The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Excellent news received muted by the market The reason was the likelihood that it will increase the probability of further interest rate rises by the Federal Reserve Board. In fact, a Reuter’s poll shows that the majority of top US bankers believe that there will be two more this year, causing a switch into money market instruments. Looking at the broad economic backdrop, China’s five year plan projects, with difficulty, an annual growth rate of 6.5%, the worse forecast in a quarter of a century! The US is expected this year to grow at an anemic annual rate of 2.2%. Also, its trade deficit widened more than expected in January as a strong dollar and weak global demand helped to push exports to a more than five and a half year low! This has increased the trade gap by an addition 2.3% to .7 billion, with exports declining for four straight months.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, newsletter, participation rate, payrolls, wages

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

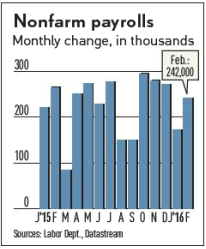

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target.

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target.

- Wages however fell back by 0.1% from February’s gain of 0.5%.

- The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market.

Excellent news received muted by the market

The reason was the likelihood that it will increase the probability of further interest rate rises by the Federal Reserve Board. In fact, a Reuter’s poll shows that the majority of top US bankers believe that there will be two more this year, causing a switch into money market instruments.

Looking at the broad economic backdrop, China’s five year plan projects, with difficulty, an annual growth rate of 6.5%, the worse forecast in a quarter of a century! The US is expected this year to grow at an anemic annual rate of 2.2%. Also, its trade deficit widened more than expected in January as a strong dollar and weak global demand helped to push exports to a more than five and a half year low! This has increased the trade gap by an addition 2.3% to $45.7 billion, with exports declining for four straight months.

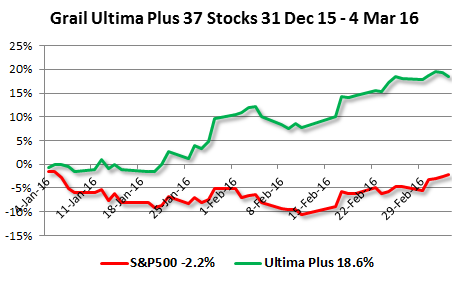

With these all-arching economic prospects it appears to point to little growth for the leading stock market indexes, and is likely to be reflected in the S&P500 and the Dow Jones, indicating at best a similar year as 2015.

However, these central averages are not the whole story by any means, since the market is made up of many types of averages, such as the Russell 2000 small-cap index, which gained 4.32% this week and the S&P 400 mid-cap index, which similarly gained 4.40%. All is not what it appears to be. The days of passively expecting the market to return a commensurate gain based for example on an Index Fund such as on the S&P500 are gone in favor of the more competitively responsive genre of alpha stocks, as this portfolio shows; and even more so, as disappointed investors see beyond the illusion of an unchanging market and adjust to the new status quo of alpha stock investing.

|

|