When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky. Which is fine I suppose since we own the devils (although not much in the way of the US variety) but I can’t help but wonder what happens when the spell breaks. Goldilocks may be in the house now but on Wall Street she is often chased away by a certain Mr. Murphy and his eponymous law. While nothing seems to dent the enthusiasm for stocks today for more than a few hours, there will inevitably come a time when no amount of positive news will be sufficient to convince today’s bulls to

Topics:

Joseph Y. Calhoun considers the following as important: Alhambra Research, Bi-Weekly Economic Review, Bloomberg Commodity, bonds, commodities, credit spreads, currencies, Dollar, economic growth, Featured, Federal Reserve, Gold, inflation, Interest rates, Investing, Markets, newslettersent, Politics, Recession, stocks, tax reform, The United States, U.S. Dollar Index, U.S. Treasuries, Volatility, Yield Curve

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky. Which is fine I suppose since we own the devils (although not much in the way of the US variety) but I can’t help but wonder what happens when the spell breaks. Goldilocks may be in the house now but on Wall Street she is often chased away by a certain Mr. Murphy and his eponymous law. While nothing seems to dent the enthusiasm for stocks today for more than a few hours, there will inevitably come a time when no amount of positive news will be sufficient to convince today’s bulls to stay that way.

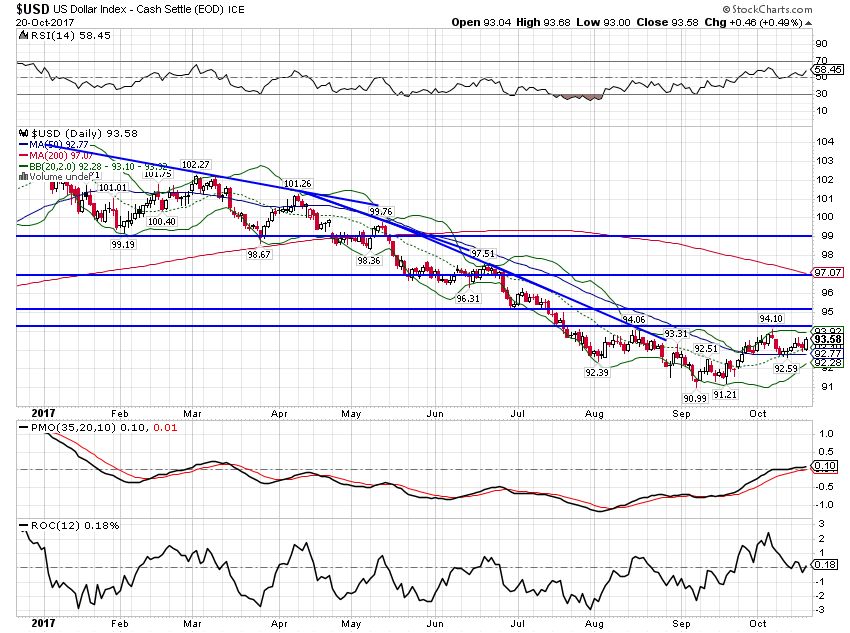

The last two weeks of slow motion melt up were brought to you by quite possibly the most boring two weeks of economic data for this entire cycle. With hurricanes affecting some releases – or not – and tax reform still a vague form on the horizon, no one much cared either way how the data looked. As it turned out it didn’t have much to say no matter how much one tried to torture some meaning from it. You could have taken one of those weeks off to play golf in Hilton Head and not missed a thing. I know that for a fact. (Although, like so many others these days, I didn’t really take time off completely. I checked markets and economic releases, did conference calls and read all Jeff’s posts. I took 4 hours out of every day to play 18 holes but otherwise it was pretty much business as usual. There is no such thing as a true vacation anymore and that is probably more than just a little sad.)

