The stock market works very differently than the natural world. When an animal is spooked, its first reaction is to freeze. Naturalists say that freezing helps animals escape the attention of predators, which hunt by sensing movement. Try that trick in the stock market – freezing when you should be taking action – and you’ll either be knocked silly by the bears or left behind by the bulls. Instincts are counter-productive We do not believe in the “rely on your gut” principle, propagated on Investopedia. On the contrary, instincts that were useful in prehistoric days are counter-productive in the world of investing. The instinct to freeze isn’t much use when facing a correction. How is it then that well-trained martial artists, elite police officers and Special Forces soldiers tend to react decisively, as they did recently on a Paris train to a threat while ordinary people froze? Often you will hear the elite say after a crisis that their “training took over.” just as it did for these heroes. Train yourself Training enables the elite performer to react properly, despite their natural instincts. The well-trained investor shares this same trait for action, when many freeze too afraid to respond to the threat warranted by the situation.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, greed, instinct, investment¨, Rudyard Kipling, sell rules, training

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The stock market works very differently than the natural world. When an animal is spooked, its first reaction is to freeze. Naturalists say that freezing helps animals escape the attention of predators, which hunt by sensing movement. Try that trick in the stock market – freezing when you should be taking action – and you’ll either be knocked silly by the bears or left behind by the bulls.

Instincts are counter-productive

We do not believe in the “rely on your gut” principle, propagated on Investopedia. On the contrary, instincts that were useful in prehistoric days are counter-productive in the world of investing. The instinct to freeze isn’t much use when facing a correction. How is it then that well-trained martial artists, elite police officers and Special Forces soldiers tend to react decisively, as they did recently on a Paris train to a threat while ordinary people froze? Often you will hear the elite say after a crisis that their “training took over.” just as it did for these heroes.

We do not believe in the “rely on your gut” principle, propagated on Investopedia. On the contrary, instincts that were useful in prehistoric days are counter-productive in the world of investing. The instinct to freeze isn’t much use when facing a correction. How is it then that well-trained martial artists, elite police officers and Special Forces soldiers tend to react decisively, as they did recently on a Paris train to a threat while ordinary people froze? Often you will hear the elite say after a crisis that their “training took over.” just as it did for these heroes.

Train yourself

Training enables the elite performer to react properly, despite their natural instincts. The well-trained investor shares this same trait for action, when many freeze too afraid to respond to the threat warranted by the situation. The well-trained investor takes advantage of his knowledge either to curb harmful impulses in a correction or to grasp the opportunity offered by a breakout and follow-through day when a key upward reversal occurs.

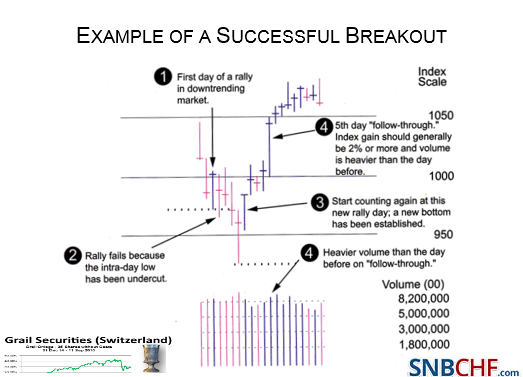

A breakout is signaled when a major index, such as the S&P 500, makes a gain of at least 2% on significantly higher volume than the previous day and a follow-through occurs confirming the change of market direction usually after the third or fourth day, since the market needs that time to test and re-adjust its sentiment. It is prudent to await this confirmation as breakouts can fail. But when it is confirmed it is the opportunity for an investor to start buying again when others are too paralyzed by fear to move.

Greed is counter-productive

Greed is a similar story. In nature, the continual stock-piling of nuts might create security for squirrels. But when a stock piles up too many gains, further gains may become increasingly uncertain. The greedy investor, who tries to squeeze the last dollar out of a price-run, is courting trouble.

The less experienced investor, who remains over-exuberant and ignores the accumulation of red signs, is headed for a rude awakening.

The majority of investors are learning to their cost that their big winners are having difficulty to make further gains in the face of increasing volatility in this corrective late stage of the bull market, which began in March 2009. Most of all, experienced investors realize that big gains should in any case inspire caution, because they are in tune with market reality, and thus they temper their own expectations. Or as the financier Bernard Baruch ironically said, “I made my money by selling too soon!” He added this piece of advice: “Don’t try to buy at the bottom and sell at the top. It can’t be done except by liars.”

Here’s the interesting thing about our natural instincts vs. experience: Over time, training will change an investor’s emotional makeup. He or she will be wary under conditions that make the inexperienced investor exuberant, and will be confident when others are most fearful.

Studying your past trades and a willingness to learn from your mistakes will speed up your learning to emotionally master your trades when others are frozen by indecision and uncertainty.

Sell Rules

The following Sell Rules should help to limit the damage when greed and fear causes freezing:

Rudyard Kipling expressed this kind of sentiment in his poem ‘If’. Using blatant poetic license let me echo his wisdom with the following:

If you can keep your head when all about you are losing theirs, you’ll be a good Investor, my friend!

Kipling recognized the mark of a true investor – he doesn’t freeze up like most and simply ignores his instincts.

See more for