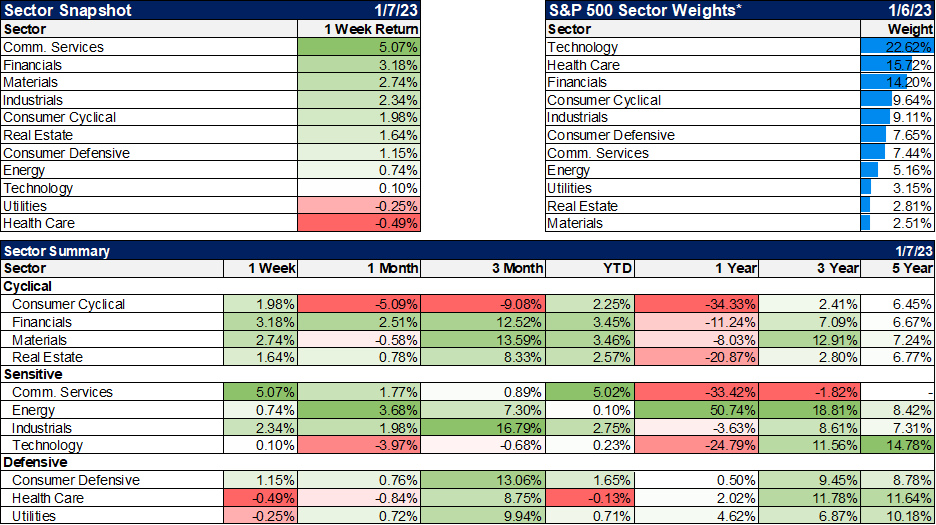

MarketsCommodities were the only major asset class down last week but that was almost entirely due to energy. Crude oil was down 8% and natural gas a whopping 17% on the week. By contrast, the metals performed quite well last week with gold, copper, platinum and palladium all up. Non-US stocks again led the way as they have since the dollar peaked in September. China was the biggest winner as investors continued to add to their COVID re-opening bets. The value outperformance trend continued in strong fashion. |

|

| Last shall be first. Communications sector was the biggest winner on the week after leading the way down last year. | |

Economic IndicatorsNo one knows what will happen this year. There are any number of “black swans” that could land in the new year. Will Russia launch another offensive to try and capture Kyiv? Will China’s reopening of their economy be successful and how will it impact the global economy and markets? Will we get gridlock in Congress or will Biden find a way to continue to embarrass drunken sailors? Will Europe run out of gas? I thought of those but there are infinite possibilities and if it is truly a black swan, it won’t be found here. We take things as they come. Making predictions is actually the last thing an investor should do. Making predictions, especially in public, creates expectations and affects your judgment as you feel a need to defend your predictions. It is better to make no predictions and have no expectations, be ready for anything. |

What we’re going to do this year is what we do every year – work hard, conduct research, look for trends to exploit, monitor the economy and pay attention to the indicators that have worked in the past while not taking them as gospel but mostly, we’ll listen to markets which provide the wisdom – and sometimes idiocy – of the crowd. We’ll also listen to clients’, about their hopes and fears, always cognizant that what we do is important work. What we do matters and we’ll remind ourselves, every day, who we do this for, who we work for.

I am excited about the new year. Alhambra is entering its 17th year and I couldn’t be happier with our continued progress. I have been in the investment business for 32 years and investing for 42 and I still love it. There isn’t much I haven’t seen in my career but I know something will happen this year that never has before (or at least in recent memory). I can’t wait to see what it is.

Tags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,currencies,dollar,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,growth stocks,Markets,Monetary Policy,newsletter,Real Estate,recession,stocks,valuations,value stocks,Warren Buffett