Most of the sentiment based data was better than expected, as one might expect with the stock market making new highs daily. Don’t tell me that company managers aren’t affected by the markets and Fed rhetoric. The Fed surveys (Philly and Empire State) were both much better than expected with employment particularly strong. The employment component of the Philly survey hit an all time high (best in 48 years???). Curiously, that didn’t show up in the JOLTS report which showed a slight fall in job openings. The U of Michigan consumer sentiment survey was also better than expected with expectations up 7 points. Home builders were upbeat with the housing market index at 68. Starts and permits were both down though so one wonders where their enthusiasm originates. Multi-family permits were down a considerable 24% year over year but single family permits were up 9.3% so builders are obviously focused on the latter figure.

One exception to the sentiment surge was the NFIB small business optimism index which fell, unexpectedly, to 103. The drop was driven by waning sales expectations. Yeah, tax reform is hard and expectations for sales gains this year – or even next in my opinion – due to policy change were always unrealistic. We are seeing some sales gains this year, but it is being driven primarily by improvement in the rest of the world, not the US.

And while sentiment may be exuberant it hasn’t translated to consumption. Retail sales were less than expected but the report had hurricanes written all over it so large grains of salt are required. But consumption patterns weren’t going to change in one month anyway and the trend the last few years hasn’t been very good…or very bad, a trend the bulls probably ought to hope doesn’t change much. Industrial production was also wishy washy with the headline a little less dire than anticipated while the manufacturing portion disappointed anyone who hasn’t been paying attention. Capacity utilization continued its downtrend as well, a trend that does not bode well for those anticipating higher inflation.

| The inflation data did get the market’s attention for a few minutes but again there was so much noise in the various reports – from oil prices and hurricane effects – that not much should be made of it. Certainly there didn’t appear to be anything to change Janet Yellen’s recent views on inflation, namely that she has no clue why it hasn’t done what she expected or what it might do in the future. And who knows, her opinion may not matter come next year anyway. President Trump has narrowed his choices for Fed head to a few, although she is apparently among the finalists. With Trump’s self announced preference for low interest rates – he’s a debt guy you know – he could do worse than keep the devil he knows.

