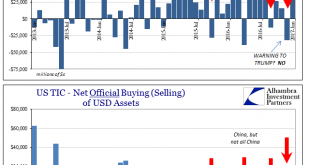

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke...

Read More »TIC Analysis of Selling

[unable to retrieve full-text content]When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of banana...

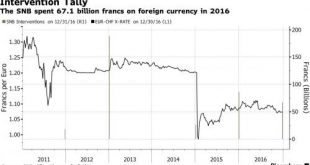

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »Non-Randomly Surveying RMB

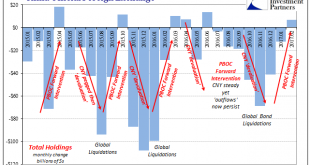

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been –...

Read More »Status of US Pivot To Asia

Summary: Pivot still taking place, but without TPP, more militaristic. President Trump seems a little less confrontational toward China. China is unlikely to be cited as a currency manipulator in next month’s Treasury report. The Obama Administration tried restarting US-Russian relations with little success. The inability to secure the European flank weakened the pivot to Asia. The Trans-Pacific Partnership...

Read More »Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »China’s NPC Ends with New Initiatives

Summary: China will make its mainland bond market more accessible. As China’s portfolio of patents grows it will likely become more protective of others’ intellectual property rights. PRC President Xi will likely visit US President Trump early next month. The market’s immediate focus is on today’s FOMC meeting and Dutch elections. However, China’s annual legislative session (National People’s Congress) ended...

Read More »Trump Administration Modifying Stance on Way to G20

Summary: Confrontation with China has been dialed down. Criticism of the Fed has been walked back. There is less talk about the dollar. Employment data has been embraced. As a candidate, Trump took a hardline. China is manipulating its currency. The Federal Reserve is acting to help Clinton get elected. The jobs data is fake. Over the past week, the each of these three positions has been considerably softened. It is...

Read More »China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same...

Read More »FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

Swiss Franc EUR/CHF - Euro Swiss Franc, March 07(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has continued to gradually slide lower against the Swiss Franc with rates for this pair falling to 1.2350. GBP CHF is particularly week on two counts: The safe haven status of the Swiss Franc and Brexit. Sterling continues to remain under a degree of pressure as the Brexit uncertainty continues to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org