Last week’s market action confirmed clearly its corrective trend. I cannot say more than that, because when systematic risk kicks in the good, the bad, and the ugly all suffer the same slippery fate. Clearly it prophecies a healthy renewal once this bear trend is over, but first this downward phase has to be over-done before there is a capitulation that would signal a key reversal. For now, there is not much to expect. As the market is in the grip of a profit recession on the one side, and a faltering global economy, worsened by deflationary commodity prices, on the other! To make matters worse, the U.S.’s economy is out of sync with the rest of the world, and the Federal Reserve both at home and abroad in pursuit of its planned interest rate increases will cause a growing rift between the U.S. and other economies, before contagion comes home as a backlash. The stock market began the New Year to face an Asian world of China’s steep stock market declines and North Korea’s mini hydrogen bomb test to add to the flock of black swans circulating around the globe! The bears gorged themselves full this week with all 31 industrial sectors negative. Tobacco, as best performer lost 0.99% and the worst of 31 industries was Automotive, which fell 10.61%! The S&P 500’s P/E Ratio stands at 20.25 times earnings and declining. However, the long-term average is 15.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

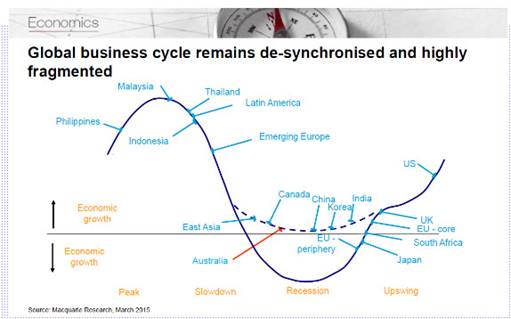

Last week’s market action confirmed clearly its corrective trend. I cannot say more than that, because when systematic risk kicks in the good, the bad, and the ugly all suffer the same slippery fate. Clearly it prophecies a healthy renewal once this bear trend is over, but first this downward phase has to be over-done before there is a capitulation that would signal a key reversal. For now, there is not much to expect. As the market is in the grip of a profit recession on the one side, and a faltering global economy, worsened by deflationary commodity prices, on the other! To make matters worse, the U.S.’s economy is out of sync with the rest of the world, and the Federal Reserve both at home and abroad in pursuit of its planned interest rate increases will cause a growing rift between the U.S. and other economies, before contagion comes home as a backlash.

Last week’s market action confirmed clearly its corrective trend. I cannot say more than that, because when systematic risk kicks in the good, the bad, and the ugly all suffer the same slippery fate. Clearly it prophecies a healthy renewal once this bear trend is over, but first this downward phase has to be over-done before there is a capitulation that would signal a key reversal. For now, there is not much to expect. As the market is in the grip of a profit recession on the one side, and a faltering global economy, worsened by deflationary commodity prices, on the other! To make matters worse, the U.S.’s economy is out of sync with the rest of the world, and the Federal Reserve both at home and abroad in pursuit of its planned interest rate increases will cause a growing rift between the U.S. and other economies, before contagion comes home as a backlash.

The stock market began the New Year to face an Asian world of China’s steep stock market declines and North Korea’s mini hydrogen bomb test to add to the flock of black swans circulating around the globe! The bears gorged themselves full this week with all 31 industrial sectors negative. Tobacco, as best performer lost 0.99% and the worst of 31 industries was Automotive, which fell 10.61%! The S&P 500’s P/E Ratio stands at 20.25 times earnings and declining. However, the long-term average is 15.57, which, if the index would revert to this average, would need to fall something like 452 points, or 24% from Friday’s close of 1922.03 to reach 1470! However, I do not seriously suggest that this would be the case, but the market now does look to be in free-fall. The U.S economy and the stock market need signs of sustainable growth, but at this stage of the business cycle, the odds are that the only thing that will grow this year will be the profit recession! However, the forthcoming earnings surprises turn out to be better than expected.

The stock market began the New Year to face an Asian world of China’s steep stock market declines and North Korea’s mini hydrogen bomb test to add to the flock of black swans circulating around the globe! The bears gorged themselves full this week with all 31 industrial sectors negative. Tobacco, as best performer lost 0.99% and the worst of 31 industries was Automotive, which fell 10.61%! The S&P 500’s P/E Ratio stands at 20.25 times earnings and declining. However, the long-term average is 15.57, which, if the index would revert to this average, would need to fall something like 452 points, or 24% from Friday’s close of 1922.03 to reach 1470! However, I do not seriously suggest that this would be the case, but the market now does look to be in free-fall. The U.S economy and the stock market need signs of sustainable growth, but at this stage of the business cycle, the odds are that the only thing that will grow this year will be the profit recession! However, the forthcoming earnings surprises turn out to be better than expected.