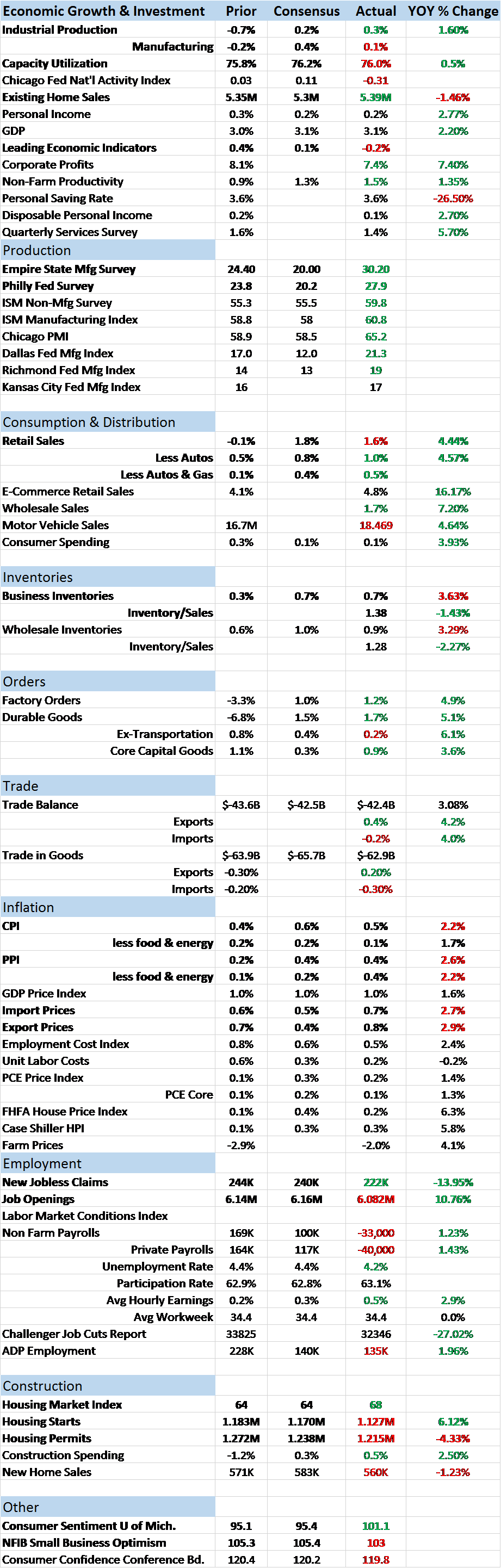

The data was all pretty much as expected and what wasn’t could be blamed on hurricanes or “transitory” events so markets barely budged over the fortnight. The 10 year Treasury note yield rose by 3 basis points: |

US 10 Year Treasury Yield, Apr - Oct 2017(see more posts on U.S. Treasuries, ) |

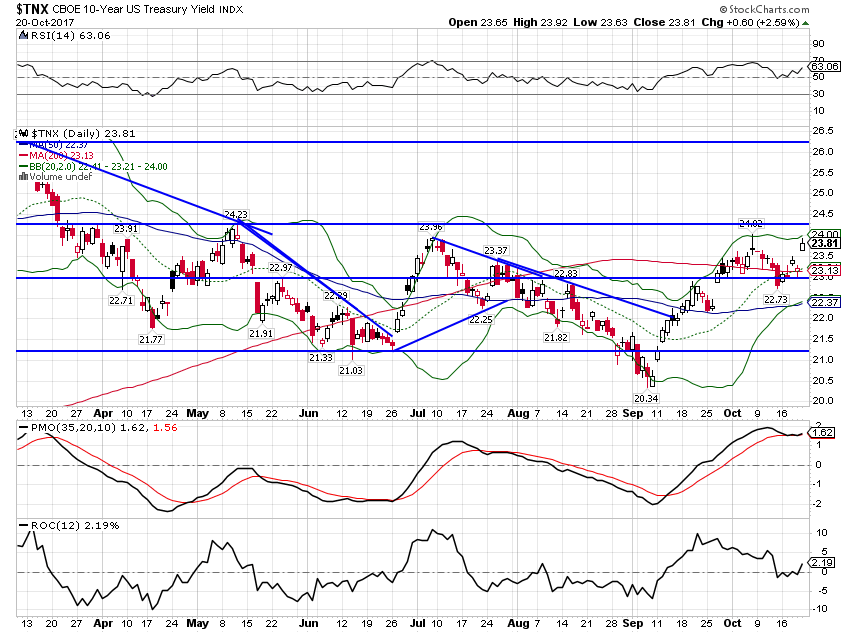

| The 10 year TIPS yield fell by 1 basis point. Yes, one (1). |

US 10 Year Treasury Inflation, Jan 2013 - Jul 2017(see more posts on U.S. Treasuries, ) |

