[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Mid-Year Global Markets Update Bi-Weekly Economic Review – (VIDEO) What will the rest of the year bring? Bi-Weekly Economic Review (VIDEO) Great Graphic: Two-year Rate Differentials Bi-Weekly Economic Review Bi-Weekly Economic Review...

Read More »Bi-Weekly Economic Review

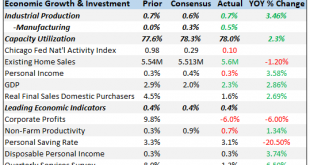

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to...

Read More »Mid-Year Global Markets Update

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some. Since that correction, the S&P 500 has traded in a range with a...

Read More »Bi-Weekly Economic Review – (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Bi-Weekly Economic Review (VIDEO) Bi-Weekly Economic Review Bi-Weekly Economic Review Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth Bi-Weekly Economic Review Bi-Weekly Economic Review: As Good As It Gets? Bi-Weekly...

Read More »Bi-Weekly Economic Review (VIDEO)

[embedded content] Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun. Related posts: Bi-Weekly Economic Review: Bi-Weekly Economic Review – VIDEO Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Cookie policy Privacy Policy Bi-Weekly Economic Review: Oil,...

Read More »Bi-Weekly Economic Review:

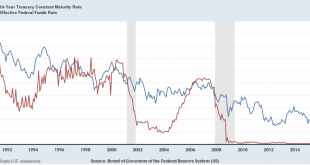

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility. There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall....

Read More »Bi-Weekly Economic Review: As Good As It Gets?

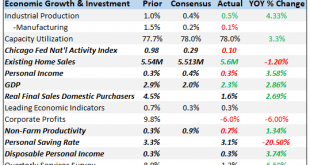

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »Bi-Weekly Economic Review: Growth Expectations Break Out?

There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade...

Read More »Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

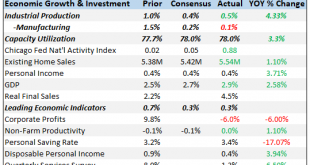

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org