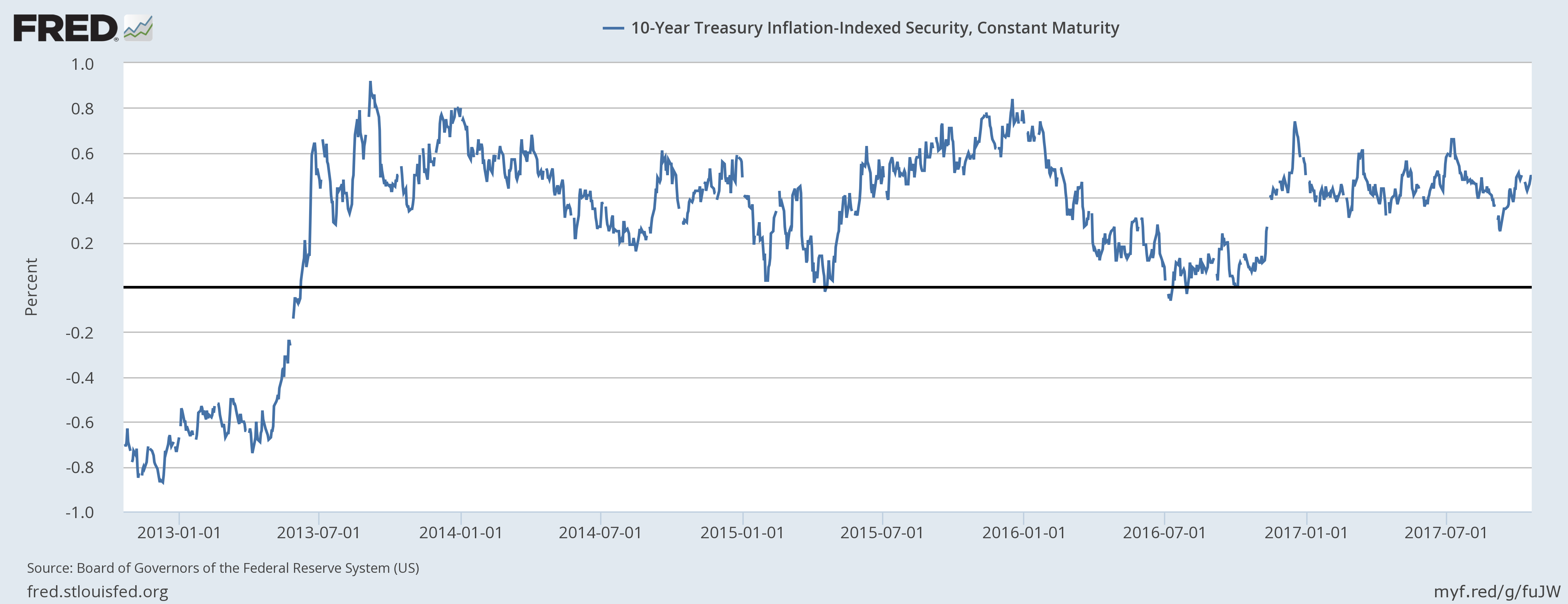

| The dollar index fell from 93.64 all the way to 93.58. It is, as I expected, consolidating at these levels. |

US Dollar Index, Feb - Oct 2017(see more posts on U.S. Dollar Index, ) |

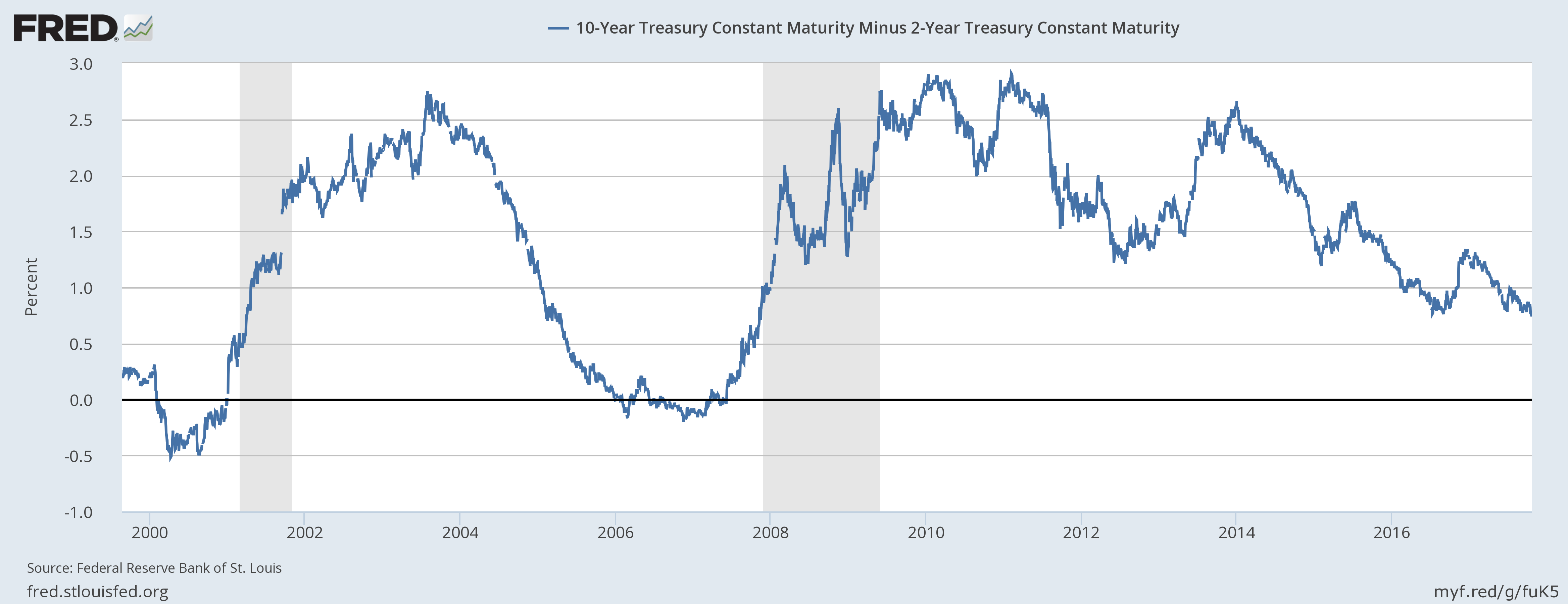

| By comparison, the yield curve plummeted by 8 basis points to the flattest of the cycle. And at these levels, still flattening but far from inversion, it means almost nothing. Just as a comparison, we hit current levels in the last cycle in 2005. |

US 10 Year Treasury Constant Maturity, 2000 - 2016(see more posts on U.S. Treasuries, ) |

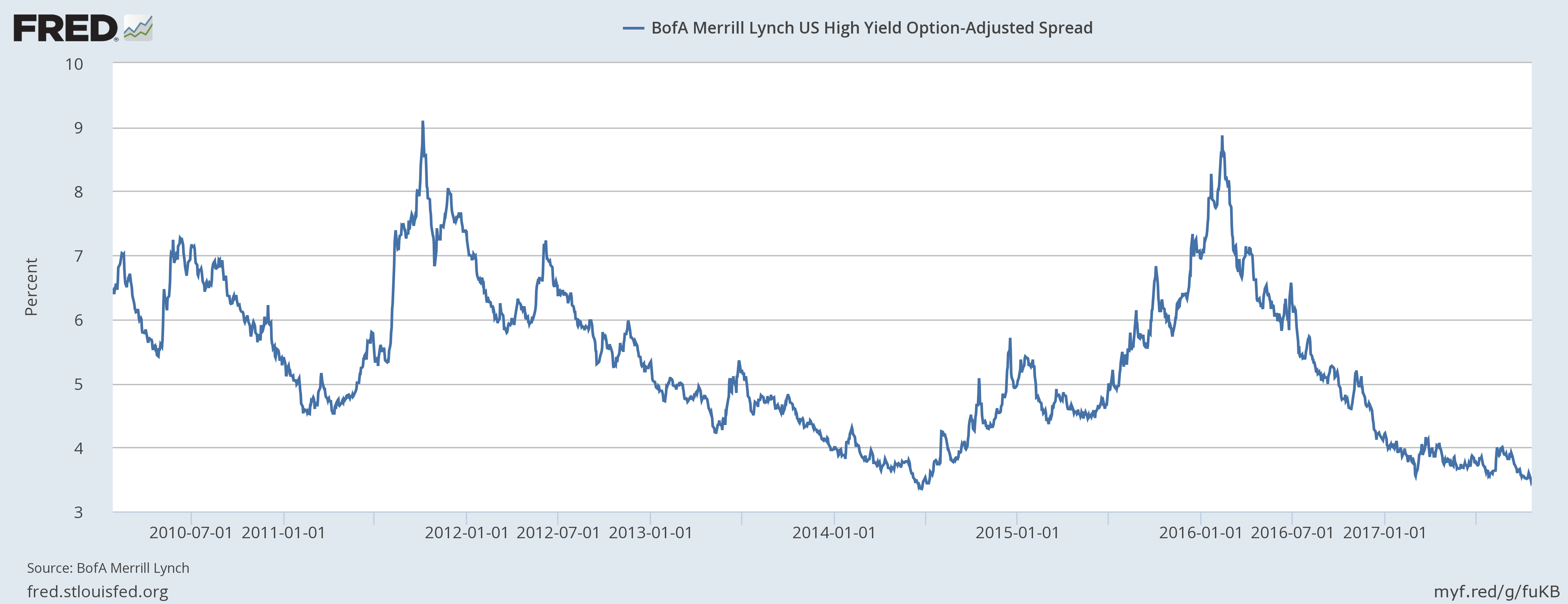

| Credit spreads continue to narrow as junk bonds hit new highs. Not even a hint of concern in junk land but that isn’t new; the spread only fell by 4 basis points since the last update two weeks ago. |

BofA Merrill Lynch US High Yield Option, Jul 2010 - Jan 2017 |

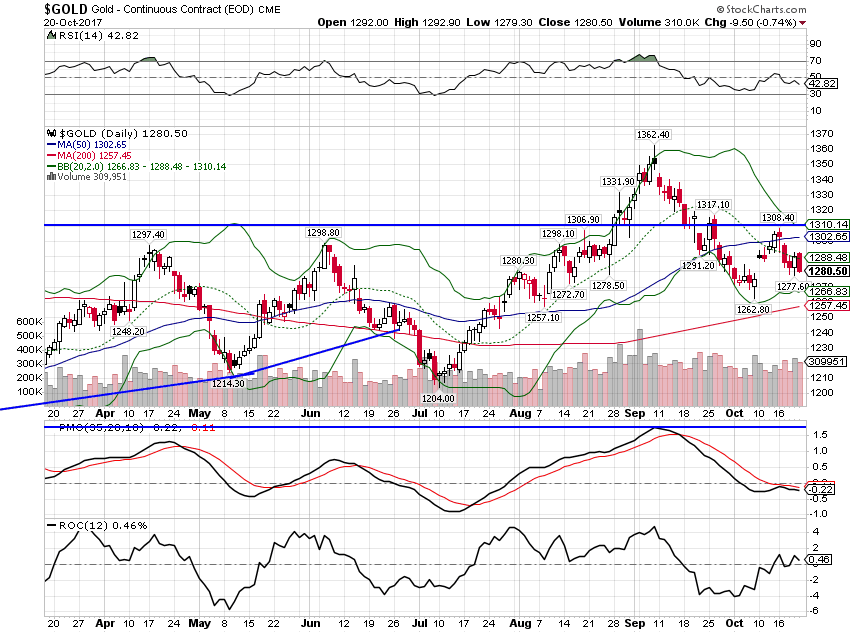

| Gold moved all of about $5 an ounce, indicating…well not much. |

Gold Daily, Apr - Oct 2017(see more posts on Gold, ) |

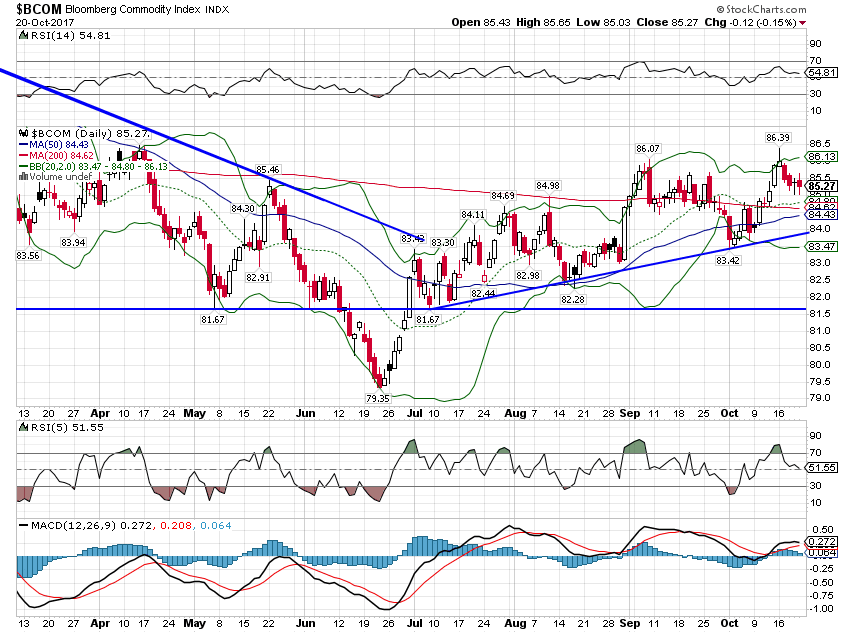

| Commodities more generally did move higher. The Bloomberg Commodity index hit bottom in early 2016 and has been generally trending higher since. Long term momentum turned positive in the first quarter of 2016 and is still positive. One wonders if low bond yields, rising stock prices and rising commodity prices are all compatible and my guess is probably not at some point. |

Bloomberg Commodity Index, Apr - Oct 2017(see more posts on Bloomberg Commodity, ) |

There is a sense of ennui that infects today’s markets, a boredom that has spread like a virus through almost every market. Low volatility is not a phenomenon confined to the stock market. Bonds, currencies and commodities are all trading as if in suspended animation, drifting along awaiting…what? Tax reform? The naming of a new Fed Chair? A central bank policy change? Stocks seem to be assuming a best case scenario from those items but bonds, gold and the dollar aren’t so sure of themselves. And frankly, neither am I. Even if I assume, for instance, that tax reform passes, I’m not sure of the impact but my guess is a lot less than Republicans hope and more than Democrats claim which translates to what? 2.2% growth? 2.5% growth? Versus the 2% we’ve had for the last four years? That would not seem to justify the current level of the stock market although it is quite consistent with those other markets. What do stock investors see that bond investors don’t?

I actually don’t think most people buying into this stock market are that sophisticated in their thinking. We are well into the performance chasing portion of the bull market, investing finally becoming “cool” again. The economic outlook hasn’t changed significantly from what has prevailed the last four years. We are plodding through this economic cycle, inevitably nearing recession but not there yet. The yield curve isn’t offering any recession warnings and neither are credit spreads. Broad economic activity indicators like the Chicago Fed National Activity Index are showing growth right around trend. There just isn’t any evidence of stress right now, the lack of fear in the market a reflection of a lack of things to fear. And stocks march higher, up a wall of no worries.

The fact that we don’t see a recession as imminent does not mean that stocks won’t or can’t correct. But it is going to take some kind of catalyst, something that changes unexpectedly, to get people to pay attention to something other than the rising balance of their 401k or brokerage statement. I have no idea what the trigger will be but it will come. There is a fine line between confidence and complacency and this broad based lack of volatility smacks of the latter. These markets have been a bore for a long time, a Rip van Winkle of a bull. When it eventually ends, it won’t be Washington Irving that comes to mind but more likely Edvard Munch.

Tags: Alhambra Research,Bi-Weekly Economic Review,Bloomberg Commodity,Bonds,commodities,credit spreads,currencies,dollar,economic growth,Featured,Federal Reserve,Gold,inflation,Interest rates,Investing,Markets,newslettersent,Politics,recession,stocks,tax reform,U.S. Dollar Index,U.S. Treasuries,Volatility,Yield Curve